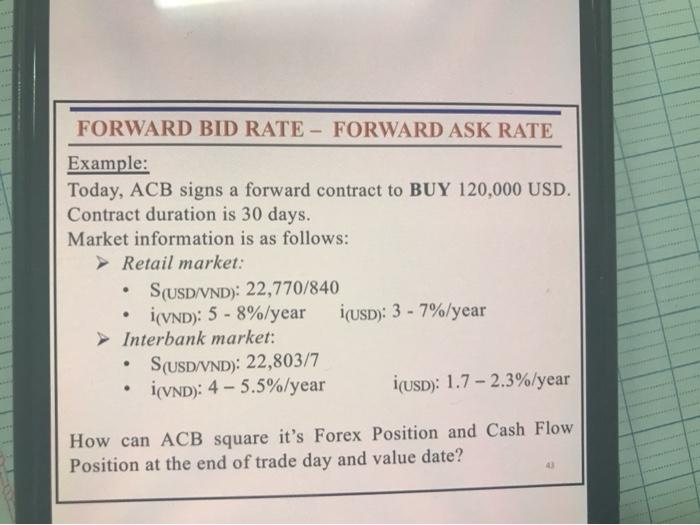

Question: FORWARD BID RATE - FORWARD ASK RATE Example: Today, ACB signs a forward contract to BUY 120,000 USD. Contract duration is 30 days. Market information

FORWARD BID RATE - FORWARD ASK RATE Example: Today, ACB signs a forward contract to BUY 120,000 USD. Contract duration is 30 days. Market information is as follows: Retail market: S(USD/VND): 22,770/840 (VND): 5 - 8%/year I(USD): 3 - 7%/year Interbank market: S(USD/VND): 22,803/7 i(VND): 4-5.5%/year i(USD): 1.7 - 2.3%/year . . How can ACB square it's Forex Position and Cash Flow Position at the end of trade day and value date? FORWARD BID RATE - FORWARD ASK RATE Example: Today, ACB signs a forward contract to BUY 120,000 USD. Contract duration is 30 days. Market information is as follows: Retail market: S(USD/VND): 22,770/840 (VND): 5 - 8%/year I(USD): 3 - 7%/year Interbank market: S(USD/VND): 22,803/7 i(VND): 4-5.5%/year i(USD): 1.7 - 2.3%/year . . How can ACB square it's Forex Position and Cash Flow Position at the end of trade day and value date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts