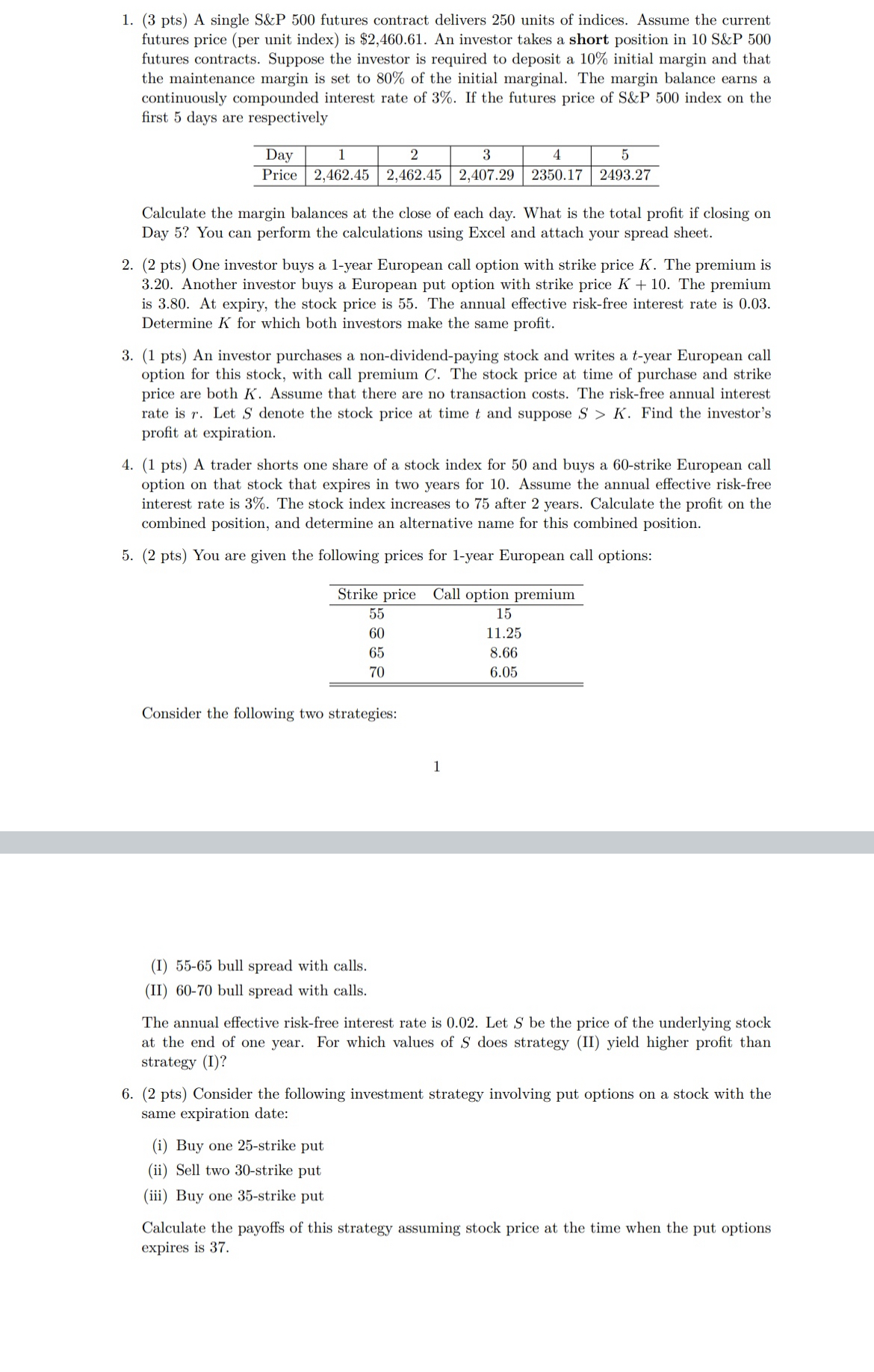

Question: futures price ( per unit index ) is $ 2 , 4 6 0 . 6 1 . An investor takes a short position in

futures price per unit index is $ An investor takes a short position in &

futures contracts. Suppose the investor is required to deposit a initial margin and that

the maintenance margin is set to of the initial marginal. The margin balance earns a

continuously compounded interest rate of If the futures price of S&P index on the

first days are respectively

Calculate the margin balances at the close of each day. What is the total profit if closing on

Day You can perform the calculations using Excel and attach your spread sheet.

pts One investor buys a year European call option with strike price The premium is

Another investor buys a European put option with strike price The premium

is At expiry, the stock price is The annual effective riskfree interest rate is

Determine for which both investors make the same profit.

pts

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock