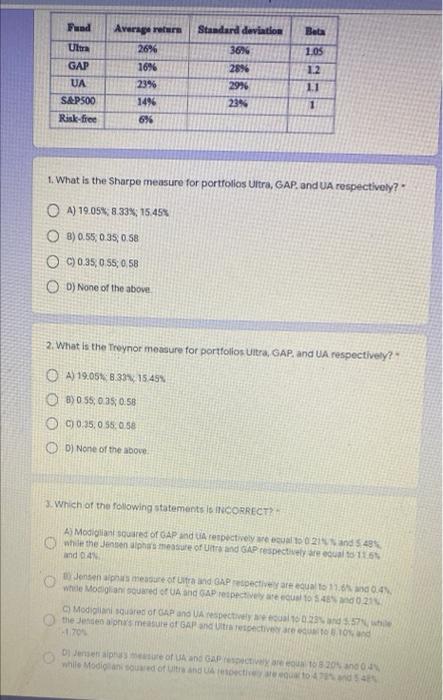

Question: Fund Standard deviation Beta Average return 26% 16% Ultra GAP UA 1.05 36% 28% 29% 23% 23% 1.2 11 1 1496 S&P500 Risk-free 6% 1.

Fund Standard deviation Beta Average return 26% 16% Ultra GAP UA 1.05 36% 28% 29% 23% 23% 1.2 11 1 1496 S&P500 Risk-free 6% 1. What is the Sharpe measure for portfolios Uitra, GAP. and UA respectively? OA) 19.05%: 8.33; 15.45 O B) 0.55 0.39 0.58 OC) 0.35 0 55; 0,58 OD) None of the above 2. What is the Treynor measure for portfolios Ultra, GAP. and UA respectively? A) 19.05 8.334 15499 B) 0 55,035, 0.58 C035,0 55,0.58 D) None of the above 3. Which of the following statements IS INCORRECT A Modigiant sure of GAP and respectively 102 and 54% while the Jensen is measure of Ultra and GAP respectively coul 1151 and 0.41 Jensen mesure of tra and GAP rectae ecuato While Modigliani souared And SAP respectives S40211 Modigli sure of GAP an Urepeterend the one's measure of GAP and is respectives are 10 and -170 Dj Jense of and GP10320 whilo Modi and of the detected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts