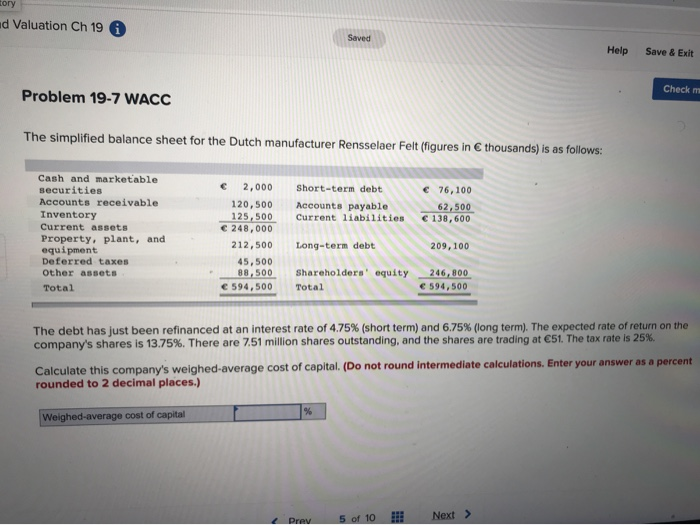

Question: Fory d Valuation Ch 19 Saved Help Save & Exit Check m Problem 19-7 WACC The simplified balance sheet for the Dutch manufacturer Rensselaer Felt

Fory d Valuation Ch 19 Saved Help Save & Exit Check m Problem 19-7 WACC The simplified balance sheet for the Dutch manufacturer Rensselaer Felt (figures in 6 thousands) is as follows: short-term debt Accounts payable Current liabilities 76,100 62,500 138,600 Cash and marketable securities Accounts receivable Inventory Current assets Property, plant, and equipment Deferred taxes Other Assets Total 2,000 120,500 125,500 248,000 212,500 45,500 88,500 594,500 Long-term debt 209,100 equity Shareholders Total 246,800 594,500 The debt has just been refinanced at an interest rate of 4.75% (short term) and 6.75% (long term). The expected rate of return on the company's shares is 13.75%. There are 751 million shares outstanding, and the shares are trading at 51. The tax rate is 25% Calculate this company's weighed-average cost of capital. (Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Weighed-average cost of capital Prav 5 of 10 Next >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts