Question: full ansorption costing vs variable costing in the first year of business, the apex company produces and sold 14,000. apex has a 25% tax rate

full ansorption costing vs variable costing

in the first year of business, the apex company produces and sold 14,000.

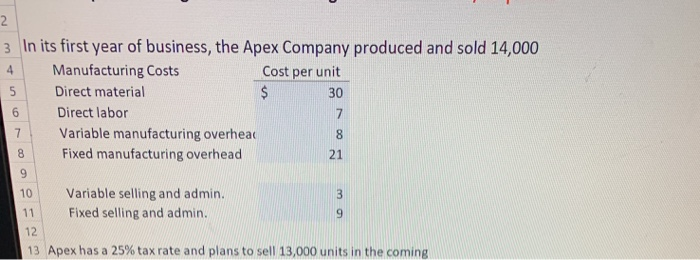

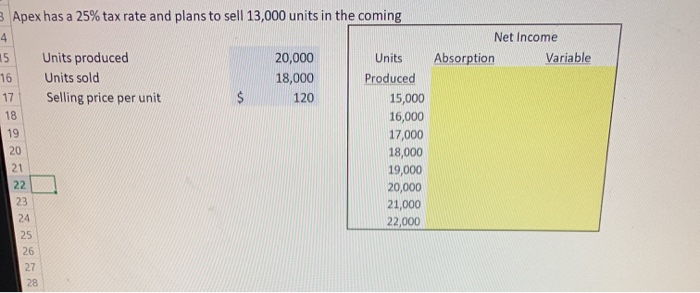

3 In its first year of business, the Apex Company produced and sold 14,000 Manufacturing Costs Cost per unit Direct material Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and admin. Fixed selling and admin. 13 Apex has a 25% tax rate and plans to sell 13,000 units in the coming Apex has a 25% tax rate and plans to sell 13,000 units in the coming Net Income Absorption Variable 15 Units produced Units sold Selling price per unit 20,000 18,000 120 Units Produced 15,000 16,000 17,000 18,000 19,000 20,000 21,000 22,000 22 3 In its first year of business, the Apex Company produced and sold 14,000 Manufacturing Costs Cost per unit Direct material Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling and admin. Fixed selling and admin. 13 Apex has a 25% tax rate and plans to sell 13,000 units in the coming Apex has a 25% tax rate and plans to sell 13,000 units in the coming Net Income Absorption Variable 15 Units produced Units sold Selling price per unit 20,000 18,000 120 Units Produced 15,000 16,000 17,000 18,000 19,000 20,000 21,000 22,000 22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts