Question: FULL SCREEN PRINTER VERSION 4 BACK NEXT Question 6 Hopkins Ltd. issued five-year bonds with a face value of $180,000 on January 1. The bonds

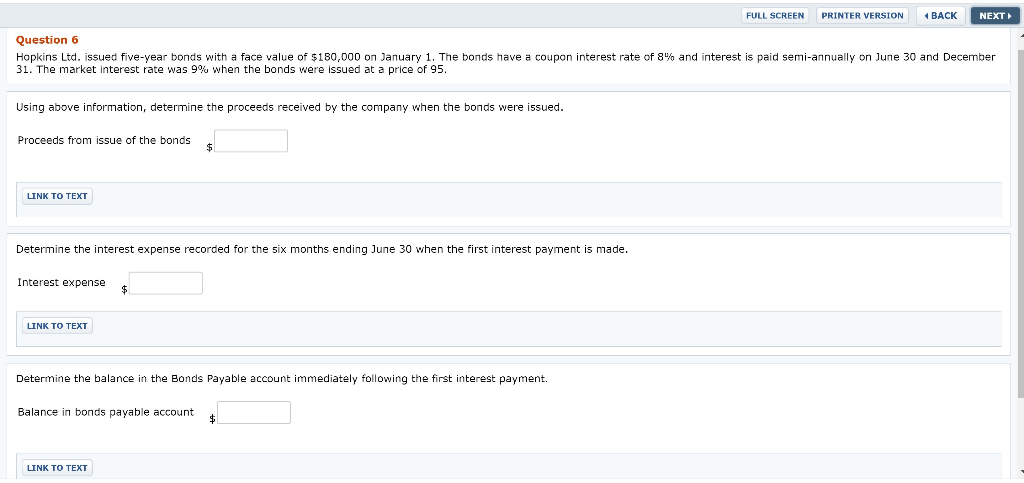

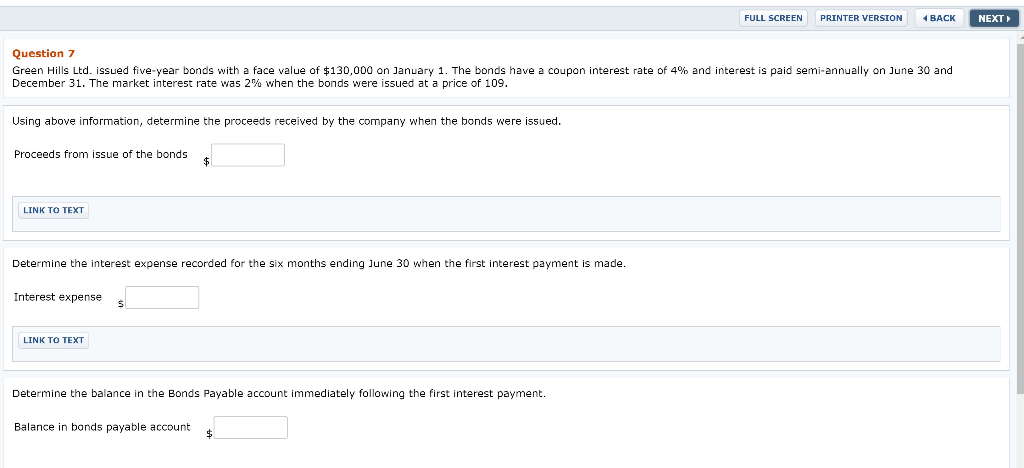

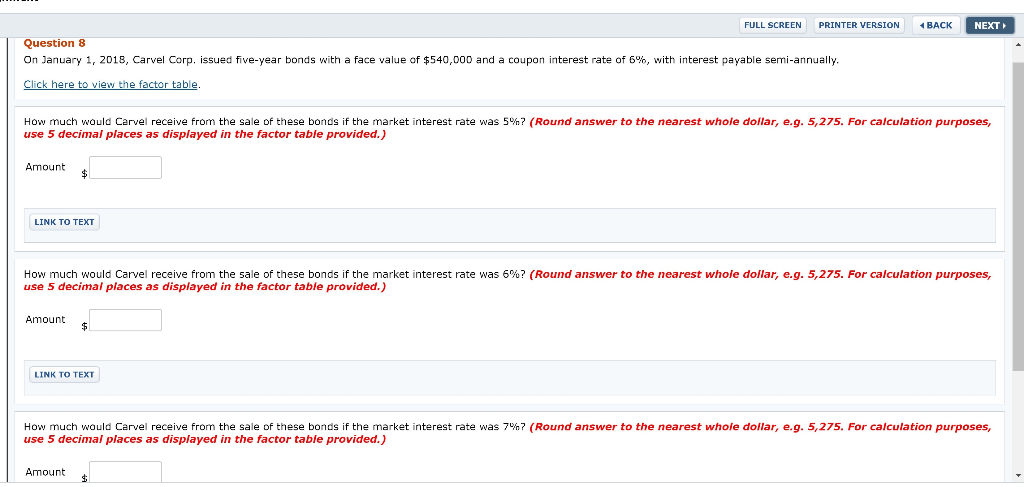

FULL SCREEN PRINTER VERSION 4 BACK NEXT Question 6 Hopkins Ltd. issued five-year bonds with a face value of $180,000 on January 1. The bonds have a coupon interest rate of 8% and interest is paid semi-annually on June 30 and December 31. The market interest rate was 9% when the bonds were issued at a price of 95. Using above information, determine the proceeds received by the company when the bonds were issued. Proceeds from issue of the bonds $ LINK TO TEXT Determine the interest expense recorded for the six months ending June 30 when the first interest payment is made. Interest expense LINK TO TEXT Determine the balance in the Bonds Payable account immediately following the first interest payment. Balance in bonds payable account $ LINK TO TEXT FULL SCREEN PRINTER VERSION BACK NEXT Question 7 Green Hills Ltd. issued five-year bonds with a face value of $130,000 on January 1. The bonds have a coupon interest rate of 4% and interest is paid semi-annually on June 30 and December 31. The market interest rate was 2% when the bonds were issued at a price of 109. Using above information, determine the proceeds received by the company when the bonds were issued. Proceeds from issue of the bonds LINK TO TEXT Determine the interest expense recorded for the six months ending June 30 when the first interest payment is made. Interest expense LINK TO TEXT Determine the balance in the Bonds Payable account immediately following the first interest payment. Balance in bonds payable account BACK NEXT FULL SCREEN PRINTER VERSION Question 8 On January 1, 2018, Carvel Corp. issued five-year bonds with a face value of $540,000 and a coupon interest rate of 6%, with interest payable semi-annually. Click here to view the factor table. How much would Carvel receive from the sale of these bonds if the market interest rate was 5%? (Round answer to the nearest whole dollar, e.g. 5,275. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Amount LINK TO TEXT How much would Carvel receive from the sale of these bonds if the market interest rate was 5%? (Round answer to the nearest whole dollar, e.g. 5,275. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Amount $ LINK TO TEXT How much would Carvel receive from the sale of these bonds if the market interest rate was 7%7 (Round answer to the nearest whole dollar, e.g. 5,275. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts