Question: Fresla Motors needs to select an assembly line for producing their new SUV. They have two options: Option A is a highly automated assembly

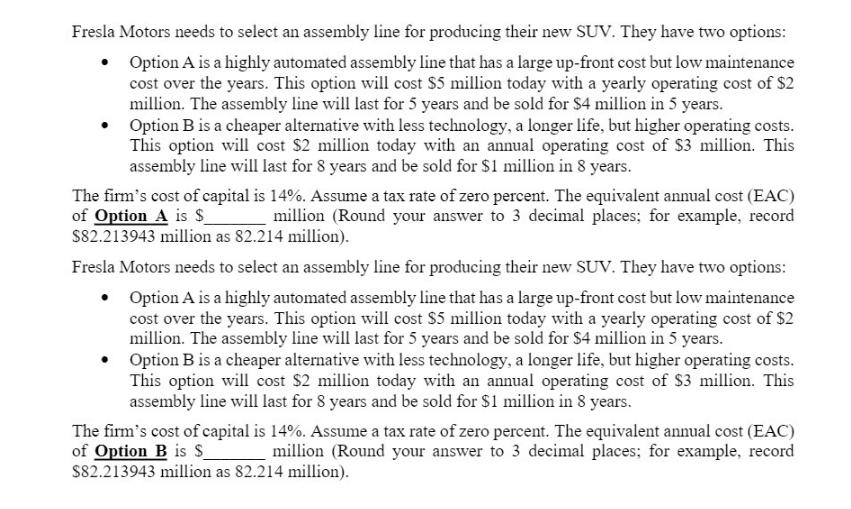

Fresla Motors needs to select an assembly line for producing their new SUV. They have two options: Option A is a highly automated assembly line that has a large up-front cost but low maintenance cost over the years. This option will cost $5 million today with a yearly operating cost of $2 million. The assembly line will last for 5 years and be sold for $4 million in 5 years. Option B is a cheaper alternative with less technology, a longer life, but higher operating costs. This option will cost $2 million today with an annual operating cost of $3 million. This assembly line will last for 8 years and be sold for $1 million in 8 years. The firm's cost of capital is 14%. Assume a tax rate of zero percent. The equivalent annual cost (EAC) of Option A is $_ million (Round your answer to 3 decimal places; for example, record $82.213943 million as 82.214 million). Fresla Motors needs to select an assembly line for producing their new SUV. They have two options: Option A is a highly automated assembly line that has a large up-front cost but low maintenance cost over the years. This option will cost $5 million today with a yearly operating cost of $2 million. The assembly line will last for 5 years and be sold for $4 million in 5 years. Option B is a cheaper alternative with less technology, a longer life, but higher operating costs. This option will cost $2 million today with an annual operating cost of $3 million. This assembly line will last for 8 years and be sold for $1 million in 8 years. The firm's cost of capital is 14%. Assume a tax rate of zero percent. The equivalent annual cost (EAC) of Option B is S million (Round your answer to 3 decimal places; for example, record $82.213943 million as 82.214 million).

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

SOLUTION To calculate the equivalent annual cost EAC for each option we need to consider the initial cost operating costs salvage value and the cost of capital For Option A Initial cost 5 million Annu... View full answer

Get step-by-step solutions from verified subject matter experts