Question: Formula Current assets - Current liabilities Current assets / Current liabilities 21250-18000 21250/18000 SPCC Industry Average 3250 N/A 1.18 in Sales/ receivable Sales / Inventory

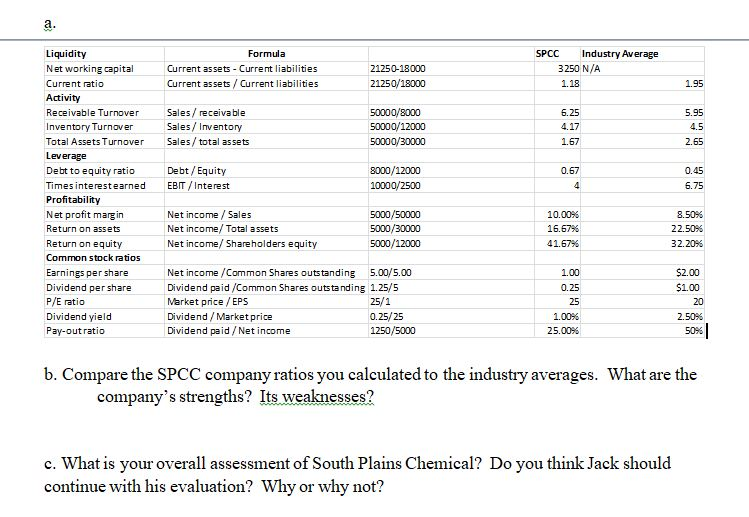

Formula Current assets - Current liabilities Current assets / Current liabilities 21250-18000 21250/18000 SPCC Industry Average 3250 N/A 1.18 in Sales/ receivable Sales / Inventory Sales / total assets 50000/8000 50000/12000 50000/30000 6.25 4.17 1.67 win 0.67 a Debt / Equity EBIT/Interest 8000/12000 10000/2500 Liquidity Net working capital Current ratio Activity Receivable Turnover Inventory Turnover Total Assets Turnover Leverage Debt to equity ratio Times interestearned Profitability Net profit margin Return on assets Return on equity Common stock ratios Earnings per share Dividend per share P/E ratio Dividend yield Pay-out ratio Net income / Sales Net income/ Total assets Net income/ Shareholders equity 5000/50000 5000/30000 5000/12000 10.00% 16.67% 41.67% 8.50% 22.50% 32.20% 1.00 0.25 Net income /Common Shares outstanding 5.00/5.00 Dividend paid /Common Shares outstanding 1.25/5 Market price / EPS 25/1 Dividend/Market price 0.25/25 Dividend paid / Net income 1250/5000 $2.00 $1.00 20 2.50% 1.00% 25.00% 504 b. Compare the SPCC company ratios you calculated to the industry averages. What are the company's strengths? Its weaknesses? c. What is your overall assessment of South Plains Chemical? Do you think Jack should continue with his evaluation? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts