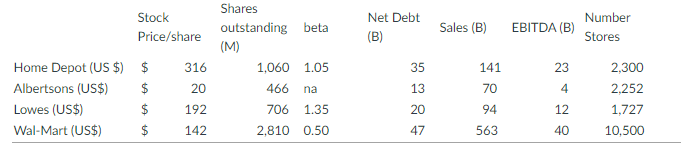

Question: Full data set: Stock Price/share Net Debt (B) Sales (B) EBITDA (B) Number Stores Shares outstanding beta (M) 1,060 1.05 466 141 23 316 20

Full data set:

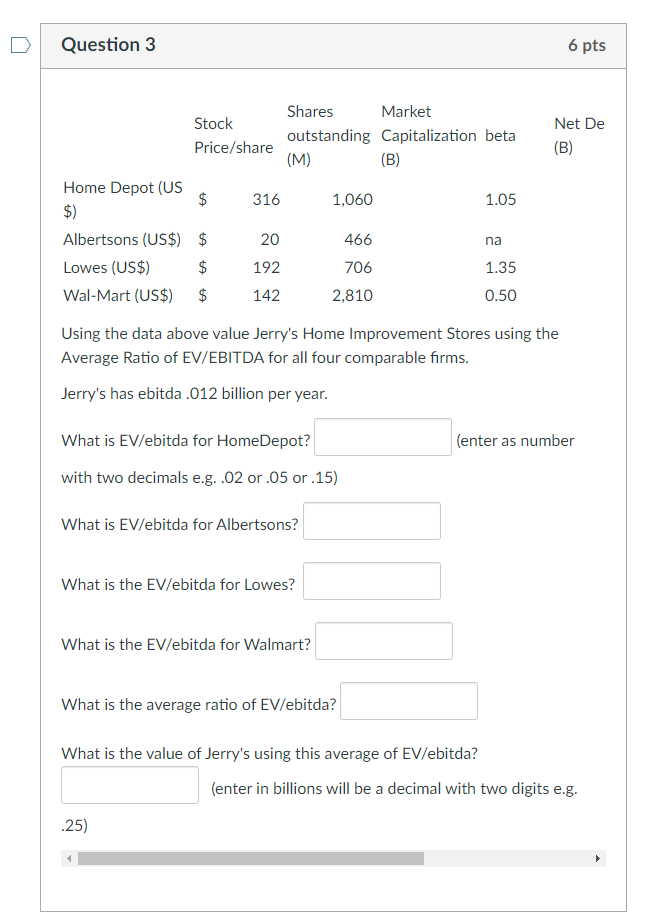

Stock Price/share Net Debt (B) Sales (B) EBITDA (B) Number Stores Shares outstanding beta (M) 1,060 1.05 466 141 23 316 20 35 13 na 70 4 Home Depot (US$) $ Albertsons (US$) $ Lowes (US$) $ Wal-Mart (US$) $ 2,300 2,252 1,727 10.500 192 706 1.35 20 94 12 142 2.810 0.50 47 563 40 Question 3 6 pts Stock Price/share Shares Market outstanding Capitalization beta (M) Net De (B) (B) 316 1,060 1.05 Home Depot (US $ $) Albertsons (US$) $ Lowes (US$) $ Wal-Mart (US$) $ 20 466 na 192 706 2,810 1.35 0.50 142 Using the data above value Jerry's Home Improvement Stores using the Average Ratio of EV/EBITDA for all four comparable firms. Jerry's has ebitda .012 billion per year. What is EV/ebitda for Home Depot? (enter as number with two decimals e.g. 02 or.05 or .15) What is EV/ebitda for Albertsons? What is the EV/ebitda for Lowes? What is the EV/ebitda for Walmart? What is the average ratio of EV/ebitda? What is the value of Jerry's using this average of EV/ebitda? (enter in billions will be a decimal with two digits e.g. .25)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts