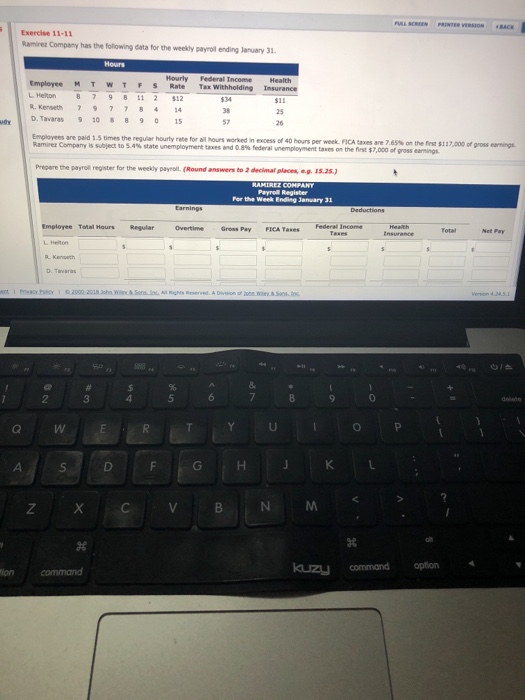

Question: VERSIONBACK Exercise 11-11 Ramirez Company has the following data for the weekly payroll ending January 31 Hourly Federal Income Health Employee M T w T

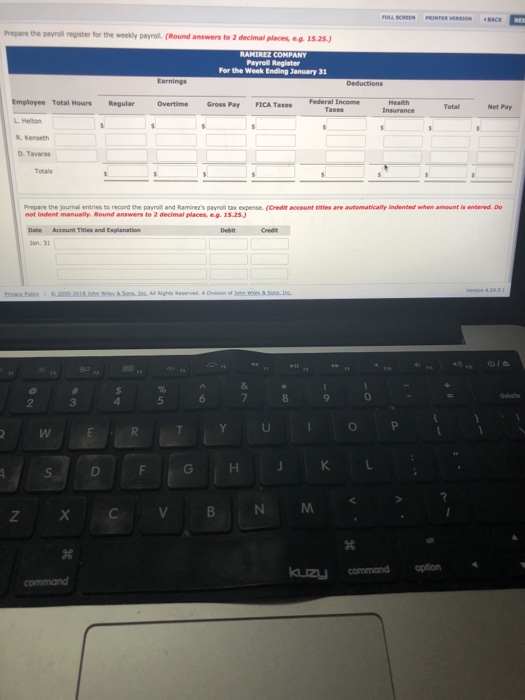

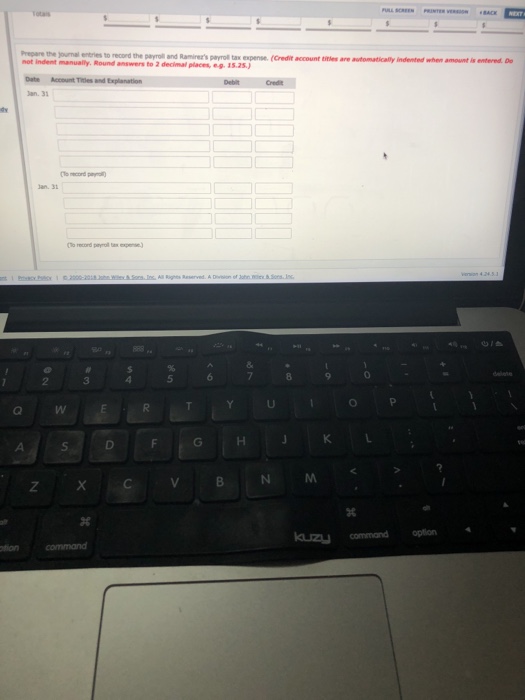

VERSIONBACK Exercise 11-11 Ramirez Company has the following data for the weekly payroll ending January 31 Hourly Federal Income Health Employee M T w T F S Rate Tax LHeton 87981| 2 S12 IR,Kenseth 7 9 7 7 84 14 $11 25 uey D. Tavaras 908 95 57 Employees are paid 1.5 times the reguiar hourly rate for all hours worked in excess of 40 houns per week FICA taxes are 7.65% Ramirez Company is subject to S4% state nemployment taves and eas esera unemploy et taln the et the nrst $117,000 ofgross_gs. Prepare the payroll register for the weekly payroll. (Round answers to 2 decimal places, e.g. 15.2s) Payrel Register For the Week Ending January 3 Employee Tolal Hours Regular Overtime Gross Pay FICA TaxesFederal Income kuzy command option 4 tion command

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts