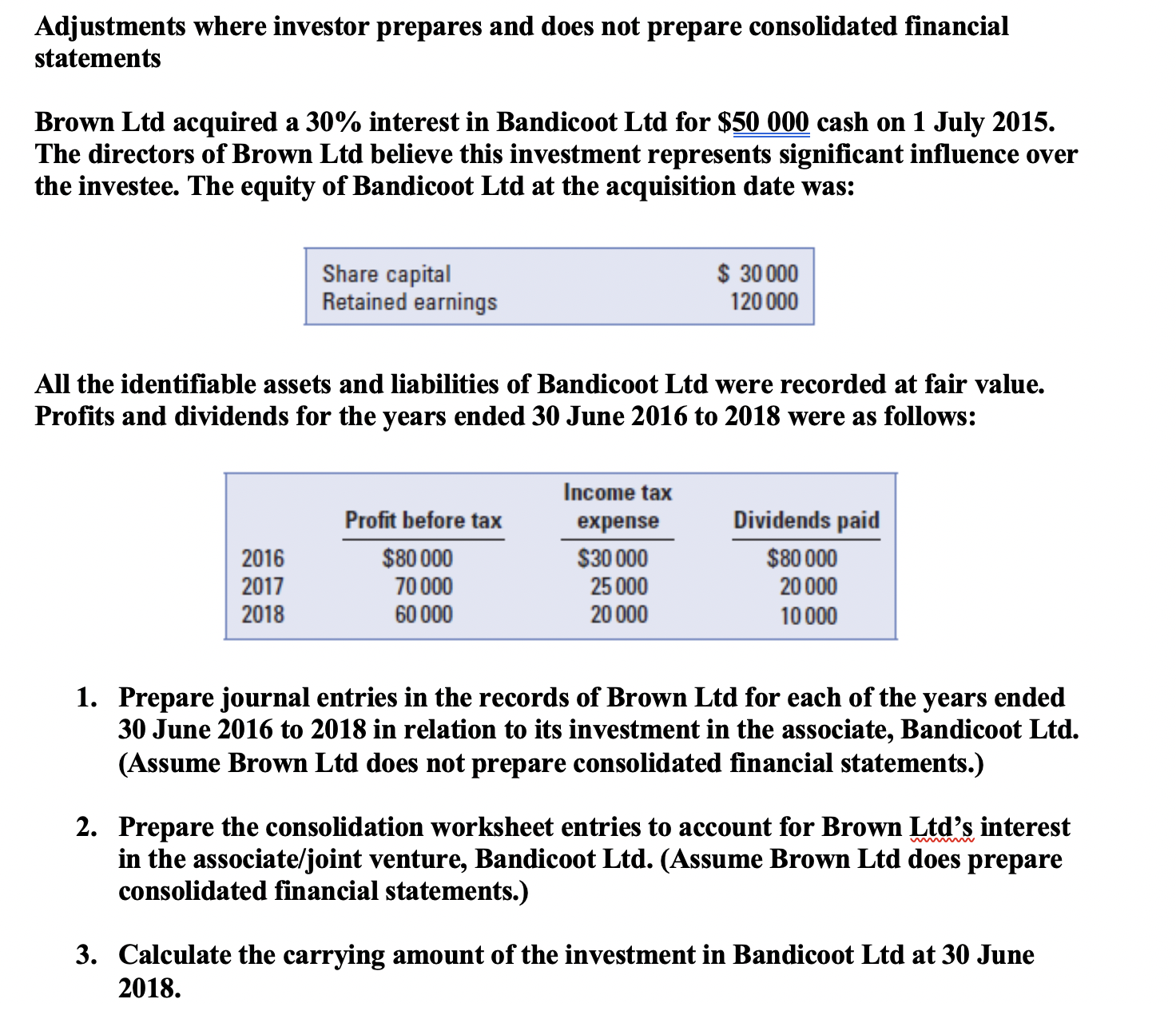

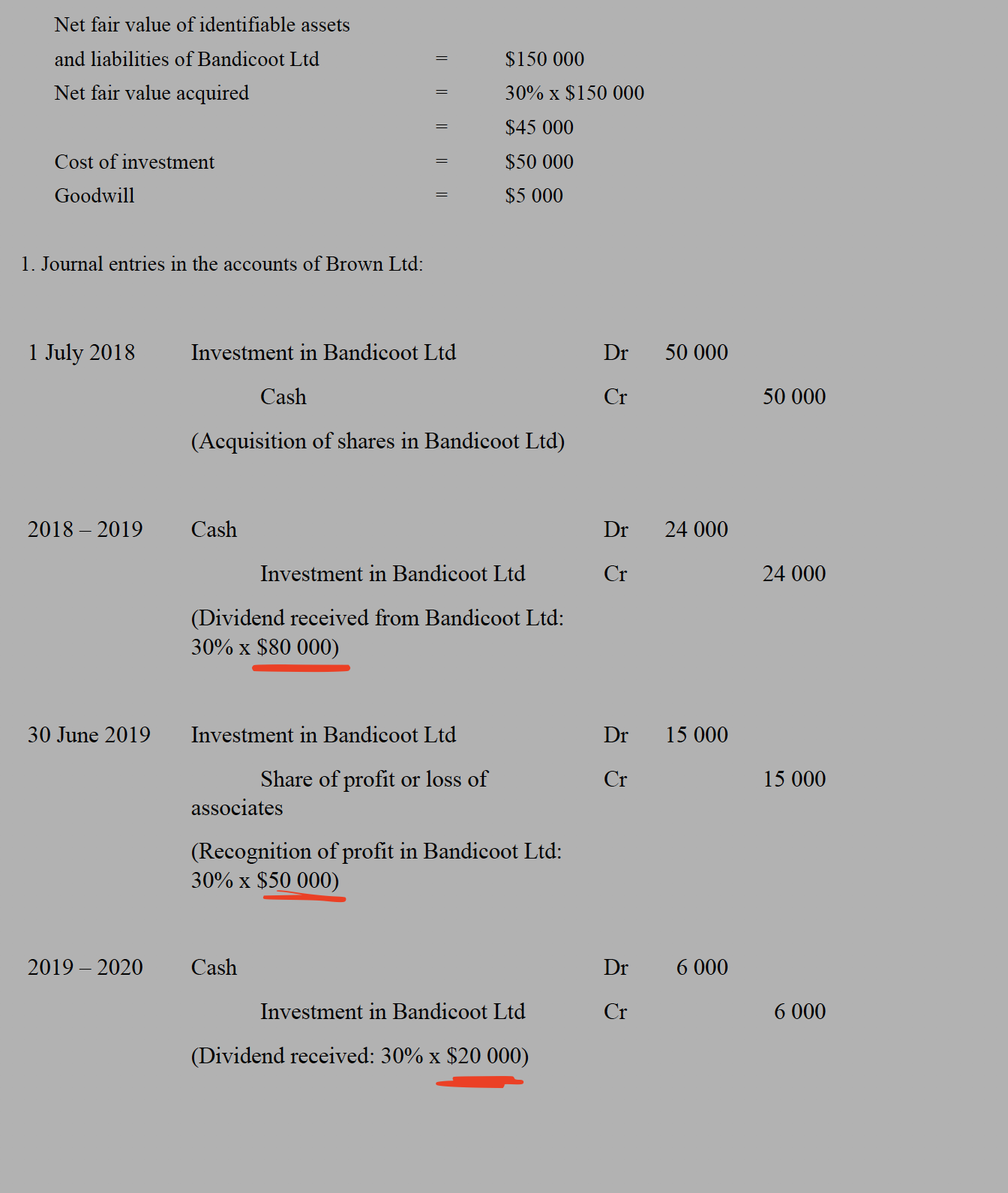

Question: From where and how we get these numbers Unser red lined Refrence Deegan. (2016). Financial Accounting . McGraw-Hill Education, Australia Adjustments where investor prepares and

From where and how we get these numbers Unser red lined

Refrence

Deegan. (2016).Financial Accounting. McGraw-Hill Education, Australia

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock