Question: FULL SCREEN PRINTER VERSION 4 BACK NEXT Question 16 On November 1, 2020, Jepson Ltd. purchased 300 of the $1,000 face value, 9% bonds of

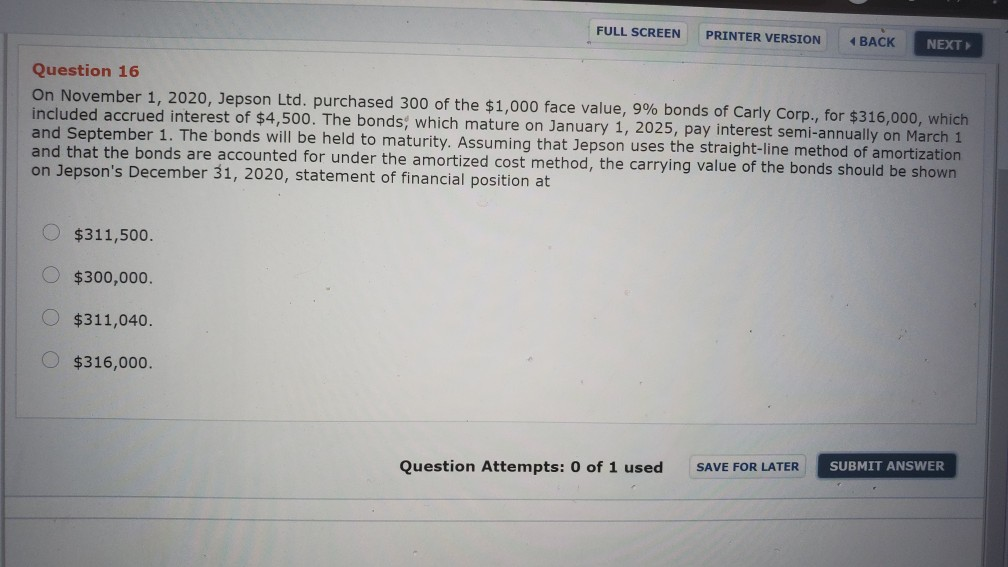

FULL SCREEN PRINTER VERSION 4 BACK NEXT Question 16 On November 1, 2020, Jepson Ltd. purchased 300 of the $1,000 face value, 9% bonds of Carly Corp., for $316,000, which included accrued interest of $4,500. The bonds, which mature on January 1, 2025, pay interest semi-annually on March 1 and September 1. The bonds will be held to maturity. Assuming that Jepson uses the straight-line method of amortization and that the bonds are accounted for under the amortized cost method, the carrying value of the bonds should be shown on Jepson's December 31, 2020, statement of financial position at $311,500. $300,000. O $311,040. O $316,000. Question Attempts: 0 of 1 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts