Question: Future value (with changing years). Dixie Bank offers a certificate of deposit with an option to select your own investment period. Jonathan has $7,500 for

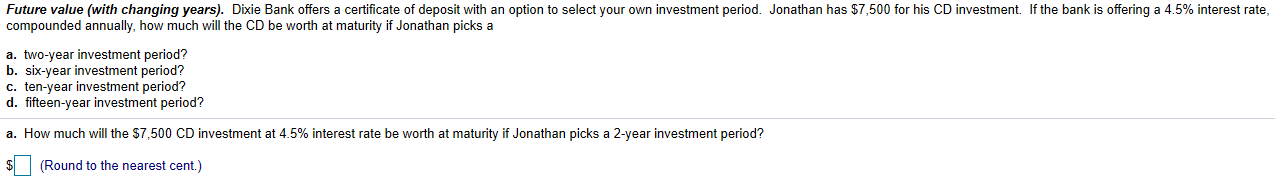

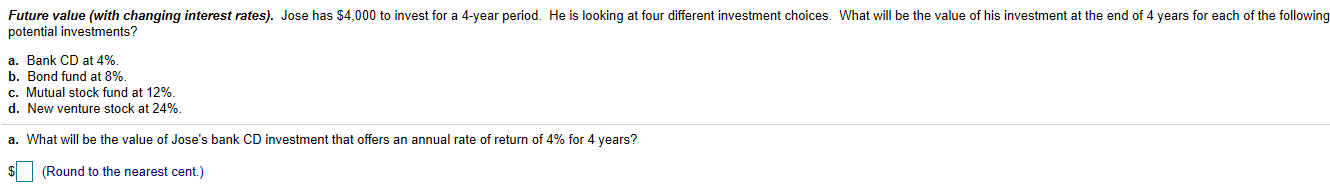

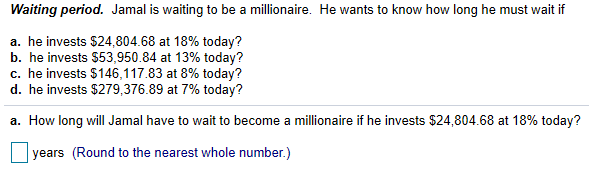

Future value (with changing years). Dixie Bank offers a certificate of deposit with an option to select your own investment period. Jonathan has $7,500 for his CD investment. If the bank is offering a 4.5% interest rate, compounded annually, how much will the CD be worth at maturity if Jonathan picks a a. two-year investment period? b. six-year investment period? c. ten-year investment period? d. fifteen-year investment period? a. How much will the $7,500 CD investment at 4.5% interest rate be worth at maturity if Jonathan picks a 2-year investment period? (Round to the nearest cent.) Future value (with changing interest rates). Jose has $4,000 to invest for a 4-year period. He is looking at four different investment choices. What will be the value of his investment at the end of 4 years for each of the following potential investments? a. Bank CD at 4%. b. Bond fund at 8%. c. Mutual stock fund at 12%. d. New venture stock at 24%. a. What will be the value of Jose's bank CD investment that offers an annual rate of return of 4% for 4 years? (Round to the nearest cent.) Waiting period. Jamal is waiting to be a millionaire. He wants to know how long he must wait if a. he invests $24,804.68 at 18% today? b. he invests $53,950.84 at 13% today? c. he invests $146,117.83 at 8% today? d. he invests $279,376.89 at 7% today? a. How long will Jamal have to wait to become a millionaire if he invests $24,804.68 at 18% today? years (Round to the nearest whole number.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts