Question: Please help, will leave a thumbs up if answered fully and correctly! Thank you! Future value (with changing years). Dixie Bank offers a certificate of

Please help, will leave a thumbs up if answered fully and correctly! Thank you!

Please help, will leave a thumbs up if answered fully and correctly! Thank you!

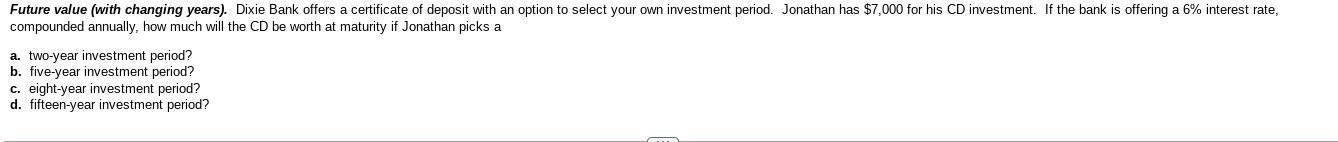

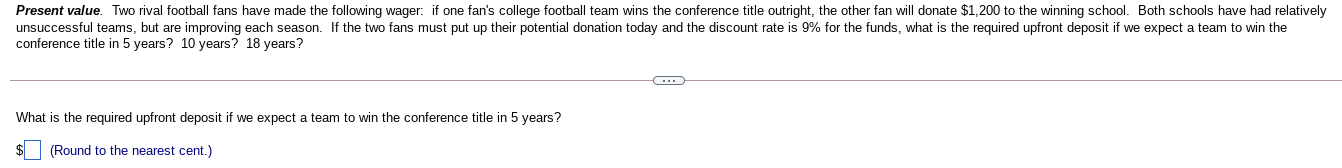

Future value (with changing years). Dixie Bank offers a certificate of deposit with an option to select your own investment period. Jonathan has $7,000 for his CD investment. If the bank is offering a 6% interest rate, compounded annually, how much will the CD be worth at maturity if Jonathan picks a a. two-year investment period? b. five-year investment period? C. eight-year investment period? d. fifteen-year investment period? Present value. Two rival football fans have made the following wager: if one fan's college football team wins the conference title outright, the other fan will donate $1,200 to the winning school. Both schools have had relatively unsuccessful teams, but are improving each season. If the two fans must put up their potential donation today and the discount rate is 9% for the funds, what is the required upfront deposit if we expect a team to win the conference title in 5 years? 10 years? 18 years? .. What is the required upfront deposit if we expect a team to win the conference title in 5 years? $(Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts