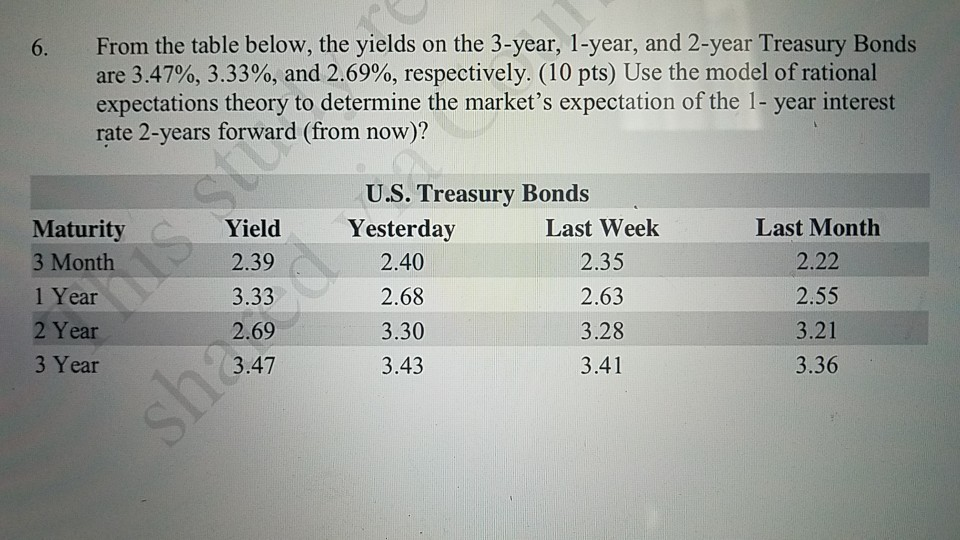

Question: From the table below, the yields on the 3-year, 1-year, and 2-year Treasury Bonds are 3.47%, 3.33%, and 2.69%, respectively. (10 pts) Use the model

From the table below, the yields on the 3-year, 1-year, and 2-year Treasury Bonds are 3.47%, 3.33%, and 2.69%, respectively. (10 pts) Use the model of rational expectations theory to determine the market's expectation of the 1- year interest rate 2-years forward (from now)? 6. U.S. Treasury Bonds Last Month Maturity Yield Yesterday Last Week 2.35 2.22 3 Month 2.39 2.40 1 Year 2.63 2.55 3.33 2.68 2 Year 3.21 2.69 3.30 3.28 shae 3 Year 3.47 3.41 3.36 3.43 sha

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts