Question: Fusion Computing Fusion Computing Inc. is a two-year-old firm that has been growing rapidly through new product development and geographical expansion. The first budget was

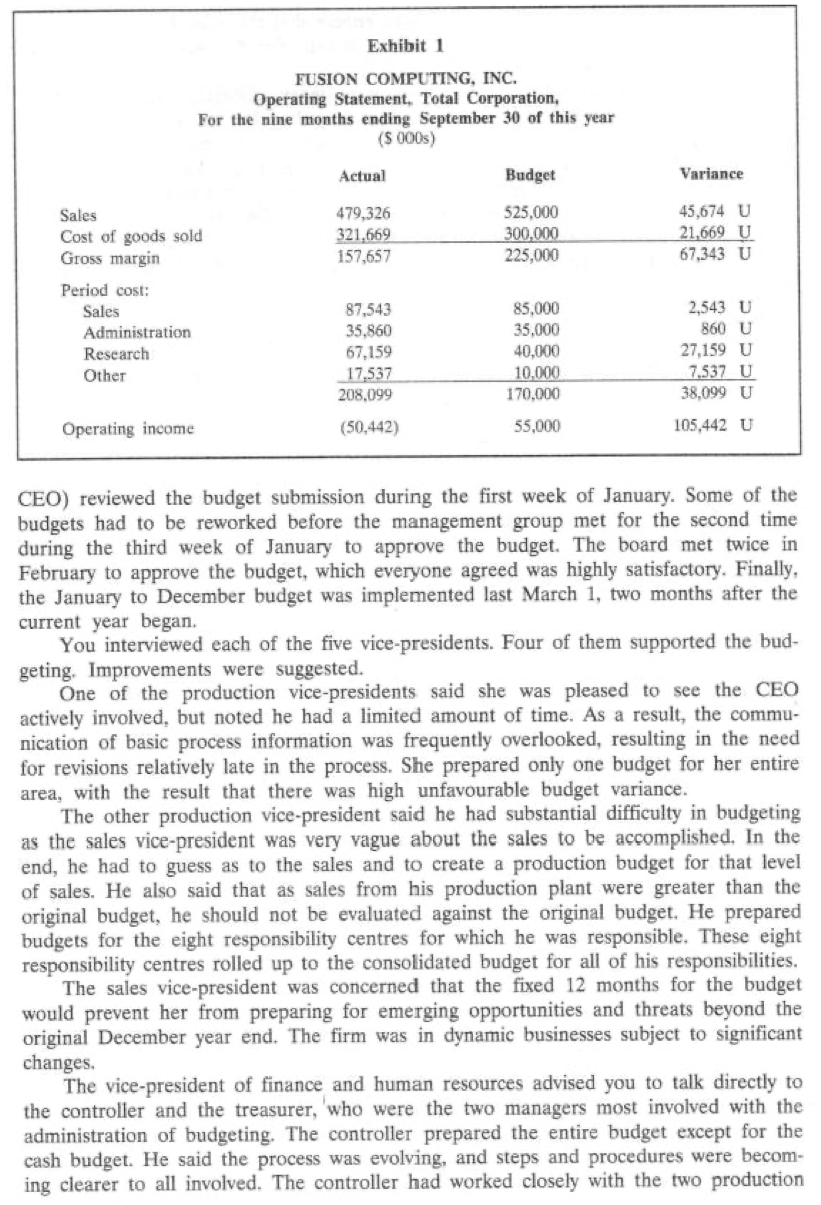

Fusion Computing Fusion Computing Inc. is a two-year-old firm that has been growing rapidly through new product development and geographical expansion. The first budget was completed about nine months ago. Presently, the second budget cycle starts in a month. Now the CEO is reviewing the earlier experience in an attempt to make improvements to the budgeting process. You have been hired on a three-month contract to review the bud- geting process, recommend changes to the board, and assist with the implementation of the next budget. Substantial importance is placed on budgeting. Specifically, Fusion's strategic plans are implemented with the budgets. The goals and objectives of the strategic plans are budgeted or quantified and expressed as commitments. The acquisitions and use of resources are also explicitly budgeted. The budgets are, therefore, commitments to financial forecasts and agreements on expected outcomes. Like any other planning activity, budgeting at Fusion helps managers focus on one direction chosen from many future alternatives. The CEO, with other members of senior management, defines the chosen path using some accounting measure of finan- cial performance, such as net income, earnings per share, or sales levels in dollars or units. Budgeting is the tool, at Fusion, that managers are to use to successfully plan and manage operations and programs. Accounting based measures provide specific quantitative criteria against which future performance (also recorded in accounting terms) can be compared. Budgets are used as a standard for accessing actual performance. Budgets were used to help identify potential problems in achieving specified goals and objectives. For the 12 month horizon, the managers in charge of responsibility centre budgets were expected to consider all possible events that might affect budgeted performance. The results of the first budget are shown in the attached operating statement (see Exhibit 1) for the first nine months of this year. Currently, it is October 5. Fusion has a board of directors, a CEO and five vice-presidents. Two vice-presidents are responsi- ble for product manufacturing. There is a vice-president for sales, another for research, and a fifth for finance and administration. The latter vice-president is responsible for financial accounting, budgeting, treasury, and other administration matters. To carry out your assignment, you review the budgeting process from last year. It started on November 1. The management group (the five vice-presidents and the Exhibit 1 FUSION COMPUTING, INC. Operating Statement, Total Corporation, For the nine months ending September 30 of this year ($ 000) Actual Budget Variance 479,326 321,669 157,657 525,000 300,000 225,000 45,674 U 21,669 U 67.343 U Sales Cost of goods sold Gross margin Period cost: Sales Administration Research Other 87,543 35,860 67,159 17.537 208,099 85,000 35,000 40,000 10.000 170,000 2,543 U 860 U 27,159 U 7,537 U 38,099 U Operating income (50,442) 55,000 105,442 U CEO) reviewed the budget submission during the first week of January. Some of the budgets had to be reworked before the management group met for the second time during the third week of January to approve the budget. The board met twice in February to approve the budget, which everyone agreed was highly satisfactory. Finally, the January to December budget was implemented last March 1, two months after the current year began. You interviewed each of the five vice-presidents. Four of them supported the bud- geting, Improvements were suggested. One of the production vice-presidents said she was pleased to see the CEO actively involved, but noted he had a limited amount of time. As a result, the commu- nication of basic process information was frequently overlooked, resulting in the need for revisions relatively late in the process. She prepared only one budget for her entire area, with the result that there was high unfavourable budget variance. The other production vice-president said he had substantial difficulty in budgeting as the sales vice-president was very vague about the sales to be accomplished. In the end, he had to guess as to the sales and to create a production budget for that level of sales. He also said that as sales from his production plant were greater than the original budget, he should not be evaluated against the original budget. He prepared budgets for the eight responsibility centres for which he was responsible. These eight responsibility centres rolled up to the consolidated budget for all of his responsibilities. The sales vice-president was concerned that the fixed 12 months for the budget would prevent her from preparing for emerging opportunities and threats beyond the original December year end. The firm was in dynamic businesses subject to significant changes. The vice-president of finance and human resources advised you to talk directly to the controller and the treasurer, who were the two managers most involved with the administration of budgeting. The controller prepared the entire budget except for the cash budget. He said the process was evolving, and steps and procedures were becom- ing clearer to all involved. The controller had worked closely with the two production vice-presidents and the sales vice-president to ensure that the sales budgets were con- sistent with production budgets and that direct labour, direct materials, and overhead were consistently budgeted. As Fusion was new to budgeting, there were many mistakes. The treasurer had difficulties with planning the receipt and payment schedules for accounts receivable and accounts payable. This was a result of the company having no experience on which to base future accounts receivable and accounts payable. The original cash bud- get proved useless, but continued to be used. Consequently, bank loans were accessed, and sometimes they were accessed when there was surplus cash. The vice-president of research refused to participate in the budgeting; he claimed that budgeting would inhibit research creativity. The CEO prepared the budget for research. Required As the consultant, use the case approach to make recommendations for improving the budgeting process at Fusion Computing Inc. Fusion Computing Fusion Computing Inc. is a two-year-old firm that has been growing rapidly through new product development and geographical expansion. The first budget was completed about nine months ago. Presently, the second budget cycle starts in a month. Now the CEO is reviewing the earlier experience in an attempt to make improvements to the budgeting process. You have been hired on a three-month contract to review the bud- geting process, recommend changes to the board, and assist with the implementation of the next budget. Substantial importance is placed on budgeting. Specifically, Fusion's strategic plans are implemented with the budgets. The goals and objectives of the strategic plans are budgeted or quantified and expressed as commitments. The acquisitions and use of resources are also explicitly budgeted. The budgets are, therefore, commitments to financial forecasts and agreements on expected outcomes. Like any other planning activity, budgeting at Fusion helps managers focus on one direction chosen from many future alternatives. The CEO, with other members of senior management, defines the chosen path using some accounting measure of finan- cial performance, such as net income, earnings per share, or sales levels in dollars or units. Budgeting is the tool, at Fusion, that managers are to use to successfully plan and manage operations and programs. Accounting based measures provide specific quantitative criteria against which future performance (also recorded in accounting terms) can be compared. Budgets are used as a standard for accessing actual performance. Budgets were used to help identify potential problems in achieving specified goals and objectives. For the 12 month horizon, the managers in charge of responsibility centre budgets were expected to consider all possible events that might affect budgeted performance. The results of the first budget are shown in the attached operating statement (see Exhibit 1) for the first nine months of this year. Currently, it is October 5. Fusion has a board of directors, a CEO and five vice-presidents. Two vice-presidents are responsi- ble for product manufacturing. There is a vice-president for sales, another for research, and a fifth for finance and administration. The latter vice-president is responsible for financial accounting, budgeting, treasury, and other administration matters. To carry out your assignment, you review the budgeting process from last year. It started on November 1. The management group (the five vice-presidents and the Exhibit 1 FUSION COMPUTING, INC. Operating Statement, Total Corporation, For the nine months ending September 30 of this year ($ 000) Actual Budget Variance 479,326 321,669 157,657 525,000 300,000 225,000 45,674 U 21,669 U 67.343 U Sales Cost of goods sold Gross margin Period cost: Sales Administration Research Other 87,543 35,860 67,159 17.537 208,099 85,000 35,000 40,000 10.000 170,000 2,543 U 860 U 27,159 U 7,537 U 38,099 U Operating income (50,442) 55,000 105,442 U CEO) reviewed the budget submission during the first week of January. Some of the budgets had to be reworked before the management group met for the second time during the third week of January to approve the budget. The board met twice in February to approve the budget, which everyone agreed was highly satisfactory. Finally, the January to December budget was implemented last March 1, two months after the current year began. You interviewed each of the five vice-presidents. Four of them supported the bud- geting, Improvements were suggested. One of the production vice-presidents said she was pleased to see the CEO actively involved, but noted he had a limited amount of time. As a result, the commu- nication of basic process information was frequently overlooked, resulting in the need for revisions relatively late in the process. She prepared only one budget for her entire area, with the result that there was high unfavourable budget variance. The other production vice-president said he had substantial difficulty in budgeting as the sales vice-president was very vague about the sales to be accomplished. In the end, he had to guess as to the sales and to create a production budget for that level of sales. He also said that as sales from his production plant were greater than the original budget, he should not be evaluated against the original budget. He prepared budgets for the eight responsibility centres for which he was responsible. These eight responsibility centres rolled up to the consolidated budget for all of his responsibilities. The sales vice-president was concerned that the fixed 12 months for the budget would prevent her from preparing for emerging opportunities and threats beyond the original December year end. The firm was in dynamic businesses subject to significant changes. The vice-president of finance and human resources advised you to talk directly to the controller and the treasurer, who were the two managers most involved with the administration of budgeting. The controller prepared the entire budget except for the cash budget. He said the process was evolving, and steps and procedures were becom- ing clearer to all involved. The controller had worked closely with the two production vice-presidents and the sales vice-president to ensure that the sales budgets were con- sistent with production budgets and that direct labour, direct materials, and overhead were consistently budgeted. As Fusion was new to budgeting, there were many mistakes. The treasurer had difficulties with planning the receipt and payment schedules for accounts receivable and accounts payable. This was a result of the company having no experience on which to base future accounts receivable and accounts payable. The original cash bud- get proved useless, but continued to be used. Consequently, bank loans were accessed, and sometimes they were accessed when there was surplus cash. The vice-president of research refused to participate in the budgeting; he claimed that budgeting would inhibit research creativity. The CEO prepared the budget for research. Required As the consultant, use the case approach to make recommendations for improving the budgeting process at Fusion Computing Inc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts