Question: Fred Morris invests in a stock that will pay dividends of $4.00 at the end of the first year; $4.40 at the end of

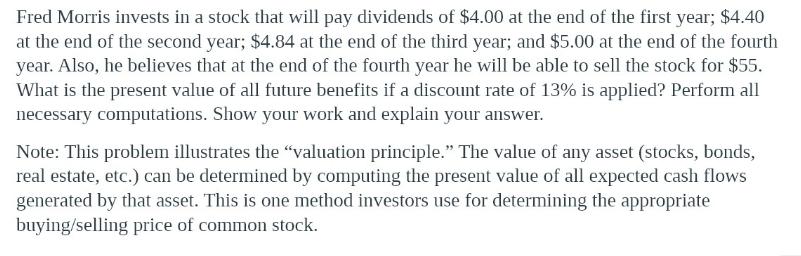

Fred Morris invests in a stock that will pay dividends of $4.00 at the end of the first year; $4.40 at the end of the second year; $4.84 at the end of the third year; and $5.00 at the end of the fourth year. Also, he believes that at the end of the fourth year he will be able to sell the stock for $55. What is the present value of all future benefits if a discount rate of 13% is applied? Perform all necessary computations. Show your work and explain your answer. Note: This problem illustrates the "valuation principle." The value of any asset (stocks, bonds, real estate, etc.) can be determined by computing the present value of all expected cash flows generated by that asset. This is one method investors use for determining the appropriate buying/selling price of common stock.

Step by Step Solution

There are 3 Steps involved in it

To calculate the present value of all future benefits we need to discount each future c... View full answer

Get step-by-step solutions from verified subject matter experts