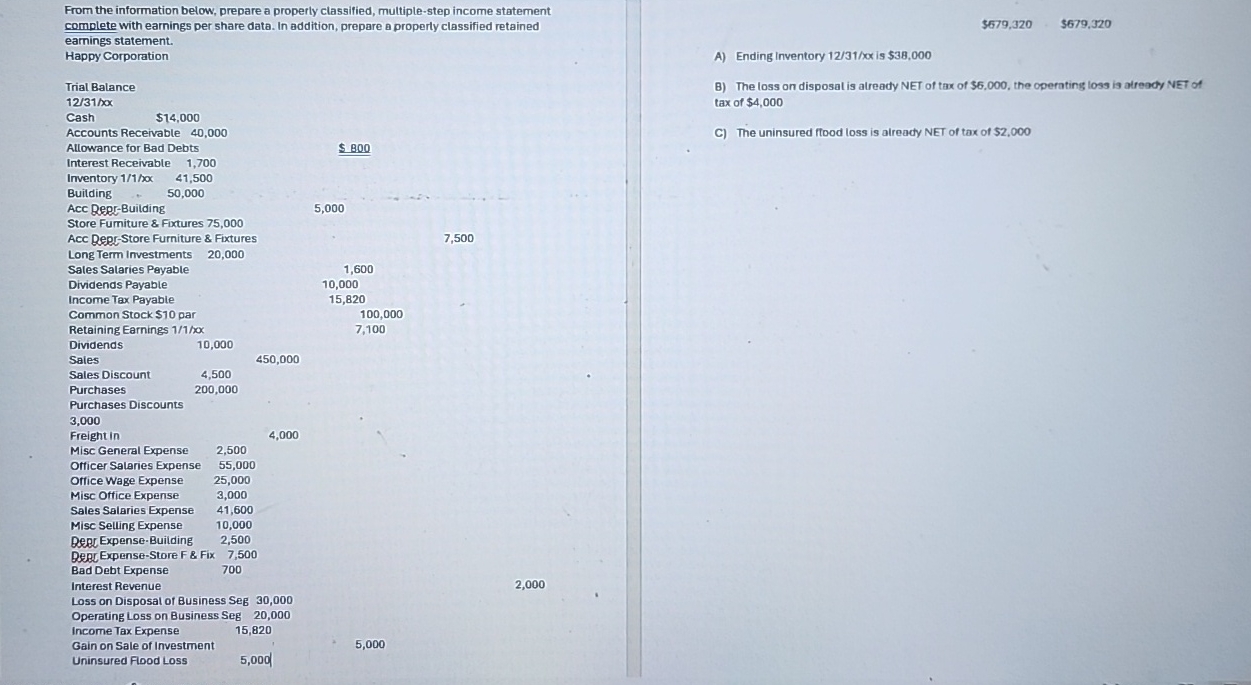

Question: From the information below, prepare a properly classified, multiple - step income statement complete with earnings per share data. In addition, prepare a property classified

From the information below, prepare a properly classified, multiplestep income statement complete with earnings per share data. In addition, prepare a property classified retained earnings statement.

Happy Corporation

Trial Balance

Cash $

Accounts Receivable

Allowance for Bad Debts

Interest Receivable

Inventory ox

Building

Acc ReprBuilding

Store Fumiture & Fixtures

Acc DeprStore Furniture & Fixtures

Long Term Investments

Sales Salaries Peyable

Dividends Payable

Income Tax Payable

Common Stock $ par

Retaining Earnings

Dividends Saies

Sales Discount

Purchases

Purchases Discounts

tableFreight inMisc General Expense,Orficer Salaries Expense,Orfice Wage Expense,Misc Office Expense,Sales Salaries Expense,Misc Selling Expense,Derd ExpenseBuilding,Derd ExpenseStore F & Fix,Bad Debt Expense,

Interest Revenue

Loss on Disposal of Business Seg

Operating Loss on Business Seg

Income Tax Expense

Gain on Sale of Investment

Uninsured Flood Loss

A Ending Inventory is $

B The loss on disposat is atready NET of tax of $ the operating loss is atready NET of tax of $

C The uninsured ftood loss is already NET of tax of $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock