Question: Please help me complete this question. Question is in second picture. Qs2. Shelzo Inc., a manufacturer of construction equipment is considering the purchase of one

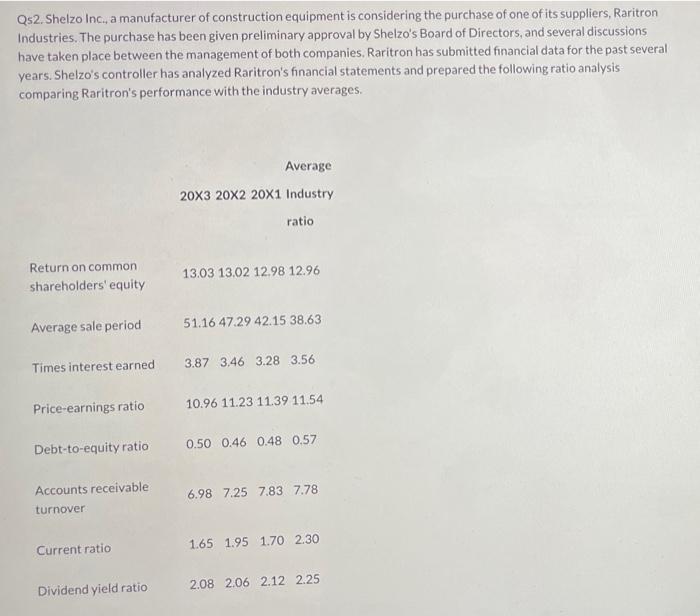

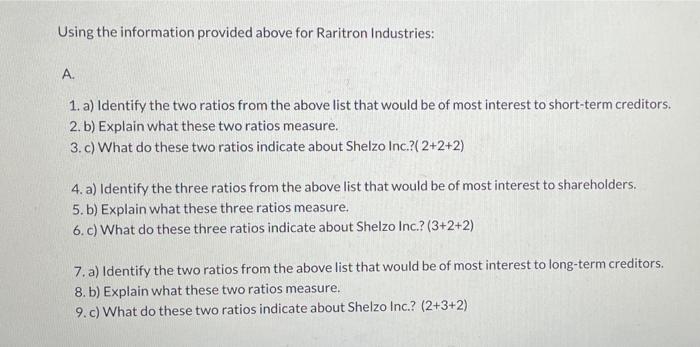

Qs2. Shelzo Inc., a manufacturer of construction equipment is considering the purchase of one of its suppliers, Raritron Industries. The purchase has been given preliminary approval by Shelzo's Board of Directors, and several discussions have taken place between the management of both companies. Raritron has submitted financial data for the past several years. Shelzo's controller has analyzed Raritron's financial statements and prepared the following ratio analysis comparing Raritron's performance with the industry averages. Average 20x3 20x2 20x1 Industry ratio Return on common 13.03 13.02 12.98 12.96 shareholders' equity Average sale period 51.16 47.29 42.15 38.63 Times interest earned 3.87 3.46 3.28 3.56 Price-earnings ratio 10.96 11.23 11.39 11.54 Debt-to-equity ratio 0.50 0.46 0.48 0.57 Accounts receivable turnover: 6.98 7.25 7.83 7.78 Current ratio 1.65 1.95 1.70 2.30 Dividend yield ratio 2.08 2.06 2.12 2.25 Using the information provided above for Raritron Industries: A. 1. a) Identify the two ratios from the above list that would be of most interest to short-term creditors. 2. b) Explain what these two ratios measure. 3. c) What do these two ratios indicate about Shelzo Inc.?(2+2+2) 4. a) Identify the three ratios from the above list that would be of most interest to shareholders. 5. b) Explain what these three ratios measure. 6. c) What do these three ratios indicate about Shelzo Inc.? (3+2+2) 7. a) Identify the two ratios from the above list that would be of most interest to long-term creditors. 8. b) Explain what these two ratios measure. 9. c) What do these two ratios indicate about Shelzo Inc.? (2+3+2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts