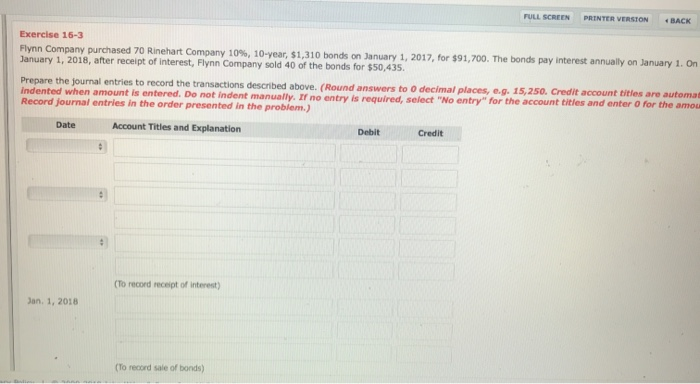

Question: FULL SCREEN PRINTER VERSION BACK Exercise 16-3 Flynn Company purchased 70 Rinehart Company 10% , 10- year , $1,310 bonds on January 1, 2017, for

FULL SCREEN PRINTER VERSION BACK Exercise 16-3 Flynn Company purchased 70 Rinehart Company 10% , 10- year , $1,310 bonds on January 1, 2017, for $91,700. The bonds pay interest annually on January 1. On January 1, 2018, after receipt of interest, Flynn Company sold 40 of the bonds for $50,435 Prepare the journal entries to record the transactions described above. (Round answers to 0 decimal places, e.g. 15,250. Credit account titles are automat indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amou Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit (To record receipt of interest) Jan. 1, 2018 (To record sale of bonds)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts