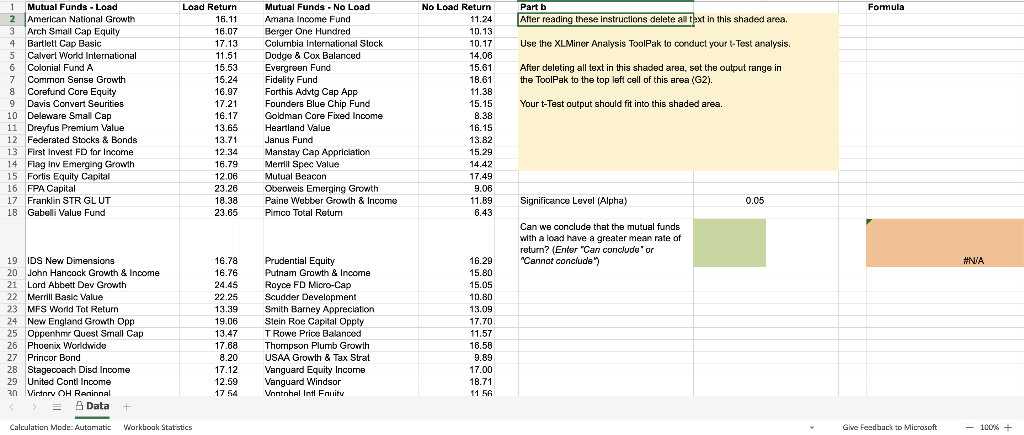

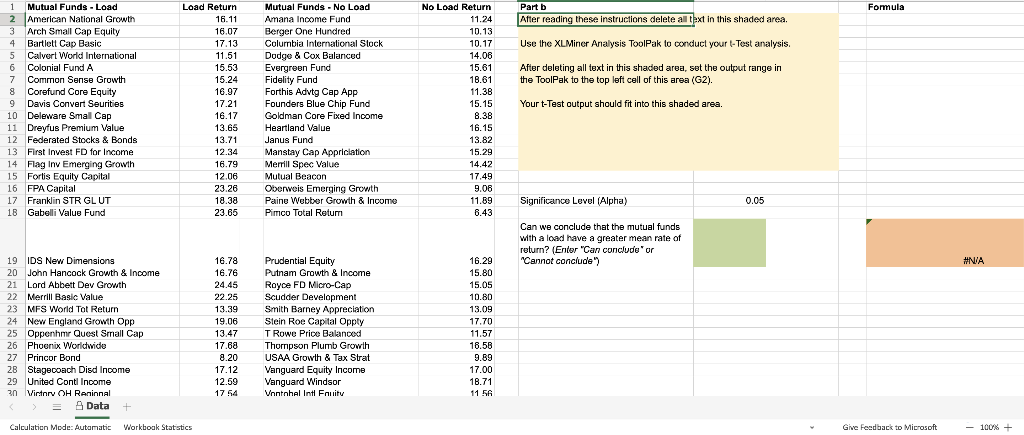

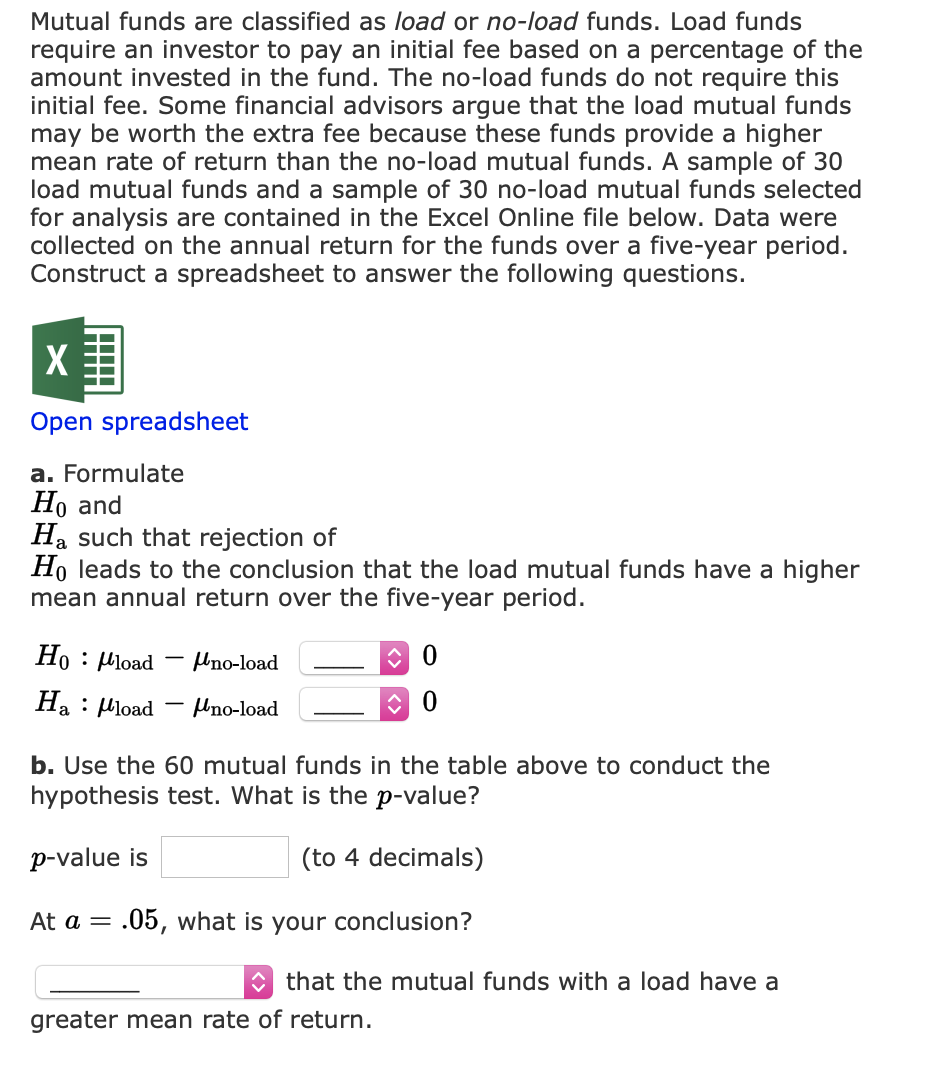

Question: Formula Part b After reading these instructions delete all text in this shaded area. Use the XL Miner Analysis ToolPak to conduct your t-Test analysis.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock