Question: from the given information find the expected future cash flow for the company three years and analysis it 2020,2021, 2022 Note 10: Leases Rent expense

from the given information find the expected future cash flow for the company three years and analysis it 2020,2021, 2022

from the given information find the expected future cash flow for the company three years and analysis it 2020,2021, 2022

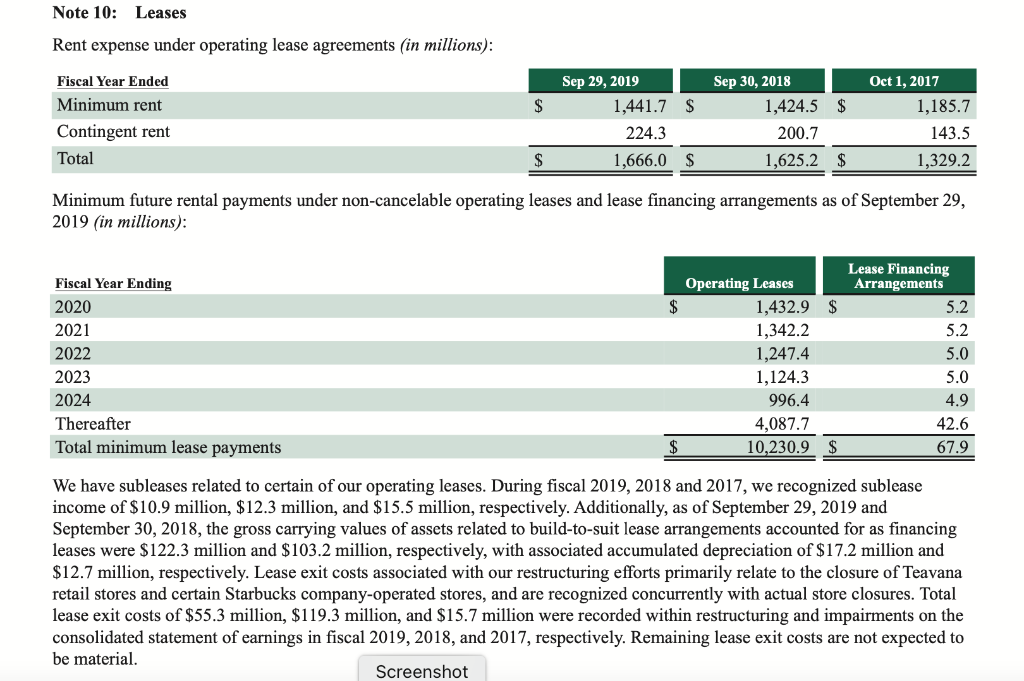

Note 10: Leases Rent expense under operating lease agreements (in millions): $ Fiscal Year Ended Minimum rent Contingent rent Total Sep 29, 2019 1,441.7 $ 224.3 Sep 30, 2018 1,424.5 $ 200.7 1,625.2 $ Oct 1, 2017 1,185.7 143.5 1,329.2 $ 1,666.0 $ Minimum future rental payments under non-cancelable operating leases and lease financing arrangements as of September 29, 2019 (in millions): $ Fiscal Year Ending 2020 2021 2022 2023 2024 Thereafter Total minimum lease payments Operating Leases 1,432.9 $ 1,342.2 1,247.4 1,124.3 996.4 4,087.7 10,230.9 $ Lease Financing Arrangements 5.2 5.2 5.0 5.0 4.9 42.6 67.9 $ We have subleases related to certain of our operating leases. During fiscal 2019, 2018 and 2017, we recognized sublease income of $10.9 million, $12.3 million, and $15.5 million, respectively. Additionally, as of September 29, 2019 and September 30, 2018, the gross carrying values of assets related to build-to-suit lease arrangements accounted for as financing leases were $122.3 million and $103.2 million, respectively, with associated accumulated depreciation of $17.2 million and $12.7 million, respectively. Lease exit costs associated with our restructuring efforts primarily relate to the closure of Teavana retail stores and certain Starbucks company-operated stores, and are recognized concurrently with actual store closures. Total lease exit costs of $55.3 million, $119.3 million, and $15.7 million were recorded within restructuring and impairments on the consolidated statement of earnings in fiscal 2019, 2018, and 2017, respectively. Remaining lease exit costs are not expected to be material. Screenshot Note 10: Leases Rent expense under operating lease agreements (in millions): $ Fiscal Year Ended Minimum rent Contingent rent Total Sep 29, 2019 1,441.7 $ 224.3 Sep 30, 2018 1,424.5 $ 200.7 1,625.2 $ Oct 1, 2017 1,185.7 143.5 1,329.2 $ 1,666.0 $ Minimum future rental payments under non-cancelable operating leases and lease financing arrangements as of September 29, 2019 (in millions): $ Fiscal Year Ending 2020 2021 2022 2023 2024 Thereafter Total minimum lease payments Operating Leases 1,432.9 $ 1,342.2 1,247.4 1,124.3 996.4 4,087.7 10,230.9 $ Lease Financing Arrangements 5.2 5.2 5.0 5.0 4.9 42.6 67.9 $ We have subleases related to certain of our operating leases. During fiscal 2019, 2018 and 2017, we recognized sublease income of $10.9 million, $12.3 million, and $15.5 million, respectively. Additionally, as of September 29, 2019 and September 30, 2018, the gross carrying values of assets related to build-to-suit lease arrangements accounted for as financing leases were $122.3 million and $103.2 million, respectively, with associated accumulated depreciation of $17.2 million and $12.7 million, respectively. Lease exit costs associated with our restructuring efforts primarily relate to the closure of Teavana retail stores and certain Starbucks company-operated stores, and are recognized concurrently with actual store closures. Total lease exit costs of $55.3 million, $119.3 million, and $15.7 million were recorded within restructuring and impairments on the consolidated statement of earnings in fiscal 2019, 2018, and 2017, respectively. Remaining lease exit costs are not expected to be material. Screenshot

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts