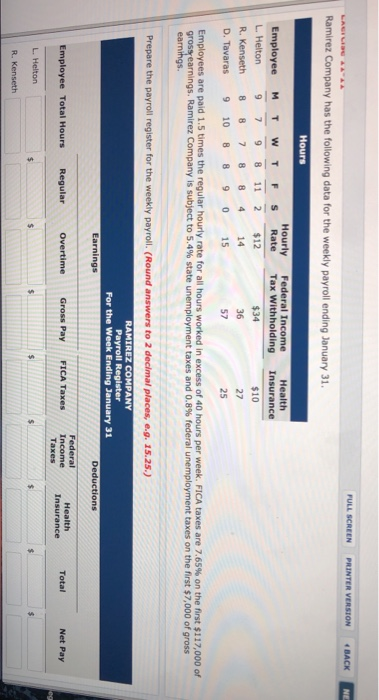

Question: FULL SCREEN PRINTER VERSION BACK Ramirez Company has the following data for the weekly payroll ending January 31 Hourly Federal Income Health Employee M T

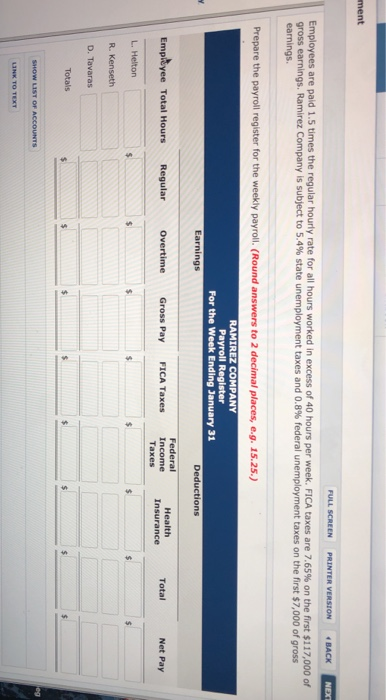

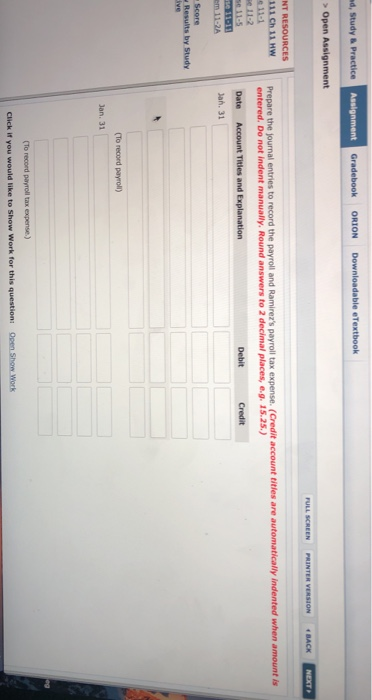

FULL SCREEN PRINTER VERSION BACK Ramirez Company has the following data for the weekly payroll ending January 31 Hourly Federal Income Health Employee M T w T F S Rate Tax withholding Insurance 9 7 9 8 11 2$12 $34 $10 27 25 R. Kenseth 88 78 8 4 14 D. Tavaras 9 10 8 8 9 0 15 57 Employees are paid 1.5 times the regular hourly rate for all hours worked in excess of 40 hours per week. FICA taxes are 7.65% on the first $117,000 of gross earnings Ramirez Company is subject to 5.4% state unemployment taxes and 0.8% federal unemployment taxes on the first $7,000 of gross Prepare the payroll register for the weekly payroll. (Round answers to 2 dochnal places, 641S23) . RAMIREZ COMPANY Payroll Register For the Week Ending January 31 Earnings Deductions Total Net Pay in excess of 40 hours per week. FICA taxes are 7.65% on the first $117,000 of gross earnings. Ramirez Company is subject to 5.4% state unemployment taxes and 0.8% federal unemployment taxes on the first $7,000 of gross R. Kenseth D. Tavaras 111 Ch 11 HW (Credit account tites are automanically indented wh entered Do not indent manually, Round answers to 2 decimal places, eg 15.25 a. 31 Jan. 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts