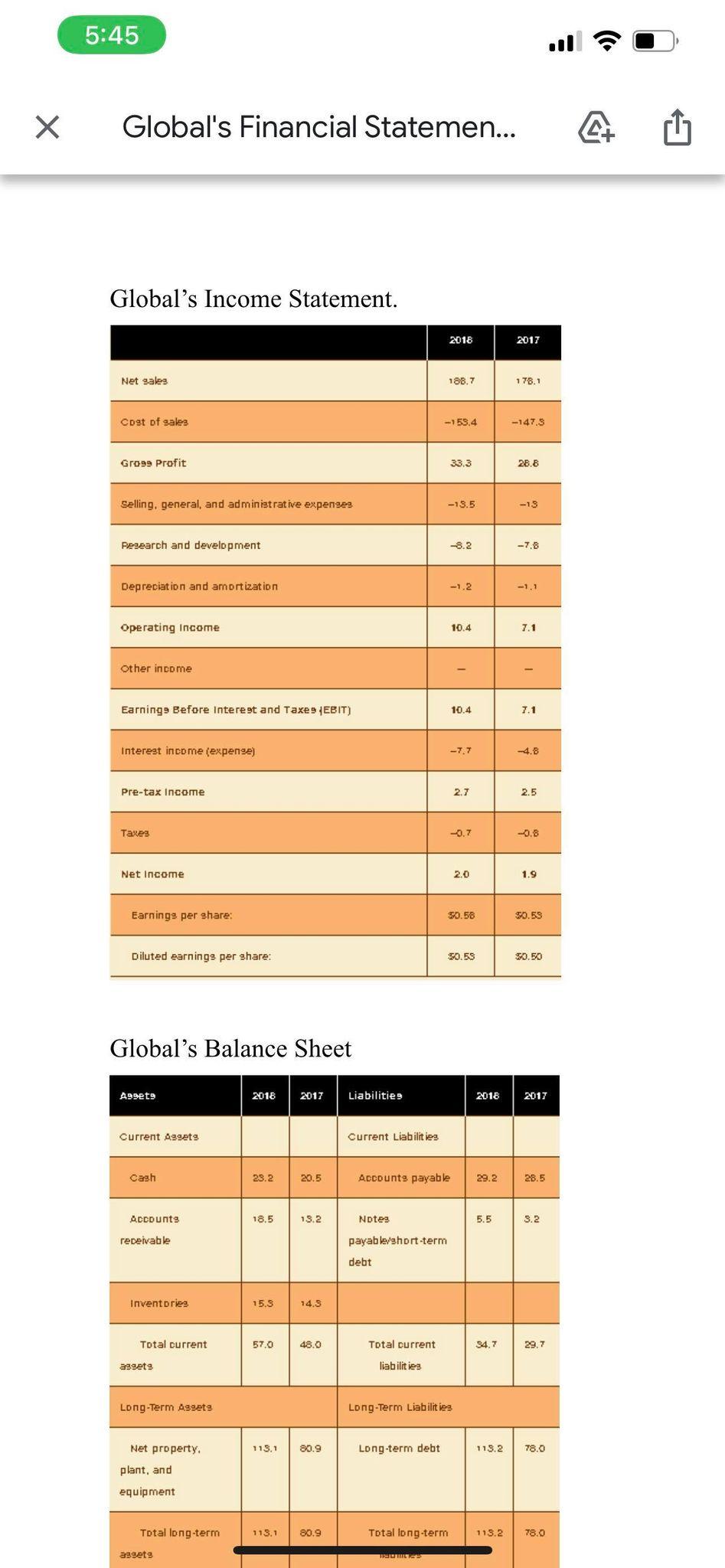

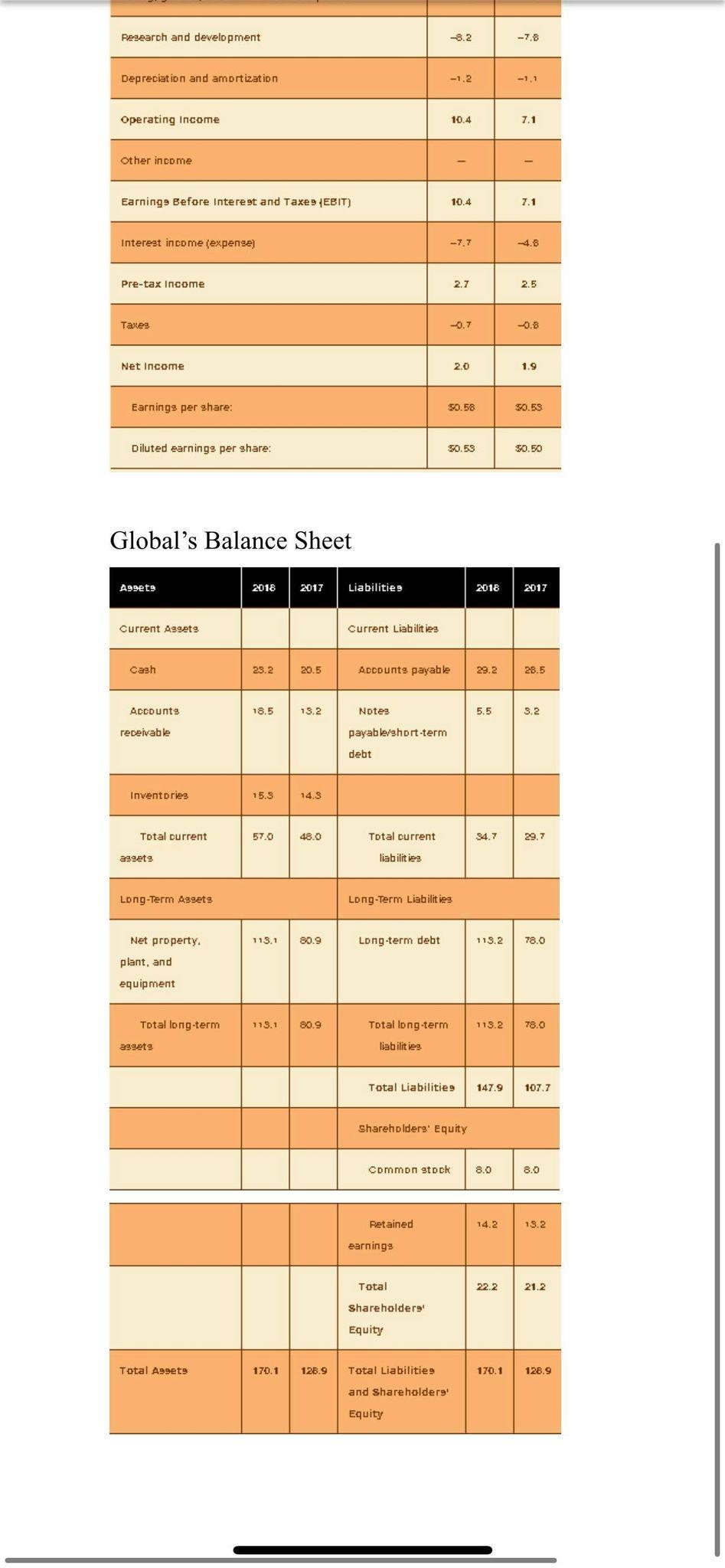

Question: From the data above, compute for the following ratios; 5. Operating Margin 6. Net Margin 7. EPS (if shares outstanding are 10 millions for both

From the data above, compute for the following ratios;

5. Operating Margin

6. Net Margin

7. EPS (if shares outstanding are 10 millions for both years)

8. P/E Ratio (if Market Price per share is $10 in 2017)

9. P/B Ratio

10. Enterprise Value

5:45 11 Global's Financial Statemen... Global's Income Statement. 2018 2017 Net sales 188.7 178.1 Cost of sales -159.4 -147.3 Gro99 Profit 33.3 28.8 Selling, general, and administrative expenses -13.5 -13 Pesearch and development -8.2 -7.8 Depreciation and amortization -1.2 i Operating Income 10.4 7.1 Other income - - Earnings Before Interest and Taxes (EBIT) 10.4 7.1 Interest income (expense) -7.7 Pre-tax income 2.7 2.5 Taxes -0.7 Net Income 2.0 1.9 Earnings per share: $0.58 90.59 Diluted earnings per share: 50.59 $0.50 Global's Balance Sheet A99ete 2018 2017 Liabilities 2018 2017 Current Assets Current Liabilities Cash 23.2 20.5 Accounts payable 29.2 28.5 Accounts 18.5 13.2 Notes 5.5 3.2 receivable payableshort-term debt Inventories 15.3 14.3 Total current 57.0 48.0 Total current 34.7 29.7 aggets liabilities Long-Term Aggets Long-Term Liabilities Net property 115.1 113,1 80.9 Long-term debt 113.2 78.0 plant, and equipment Total long-term 118.1 80.9 Total long-term 113.2 78.0 assets VICT Research and development -8.2 -7.8 Depreciation and amortization -1.2 -11 Operating Income 10.4 7.1 Other income Earnings Before Interest and Taxe (EBIT) 10.4 7.1 Interest income (expense) -7,7 -4.8 Pre-tax income 2.7 2.5 Taxes -0.7 Net Income 2.0 1.9 Earnings per share: $0.58 50.59 Diluted earnings per share: $0.59 $0.50 Global's Balance Sheet Aggets 2018 2017 Liabilities 2018 2017 Current Assets Current Liabilities Cash 29.2 20.5 Accounts payable 29.2 28.5 Accounts 18.5 13.2 Notes 5.5 3.2 receivable payable/short-term debt Inventories 15.3 14.3 Total current 57.0 48.0 Total current 34.7 29.7 aggets liabilities Long-Term Assets Long-Term Liabilities Net property. 113.1 80.9 Long-term debt 113.2 78.0 plant, and equipment Total long-term 113.1 80.9 Total long-term 113.2 78.0 asgets liabilities Total Liabilities 147.9 107.7 Shareholders' Equity Common stock 8.0 Petained 14.2 13.2 earnings Total 22.2 21.2 Shareholders Equity Total A99ete 170.1 128.9 170.1 128.9 Total Liabilities and shareholders Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts