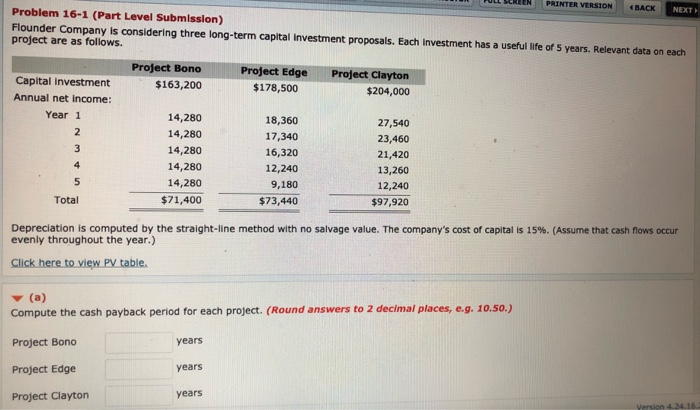

Question: FULL SCREEN PRINTER VERSION (BACK NEXT Problem 16-1 (Part Level Submission) Flounder Company is considering three long-term capital investment proposals. Each Investment has a useful

FULL SCREEN PRINTER VERSION (BACK NEXT Problem 16-1 (Part Level Submission) Flounder Company is considering three long-term capital investment proposals. Each Investment has a useful life of 5 years. Relevant data on each project are as follows. Project Bono $163,200 Project Edge $178,500 Capital Investment Annual net income: Year 1 Project Clayton $204,000 14,280 14,280 14,280 14,280 14,280 $71,400 18,360 17,340 16,320 12,240 9,180 $73,440 27,540 23,460 21,420 13,260 12,240 $97,920 Total Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. (Assume that cash flows occur evenly throughout the year.) Click here to view PV table. (a) Compute the cash payback period for each project. (Round answers to 2 decimal places, e.g. 10.50.) Project Bono years Project Edge years Project Clayton years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts