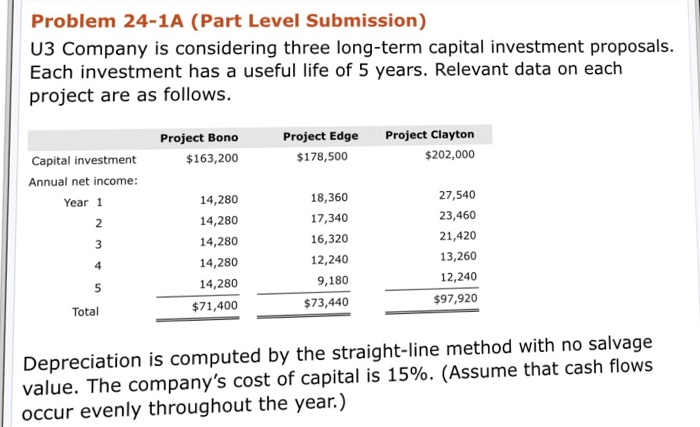

Question: Need help with part b Problem 24-1A (Part Level Submission) U3 Company is considering three long-term capital investment proposals. Each investment has a useful life

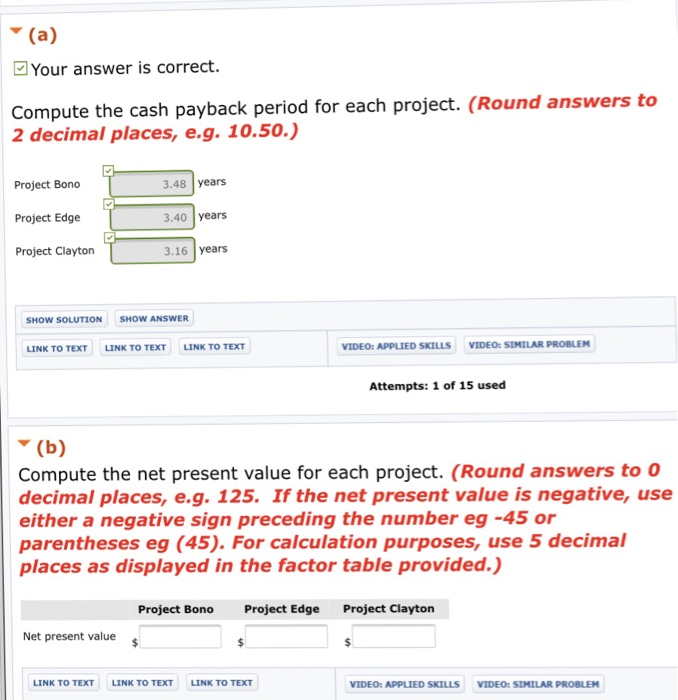

Problem 24-1A (Part Level Submission) U3 Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data on each project are as follows. Project Bono Project Edge $178,500 Project Clayton Capital investment $163,200 $202,000 Annual net income 14,280 14,280 14,280 14,280 14,280 $71,400 Year 1 18,360 17,340 16,320 12,240 9,180 $73,440 27,540 23,460 21,420 13,260 12,240 $97,920 2 Total Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. (Assume that cash flows occur evenly throughout the year.) Your answer is correct. ct. (Round answers to Compute the cash payback period for each proje 2 decimal places, e.g. 10.50.) Project Bono Project Edge Project Clayton 3.48 years 3.40 years 3.16 years SHOW SOLUTION SHOW ANSWER LINK TO TEXT LINK TO TEXT LINK TO TEXT VIDEO: APPLIED SKILLS VIDEO: SIMILAR PROBLEM Attempts: 1 of 15 used Compute the net present value for each project. (Round answers to decimal places, e.g. 125. If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45). For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Project BonoProject Edge Project Claytorn Net present value LINK TO TEXT LINK TO TEXT LINK TO TEXT VIDEO: APPLIED SKILLS VIDEO: SIMILAR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts