Question: Formulas for Quiz 4 = required return;=rf + Bi(E[rm] -rf) Bp = wi + w2w + + wnn Pt+1 + Divt+1 Pt Rt +1= Pt

![Formulas for Quiz 4 = required return;=rf + Bi(E[rm] -rf) Bp](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66edc723535f0_04266edc722c01ef.jpg)

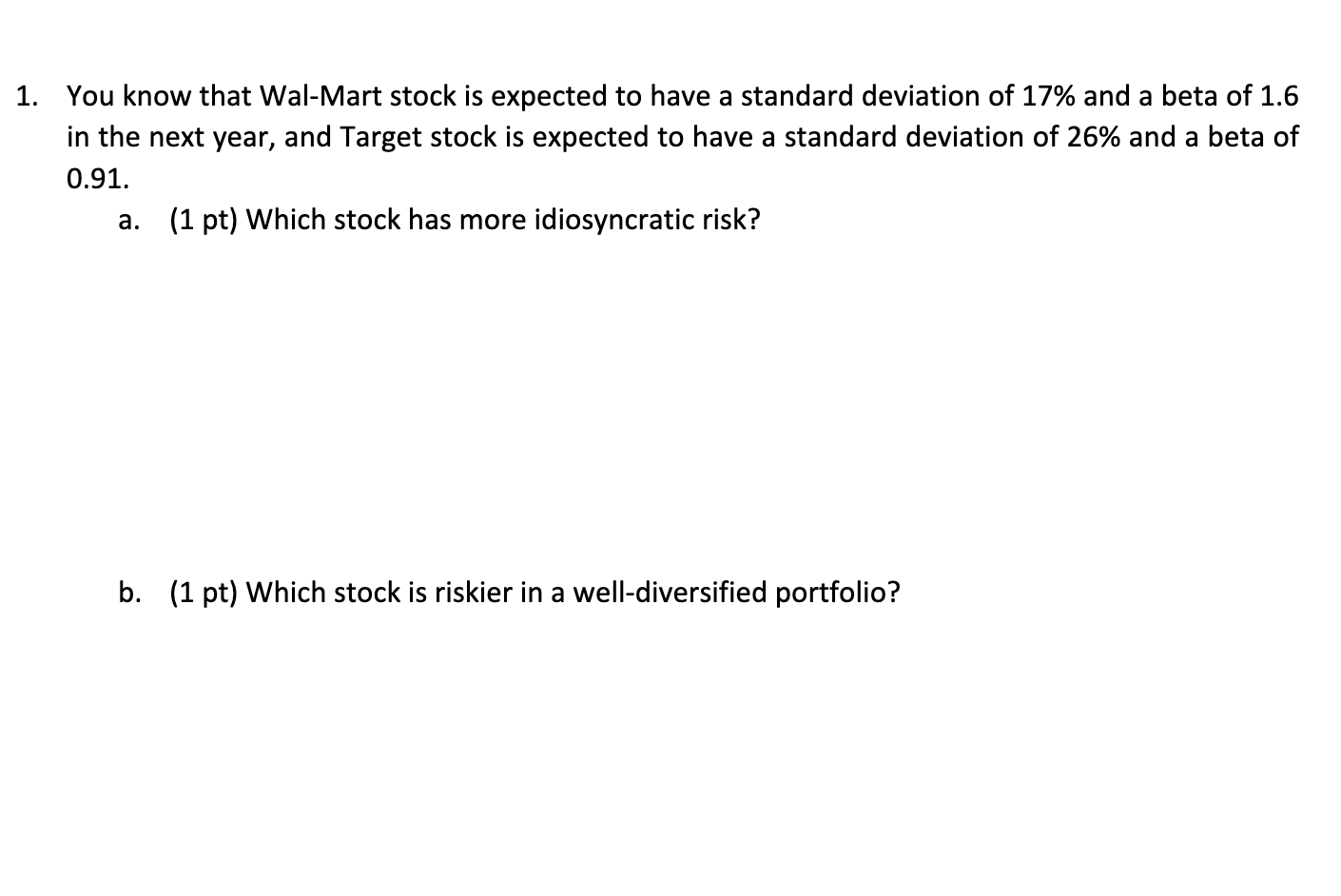

Formulas for Quiz 4 = required return;=rf + Bi(E[rm] -rf) Bp = wi + w2w + + wnn Pt+1 + Divt+1 Pt Rt +1= Pt 1 Variance(?) = (1 - 1)[(R3 R)2 + (R2 R)? + ... + (R R)?] ET - Rt t=2 R= T - 1 = Standard Deviation(o) = V Variance Oi Bi= Pi,m Om NetDebt Equity WACC = rEquity NetDebt + Equity + rDebt: (1 t) NetDebt + Equity 1. You know that Wal-Mart stock is expected to have a standard deviation of 17% and a beta of 1.6 in the next year, and Target stock is expected to have a standard deviation of 26% and a beta of 0.91. a. (1 pt) Which stock has more idiosyncratic risk? b. (1 pt) Which stock is riskier in a well-diversified portfolio? a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts