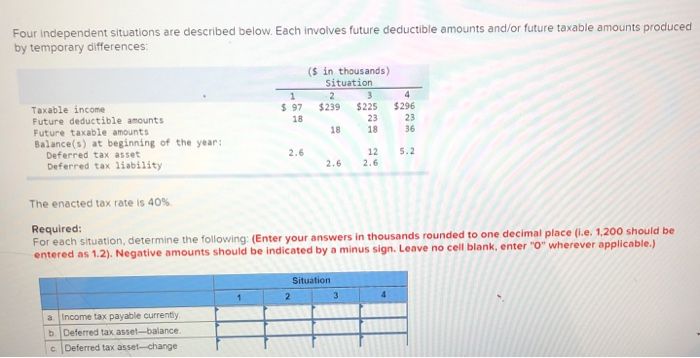

Question: Four independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences: (s in thousands) Situation $ 97

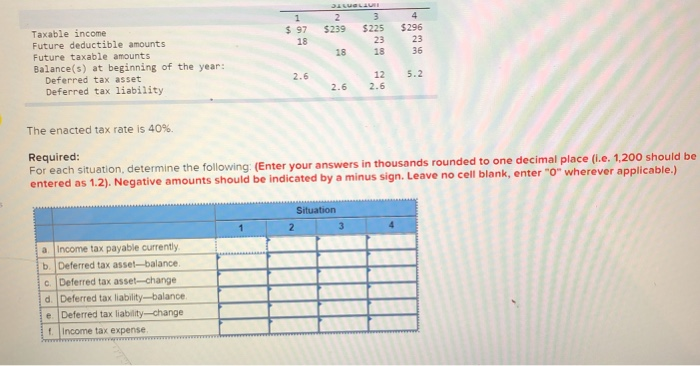

Four independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences: (s in thousands) Situation $ 97 18 $239 $225 $296 Taxable income Future deductible amounts Future taxable amounts Balance(s) at beginning of the year: Deferred tax asset Deferred tax liability 2.6 5.2 The enacted tax rate is 40% Required: For each situation, determine the following: (Enter your answers in thousands rounded to one decimal place (i.e. 1,200 should be entered as 1.2). Negative amounts should be indicated by a minus sign. Leave no cell blank, enter "o" wherever applicable.) Situation 23 a Income tax payable currently b Deferred tax asset-balance c Deferred tax asse-change $ 97 $239 $225 $296 Taxable income Future deductible amounts Future taxable amounts Balance(s) at beginning of the year: Deferred tax asset Deferred tax liability 5.2 2.5 The enacted tax rate is 40% Required: For each situation, determine the following (Enter your answers in thousands rounded to one decimal place (ie. 1.200 should be entered as 1.2). Negative amounts should be indicated by a minus sign. Leave no cell blank, enter"0" wherever applicable.) Situation a Income tax payable currently b. Deferred tax asset-balance c Deferred tax asset change d. Deferred tax liability balance e Deferred tax liability change If income tax expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts