Question: Formulate an Linear Programming model (no need to convert to standard form) with the following constraints. 1.11 CT Capital provides capital for home mortgages, auto

Formulate an Linear Programming model (no need to convert to standard form) with the following constraints.

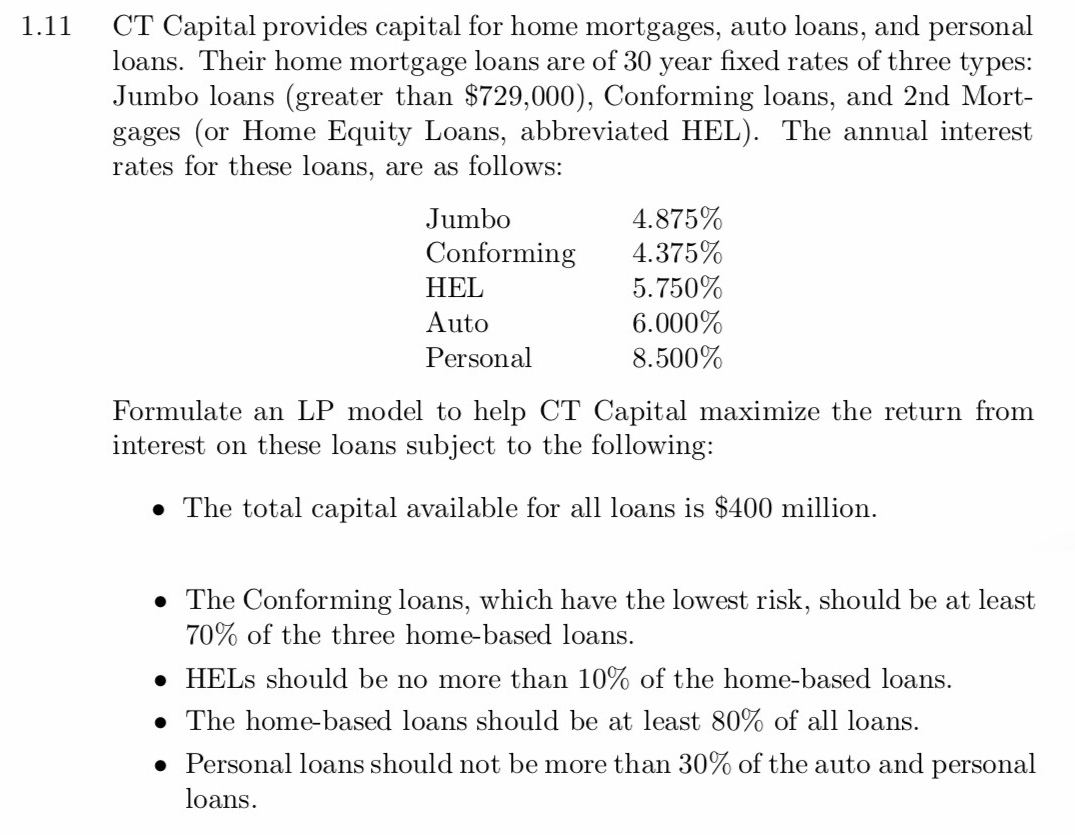

1.11 CT Capital provides capital for home mortgages, auto loans, and personal loans. Their home mortgage loans are of 30 year fixed rates of three types: Jumbo loans (greater than $729,000), Conforming loans, and 2nd Mort- gages (or Home Equity Loans, abbreviated HEL). The annual interest rates for these loans, are as follows: Jumbo Conforming HEL Auto Personal 4.875% 4.375% 5.750% 6.000% 8.500% Formulate an LP model to help CT Capital maximize the return from interest on these loans subject to the following: The total capital available for all loans is $400 million. The Conforming loans, which have the lowest risk, should be at least 70% of the three home-based loans. HELs should be no more than 10% of the home-based loans. The home-based loans should be at least 80% of all loans. Personal loans should not be more than 30% of the auto and personal loans

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts