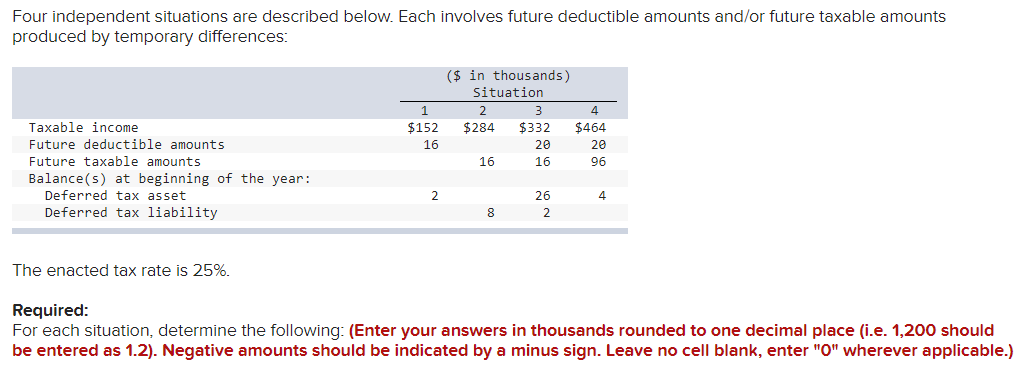

Question: Four independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences: Taxable income Future deductible amounts

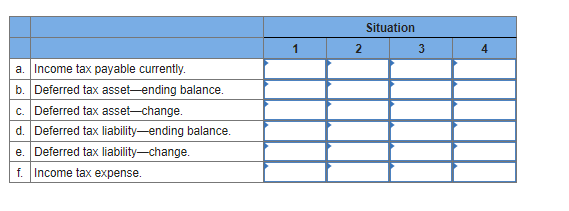

Four independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences: Taxable income Future deductible amounts Future taxable amounts Balance(s) at beginning of the year: Deferred tax asset Deferred tax liability. The enacted tax rate is 25%. 1 $152 16 2 ($ in thousands) Situation 2 3 4 $284 $332 $464 20 16 16 8 26 2 20 96 4 Required: For each situation, determine the following: (Enter your answers in thousands rounded to one decimal place (i.e. 1,200 should be entered as 1.2). Negative amounts should be indicated by a minus sign. Leave no cell blank, enter 0 wherever applicable.) a. Income tax payable currently. b. Deferred tax asset-ending balance. c. Deferred tax asset-change. d. Deferred tax liability-ending balance. e. Deferred tax liability-change. f. Income tax expense. 1 2 Situation 3

Step by Step Solution

3.36 Rating (168 Votes )

There are 3 Steps involved in it

Particulars 1 2 3 4 Taxable income 152 284 332 464 Tax rate 20 ... View full answer

Get step-by-step solutions from verified subject matter experts