Question: From the data provided in the case Exhibits 1 , 2 , 6 , and 7 , how does Twitter's performance stack up with Facebook

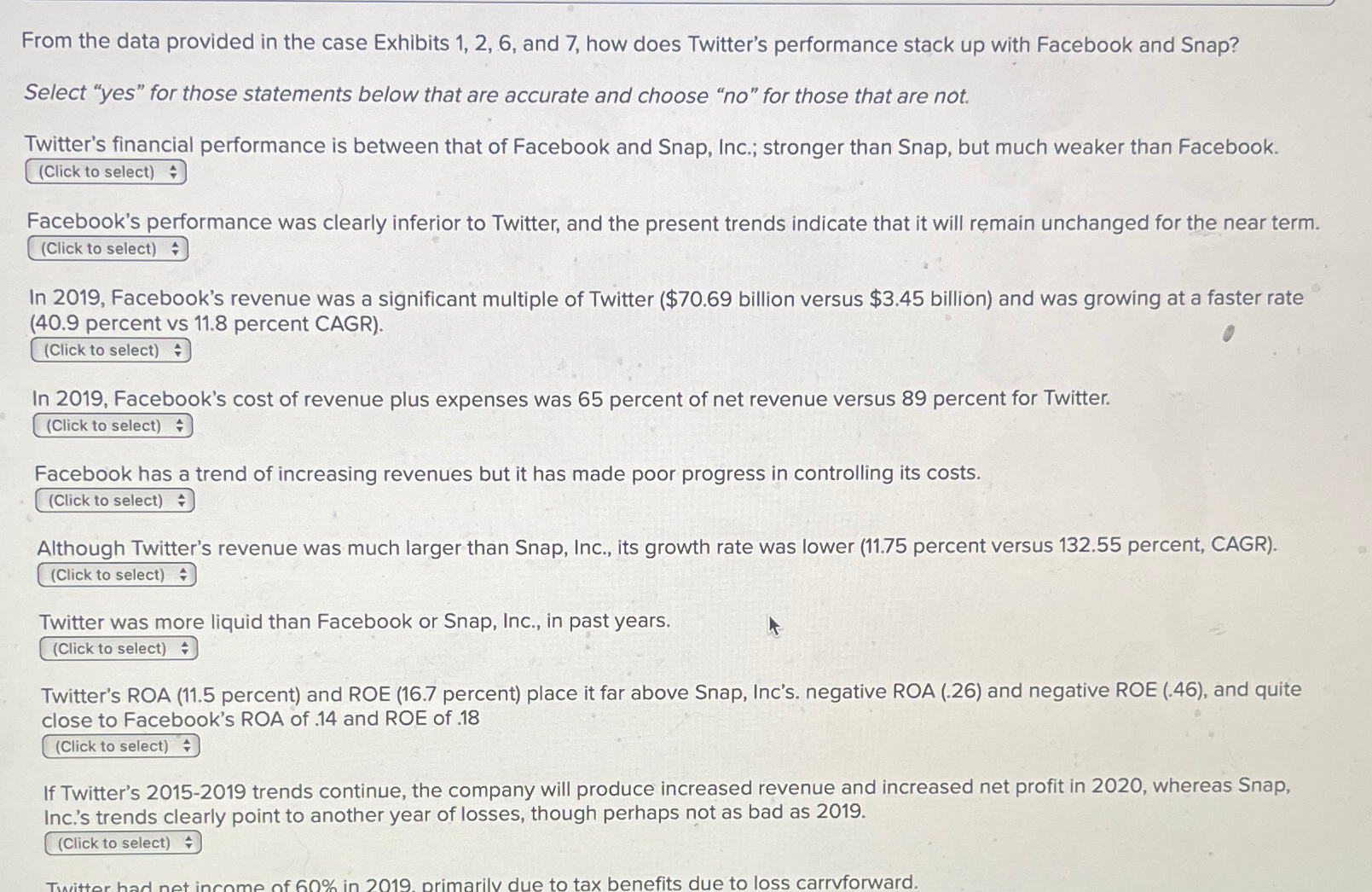

From the data provided in the case Exhibits and how does Twitter's performance stack up with Facebook and Snap?

Select "yes" for those statements below that are accurate and choose no for those that are not.

Twitter's financial performance is between that of Facebook and Snap, Inc.; stronger than Snap, but much weaker than Facebook.

Facebook's performance was clearly inferior to Twitter, and the present trends indicate that it will remain unchanged for the near term.

In Facebook's revenue was a significant multiple of Twitter $ billion versus $ billion and was growing at a faster rate percent vs percent CAGR

In Facebook's cost of revenue plus expenses was percent of net revenue versus percent for Twitter.

Facebook has a trend of increasing revenues but it has made poor progress in controlling its costs.

Although Twitter's revenue was much larger than Snap, Inc., its growth rate was lower percent versus percent, CAGR

Twitter was more liquid than Facebook or Snap, Inc., in past years.

Twitter's ROA percent and ROE percent place it far above Snap, Inc's. negative ROA and negative ROE and quite close to Facebook's ROA of and ROE of

If Twitter's trends continue, the company will produce increased revenue and increased net profit in whereas Snap, Inc.s trends clearly point to another year of losses, though perhaps not as bad as

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock