Question: Need this done ASAP Please!! IDEE . CAR Ch blue STELL VE 3 . M WO IDEE . CAR Ch blue STELL VE 3 .

Need this done ASAP Please!!

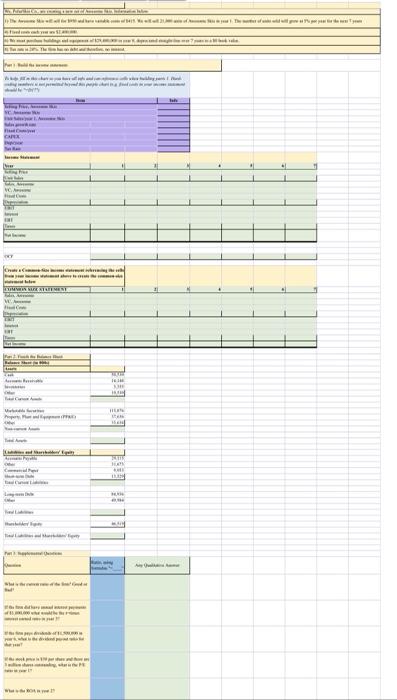

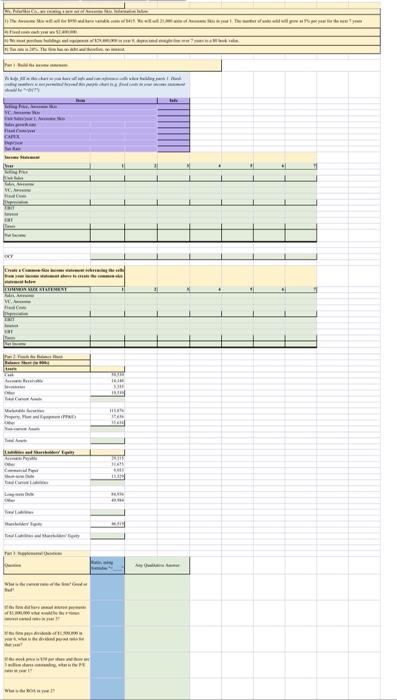

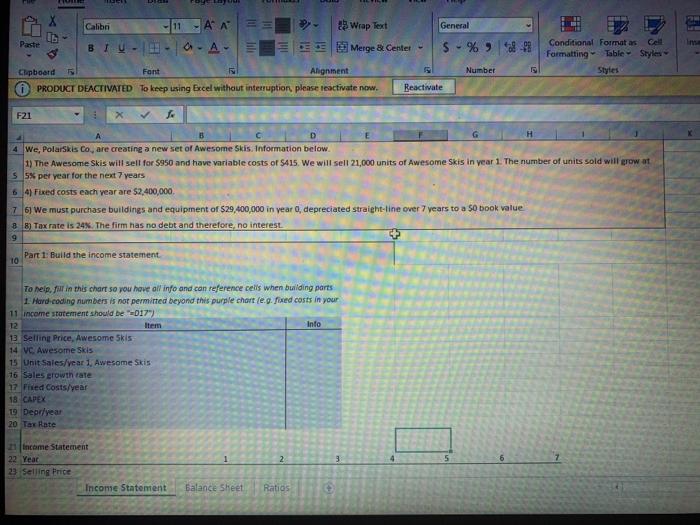

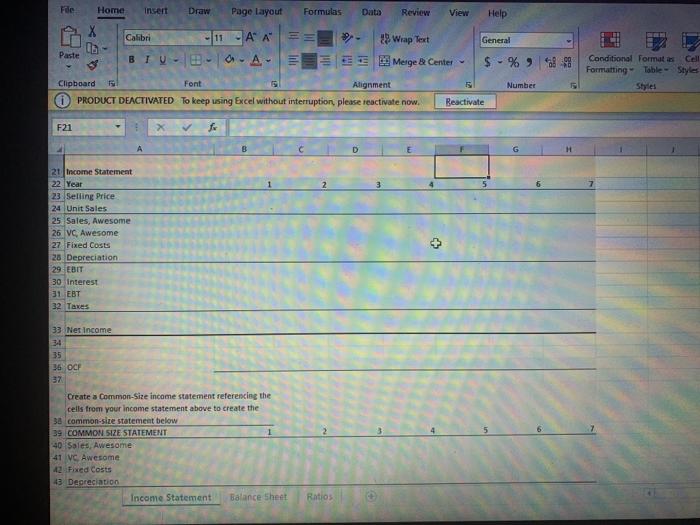

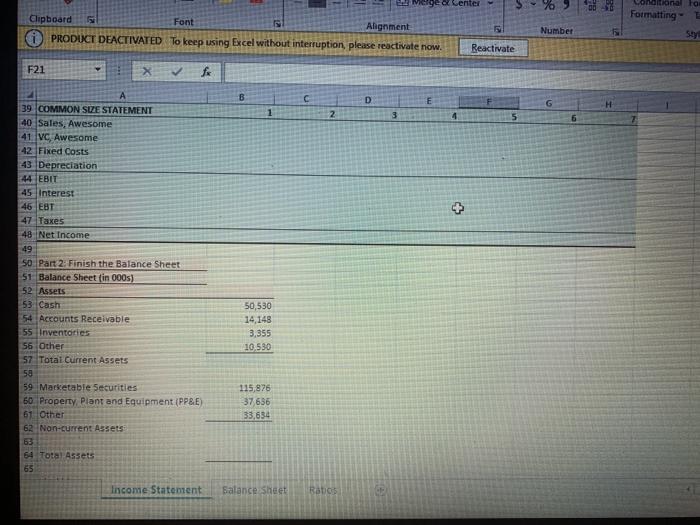

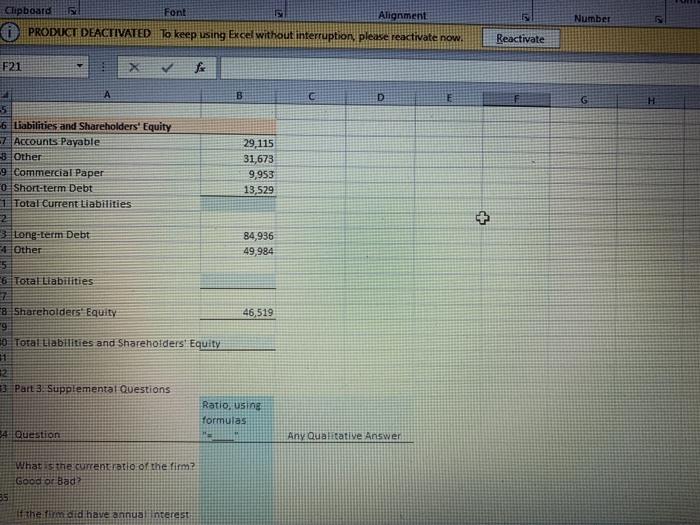

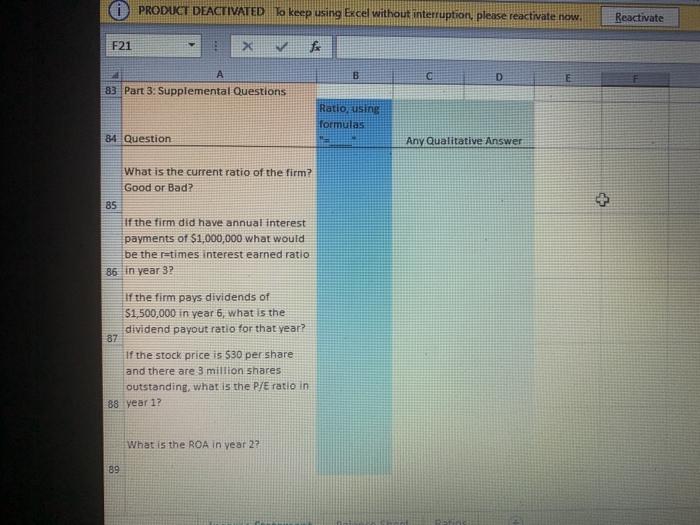

IDEE . CAR Ch blue STELL VE 3 . M WO IDEE . CAR Ch blue STELL VE 3 . M WO 25 Wrap Text General Paste Calibri 11 - BTU - OA Merge & Center 5 -% Conditional Format as Formatting Table Styles Styles Number Clipboard Font Alignment PRODUCT DEACTIVATED To keep using Excel without interruption, please reactivate now. Reactivate F21 A D 4 We, PolarSkis Co, are creating a new set of Awesome Skis. Information below 1) The Awesome Skis will sell for $950 and have variable costs of $415. We will sell 21,000 units of Awesome Skis in year 1. The number of units sold will grow at 55% per year for the next 7 years 64) Fixed costs each year are 52,400,000 76 We must purchase buildings and equipment of $29,400,000 in year depreciated straight-line over 7 years to a 50 book value 8 8) Tox rate is 24%. The firm has no debt and therefore no interest 9 10 Part 1: Build the income statement To helpful in this chart so you have all info and can reference cells when building parts 1 Hard coding numbers is not permitted beyond this purple chart (eg. fixed costs in your 11 income statement should be 017) 12 Item Info 13 Selling Price, Awesome Skis 14 VC Awesome Skis 15 Unit Sales/year 1 Awesome Skis 16 Sales growth rate 17 Fixed Costs/year 18 CAPEX 19 Deoryear 20 Tax Rate 2 3 6 Income Statement 22 Year 23 Selling Price Income Statement Balance Sheet Ratios Fide Home insert Draw Page Layout Formulas Data Review View Help HI IN Calibri - 11-AA Wrap Text General Paste BTU-8-0. A. Merge & Center $ - % 9 Clipboard TS Font Alignment Number PRODUCT DEACTIVATED To keep using Excel without interruption, please reactivate now. Reactivate Conditional Formatas Cell Formatting Table Styles Styles F21 X f A B D 21 Income Statement 22 Year 23 Selling Price 24 Unit Sales 25 Sales, Awesome 26. VC, Awesome 27 Fixed Costs 20 Depreciation 29 EBIT 30 Interest 31 EBT 32 Taxes + 33 Net Income 34 35 36 OCF 37 Create a Common-Size income statement referencing the cells from your income statement above to create the 38 common-size statement below 39 COMMON SIZE STATEMENT 40 Sales, Awesome 41 VC Awesome 42 Fixed Costs 43 Depreciation Income Statement Balance Sheet Ratios Londona la Formatting Clipboard Font Alignment PRODUCT DEACTIVATED To keep using Excel without interruption, please reactivate now. Number sty Reactivate F21 X fx D G 2 3 39 COMMON SUZE STATEMENT 40 Sales, Awesome 41 VC Awesome 42 Fixed Costs 43 Depreciation 44 EBIT 45 Interest 46 EBT 47 Taxes 48 Net Income 49 SD Part 2: Finish the Balance Sheet 51 Balance Sheet (in 000) 52 Assets 53 Cash 54 Accounts Receivable 55 Inventories 56 Other 57 Total Current Assets 58 59 Marketable Securities 60 Property Plant and Equipment (PPBE 67. Other 62 Non-current Assets 63 64 Total Assets 65 50,530 14,148 3,355 10.530 115,826 37636 33,634 Income Statement Balance Sheet Botos Numbet Clipboard Font Alignment PRODUCT DEACTIVATED To keep using Excel without interruption, please reactivate now. Reactivate F21 fo A B t C D F . 6 Liabilities and Shareholders' Equity 7 Accounts Payable 29,115 3 Other 31,673 9 Commercial Paper 9,953 0 Short-term Debt 13,529 Total Current Liabilities 2 3. Long-Lerm Debt 84,936 4 Other 49,984 5 6 Total Liabilities 7 8 Shareholders' Equity 46,519 "9 30 Toral Liabilities and Shareholders Equity 11 2 3. Part 3. Supplementat questions Ratio, using formulas 34 Question Any Qualitative Answer What the current ratio of the firm? Good or Bad 35 If the firm did have annual interest i PRODUCT DEACTIVATED to keep using Excel without interruption, please reactivate now. Reactivate F21 > V f B D 83 Part 3: Supplemental Questions E Ratio, using formulas 84 Question Any Qualitative Answer + What is the current ratio of the firm? Good or Bad? 85 If the firm did have annual interest payments of $1,000,000 what would be the r=times interest earned ratio 86 in year 3? If the fimm pays dividends of $1,500,000 in year 6, what is the dividend payout ratio for that year? 87 If the stock price is 530 per share and there are 3 million shares outstanding, what is the P/E ratio in 88 year 1? What is the ROA in year 2? 89 IDEE . CAR Ch blue STELL VE 3 . M WO IDEE . CAR Ch blue STELL VE 3 . M WO 25 Wrap Text General Paste Calibri 11 - BTU - OA Merge & Center 5 -% Conditional Format as Formatting Table Styles Styles Number Clipboard Font Alignment PRODUCT DEACTIVATED To keep using Excel without interruption, please reactivate now. Reactivate F21 A D 4 We, PolarSkis Co, are creating a new set of Awesome Skis. Information below 1) The Awesome Skis will sell for $950 and have variable costs of $415. We will sell 21,000 units of Awesome Skis in year 1. The number of units sold will grow at 55% per year for the next 7 years 64) Fixed costs each year are 52,400,000 76 We must purchase buildings and equipment of $29,400,000 in year depreciated straight-line over 7 years to a 50 book value 8 8) Tox rate is 24%. The firm has no debt and therefore no interest 9 10 Part 1: Build the income statement To helpful in this chart so you have all info and can reference cells when building parts 1 Hard coding numbers is not permitted beyond this purple chart (eg. fixed costs in your 11 income statement should be 017) 12 Item Info 13 Selling Price, Awesome Skis 14 VC Awesome Skis 15 Unit Sales/year 1 Awesome Skis 16 Sales growth rate 17 Fixed Costs/year 18 CAPEX 19 Deoryear 20 Tax Rate 2 3 6 Income Statement 22 Year 23 Selling Price Income Statement Balance Sheet Ratios Fide Home insert Draw Page Layout Formulas Data Review View Help HI IN Calibri - 11-AA Wrap Text General Paste BTU-8-0. A. Merge & Center $ - % 9 Clipboard TS Font Alignment Number PRODUCT DEACTIVATED To keep using Excel without interruption, please reactivate now. Reactivate Conditional Formatas Cell Formatting Table Styles Styles F21 X f A B D 21 Income Statement 22 Year 23 Selling Price 24 Unit Sales 25 Sales, Awesome 26. VC, Awesome 27 Fixed Costs 20 Depreciation 29 EBIT 30 Interest 31 EBT 32 Taxes + 33 Net Income 34 35 36 OCF 37 Create a Common-Size income statement referencing the cells from your income statement above to create the 38 common-size statement below 39 COMMON SIZE STATEMENT 40 Sales, Awesome 41 VC Awesome 42 Fixed Costs 43 Depreciation Income Statement Balance Sheet Ratios Londona la Formatting Clipboard Font Alignment PRODUCT DEACTIVATED To keep using Excel without interruption, please reactivate now. Number sty Reactivate F21 X fx D G 2 3 39 COMMON SUZE STATEMENT 40 Sales, Awesome 41 VC Awesome 42 Fixed Costs 43 Depreciation 44 EBIT 45 Interest 46 EBT 47 Taxes 48 Net Income 49 SD Part 2: Finish the Balance Sheet 51 Balance Sheet (in 000) 52 Assets 53 Cash 54 Accounts Receivable 55 Inventories 56 Other 57 Total Current Assets 58 59 Marketable Securities 60 Property Plant and Equipment (PPBE 67. Other 62 Non-current Assets 63 64 Total Assets 65 50,530 14,148 3,355 10.530 115,826 37636 33,634 Income Statement Balance Sheet Botos Numbet Clipboard Font Alignment PRODUCT DEACTIVATED To keep using Excel without interruption, please reactivate now. Reactivate F21 fo A B t C D F . 6 Liabilities and Shareholders' Equity 7 Accounts Payable 29,115 3 Other 31,673 9 Commercial Paper 9,953 0 Short-term Debt 13,529 Total Current Liabilities 2 3. Long-Lerm Debt 84,936 4 Other 49,984 5 6 Total Liabilities 7 8 Shareholders' Equity 46,519 "9 30 Toral Liabilities and Shareholders Equity 11 2 3. Part 3. Supplementat questions Ratio, using formulas 34 Question Any Qualitative Answer What the current ratio of the firm? Good or Bad 35 If the firm did have annual interest i PRODUCT DEACTIVATED to keep using Excel without interruption, please reactivate now. Reactivate F21 > V f B D 83 Part 3: Supplemental Questions E Ratio, using formulas 84 Question Any Qualitative Answer + What is the current ratio of the firm? Good or Bad? 85 If the firm did have annual interest payments of $1,000,000 what would be the r=times interest earned ratio 86 in year 3? If the fimm pays dividends of $1,500,000 in year 6, what is the dividend payout ratio for that year? 87 If the stock price is 530 per share and there are 3 million shares outstanding, what is the P/E ratio in 88 year 1? What is the ROA in year 2? 89

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts