Question: From 1950 to 2007, the average return in the stock market, as measured by the S&P 500, was 13.2 percent and a standard deviation of

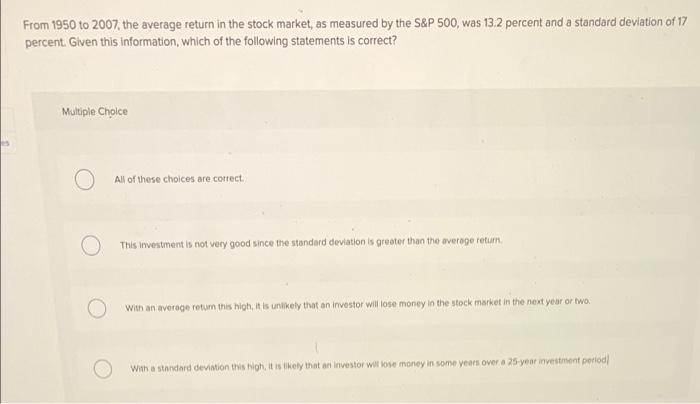

From 1950 to 2007, the average return in the stock market, as measured by the S&P 500, was 13.2 percent and a standard deviation of 17 percent. Given this information, which of the following statements is correct? Multiple Choice All of these choices are correct This investment is not very good since the standard deviation is greater than the average return, With an average return this high, it is unlikely that an investor will lose money in the stock market in the next year or two. with a standard deviation this high, it is likely that an investor witlose money in some years over a 25-year investment period

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock