Question: need help (answer displayed incorrect) The Green S & L originated a pool containing 75 ten-year fixed interest rate mortgages with an average balance of

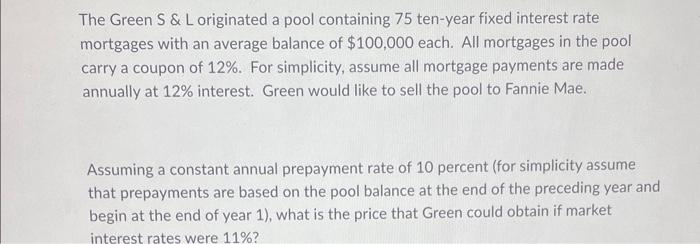

The Green S \& L originated a pool containing 75 ten-year fixed interest rate mortgages with an average balance of $100,000 each. All mortgages in the pool carry a coupon of 12%. For simplicity, assume all mortgage payments are made annually at 12% interest. Green would like to sell the pool to Fannie Mae. Assuming a constant annual prepayment rate of 10 percent (for simplicity assume that prepayments are based on the pool balance at the end of the preceding year and begin at the end of year 1), what is the price that Green could obtain if market interest rates were 11% ? Assume that five years have passed since the date in 1 . If market interest rates were 12%, what price could Green obtain now? Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts