Question: furmola and steps Question 4 8 points Chapter 7 CL04 To answer the questions that follow, please carefully read the three scenarios presented below. SCENARIO

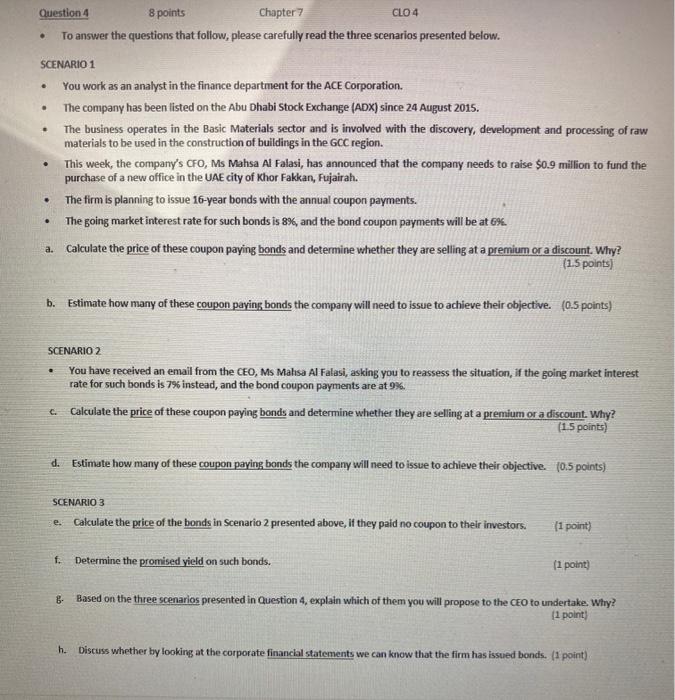

Question 4 8 points Chapter 7 CL04 To answer the questions that follow, please carefully read the three scenarios presented below. SCENARIO 1 You work as an analyst in the finance department for the Ace Corporation. The company has been listed on the Abu Dhabi Stock Exchange (ADX) since 24 August 2015. The business operates in the Basic Materials sector and is involved with the discovery, development and processing of raw materials to be used in the construction of buildings in the GCC region. This week, the company's CFO, Ms Mahsa Al Falasi, has announced that the company needs to raise $0.9 million to fund the purchase of a new office in the UAE city of Khor Fakkan, Fujairah. The firm is planning to issue 16-year bonds with the annual coupon payments. The going market interest rate for such bonds is 8%, and the bond coupon payments will be at 6%. a. Calculate the price of these coupon paying bonds and determine whether they are selling at a premium or a discount. Why? (1.5 points) . b. Estimate how many of these coupon paying bonds the company will need to issue to achieve their objective. (0.5 points) SCENARIO 2 . You have received an email from the CEO, Ms Marsa Al Falasi, asking you to reassess the situation, if the going market interest rate for such bonds is 7% instead, and the bond coupon payments are at 9%. Calculate the price of these coupon paying bands and determine whether they are selling at a premium or a discount. Why? (1.5 points) d. Estimate how many of these coupon paying bonds the company will need to issue to achieve their objective. (0.5 points) SCENARIO 3 e. Calculate the price of the bonds in Scenario 2 presented above, if they paid no coupon to their investors. (1 point) f. Determine the promised yield on such bonds. (1 point) B Based on the three scenarios presented in Question 4, explain which of them you will propose to the CEO to undertake. Why? (1 point) h. Discuss whether by looking at the corporate financial statements we can know that the firm has issued bonds. (1 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts