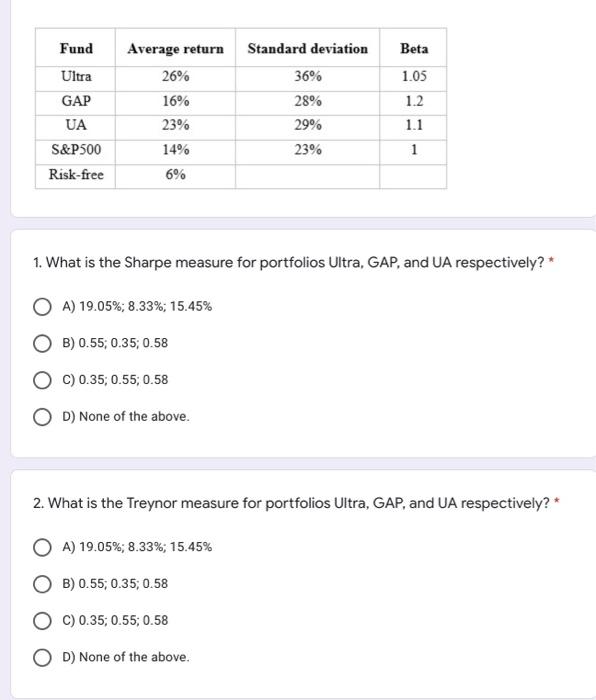

Question: Fund Beta 1.05 Average return 26% 16% 23% 14% Ultra GAP UA S&P500 Risk-free Standard deviation 36% 28% 29% 23% 1.2 1.1 1 6% 1.

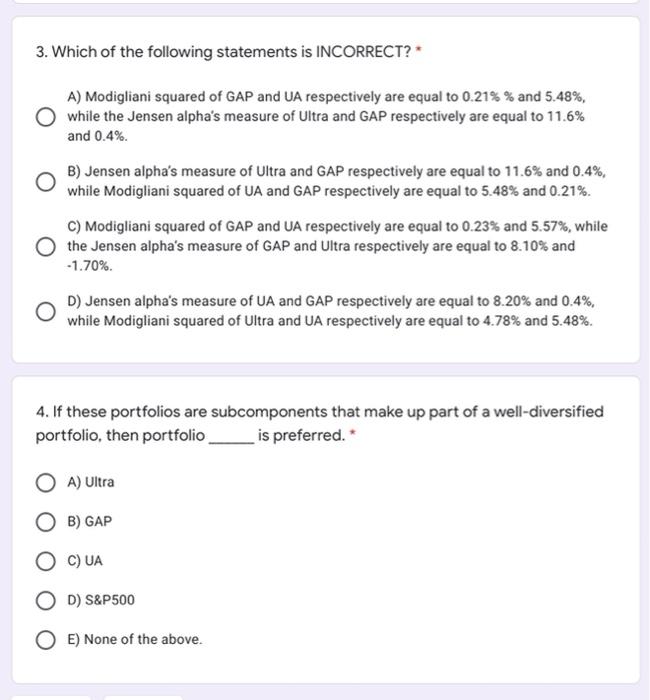

Fund Beta 1.05 Average return 26% 16% 23% 14% Ultra GAP UA S&P500 Risk-free Standard deviation 36% 28% 29% 23% 1.2 1.1 1 6% 1. What is the Sharpe measure for portfolios Ultra, GAP, and UA respectively?* A) 19.05%; 8.33%; 15.45% B) 0.55; 0.35 0.58 C) 0.35; 0.55; 0.58 D) None of the above. 2. What is the Treynor measure for portfolios Ultra, GAP, and UA respectively?* A) 19.05%; 8.33%; 15.45% B) 0.55, 0.35; 0.58 C) 0.35; 0.55; 0.58 OD) None of the above. 3. Which of the following statements is INCORRECT?* A) Modigliani squared of GAP and UA respectively are equal to 0.21% % and 5.48%, while the Jensen alpha's measure of Ultra and GAP respectively are equal to 11.6% and 0.4% B) Jensen alpha's measure of Ultra and GAP respectively are equal to 11.6% and 0.4%, while Modigliani squared of UA and GAP respectively are equal to 5.48% and 0.21%. C) Modigliani squared of GAP and UA respectively are equal to 0.23% and 5.57%, while the Jensen alpha's measure of GAP and Ultra respectively are equal to 8.10% and -1.70%. D) Jensen alpha's measure of UA and GAP respectively are equal to 8.20% and 0.4%, while Modigliani squared of Ultra and UA respectively are equal to 4.78% and 5.48%. 4. If these portfolios are subcomponents that make up part of a well-diversified portfolio, then portfolio is preferred. * OA) Ultra O B) GAP C) UA D) S&P500 OE) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts