Question: PLEASE HELP ME TO ANSWER PART (a - d) FOR QUESTION #2. EITHER on TSLA, ABNB, NVDA, or APPL Question 2 a) Assume that you

PLEASE HELP ME TO ANSWER PART (a - d) FOR QUESTION #2. EITHER on TSLA, ABNB, NVDA, or APPL

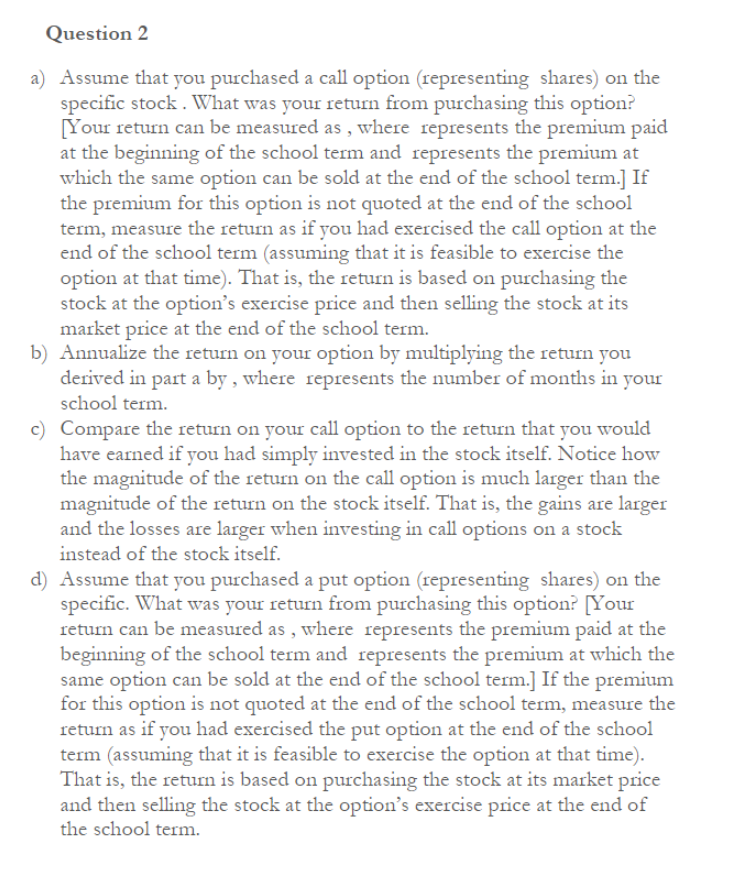

Question 2 a) Assume that you purchased a call option (representing shares) on the specific stock. What was your return from purchasing this option? [Your return can be measured as , where represents the premium paid at the beginning of the school term and represents the premium at which the same option can be sold at the end of the school term.) If the premium for this option is not quoted at the end of the school term, measure the return as if you had exercised the call option at the end of the school term (assuming that it is feasible to exercise the option at that time). That is, the return is based on purchasing the stock at the option's exercise price and then selling the stock at its market price at the end of the school term. b) Annualize the return on your option by multiplying the return you derived in part a by , where represents the number of months in your school term. c) Compare the return on your call option to the return that you would have earned if you had simply invested in the stock itself. Notice how the magnitude of the return on the call option is much larger than the magnitude of the return on the stock itself. That is, the gains are larger and the losses are larger when investing in call options on a stock instead of the stock itself. d) Assume that you purchased a put option (representing shares) on the specific. What was your return from purchasing this option? [Your return can be measured as , where represents the premium paid at the beginning of the school term and represents the premium at which the same option can be sold at the end of the school term.] If the premium for this option is not quoted at the end of the school term, measure the return as if you had exercised the put option at the end of the school term (assuming that it is feasible to exercise the option at that time). That is, the return is based on purchasing the stock at its market price and then selling the stock at the option's exercise price at the end of the school term. Question 2 a) Assume that you purchased a call option (representing shares) on the specific stock. What was your return from purchasing this option? [Your return can be measured as , where represents the premium paid at the beginning of the school term and represents the premium at which the same option can be sold at the end of the school term.) If the premium for this option is not quoted at the end of the school term, measure the return as if you had exercised the call option at the end of the school term (assuming that it is feasible to exercise the option at that time). That is, the return is based on purchasing the stock at the option's exercise price and then selling the stock at its market price at the end of the school term. b) Annualize the return on your option by multiplying the return you derived in part a by , where represents the number of months in your school term. c) Compare the return on your call option to the return that you would have earned if you had simply invested in the stock itself. Notice how the magnitude of the return on the call option is much larger than the magnitude of the return on the stock itself. That is, the gains are larger and the losses are larger when investing in call options on a stock instead of the stock itself. d) Assume that you purchased a put option (representing shares) on the specific. What was your return from purchasing this option? [Your return can be measured as , where represents the premium paid at the beginning of the school term and represents the premium at which the same option can be sold at the end of the school term.] If the premium for this option is not quoted at the end of the school term, measure the return as if you had exercised the put option at the end of the school term (assuming that it is feasible to exercise the option at that time). That is, the return is based on purchasing the stock at its market price and then selling the stock at the option's exercise price at the end of the school term

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts