Question: Full question in two pics Question 17 (40 points) Saved Shelzo Inc., a manufacturer of construction equipment is considering the purchase of one of its

Full question in two pics

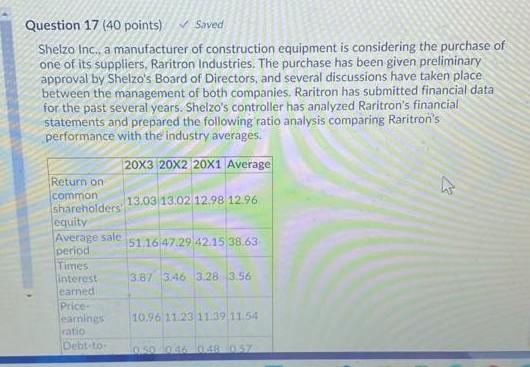

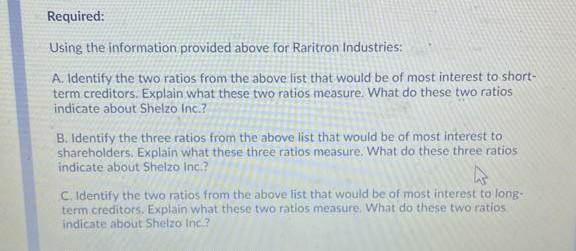

Question 17 (40 points) Saved Shelzo Inc., a manufacturer of construction equipment is considering the purchase of one of its suppliers, Raritron Industries. The purchase has been given preliminary approval by Shelzo's Board of Directors, and several discussions have taken place between the management of both companies, Raritron has submitted financial data for the past several years. Shelzo's controller has analyzed Raritron's financial statements and prepared the following ratio analysis comparing Raritron's performance with the industry averages. 20x3 20x2 20x1 Average Return on common shareholders 13.03 13.02 12.98 12.96 equity Average sale period 51 16 47.29 42.15 38,63 Times linterest 3.32 3.46 328 3.56 earned Price carines 10.96 11 23 11:39 11 54 Iratio Debt to & Required: Using the information provided above for Raritron Industries: A. Identify the two ratios from the above list that would be of most interest to short- term creditors. Explain what these two ratios measure. What do these two ratios indicate about Shelzo Inc.? B. Identify the three ratios from the above list that would be of most interest to shareholders. Explain what these three ratios measure. What do these three ratios indicate about Shelzo inc? C. Identify the two ratios from the above list that would be of most interest to long- term creditors. Explain what these two ratios measure. What do these two ratios indicate about Shelzo Inc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts