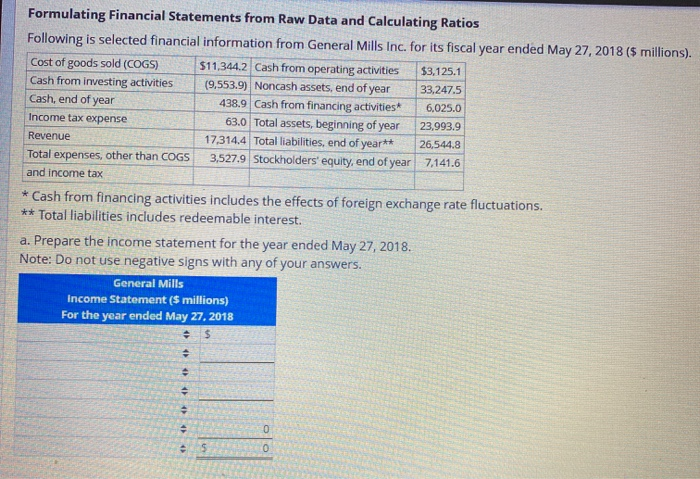

Question: Formulating Financial Statements from Raw Data and Calculating Ratios Following is selected financial information from General Mills Inc. for its fiscal year ended May 27,

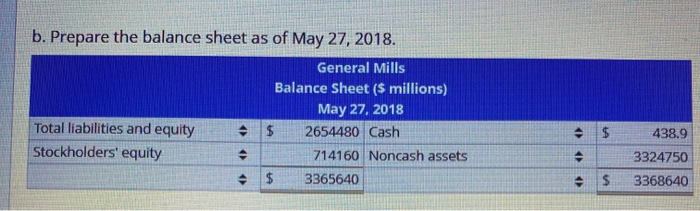

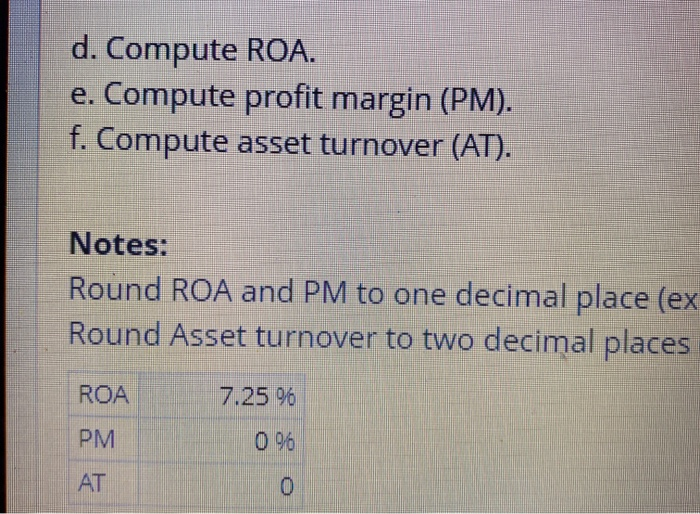

Formulating Financial Statements from Raw Data and Calculating Ratios Following is selected financial information from General Mills Inc. for its fiscal year ended May 27, 2018 (5 millions). Cost of goods sold (COGS) $11,344.2 Cash from operating activities $3,125.1 Cash from investing activities (9,553.9) Noncash assets, end of year 33,247.5 Cash, end of year 438.9 Cash from financing activities 6.025.0 Income tax expense 63.0 Total assets, beginning of year 23,993.9 Revenue 17.314.4 Total liabilities, end of year** 26,544.8 Total expenses, other than COGS 3,527.9 Stockholders' equity, end of year 7.141.6 and income tax * Cash from financing activities includes the effects of foreign exchange rate fluctuations. ** Total liabilities includes redeemable interest. a. Prepare the income statement for the year ended May 27, 2018. Note: Do not use negative signs with any of your answers. General Mills Income Statement ($ millions) For the year ended May 27, 2018 e . 0 e 0 b. Prepare the balance sheet as of May 27, 2018. General Mills Balance Sheet ($ millions) May 27, 2018 Total liabilities and equity 2654480 Cash Stockholders' equity 714160 Noncash assets + $ 3365640 $ 438.9 > ( 3324750 $ 3368640 d. Compute ROA. e. Compute profit margin (PM). f. Compute asset turnover (AT). Notes: Round ROA and PM to one decimal place (ex Round Asset turnover to two decimal places ROA 7.25 96 PM 0 96 AT 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts