Question: Fuzzy Button Clothing Company's income statement reports data for its first year of operation. The firm's CEO would like sales to increase by 25% next

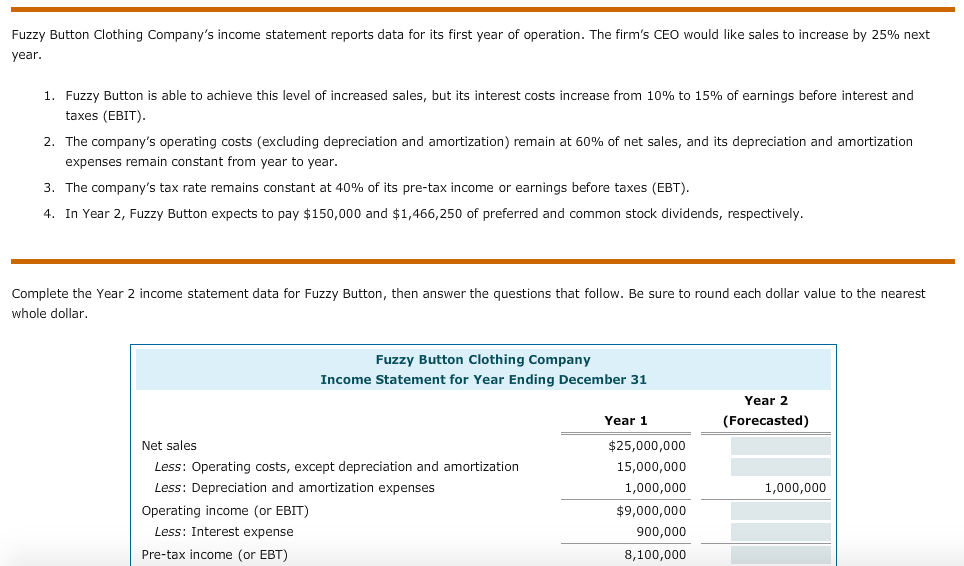

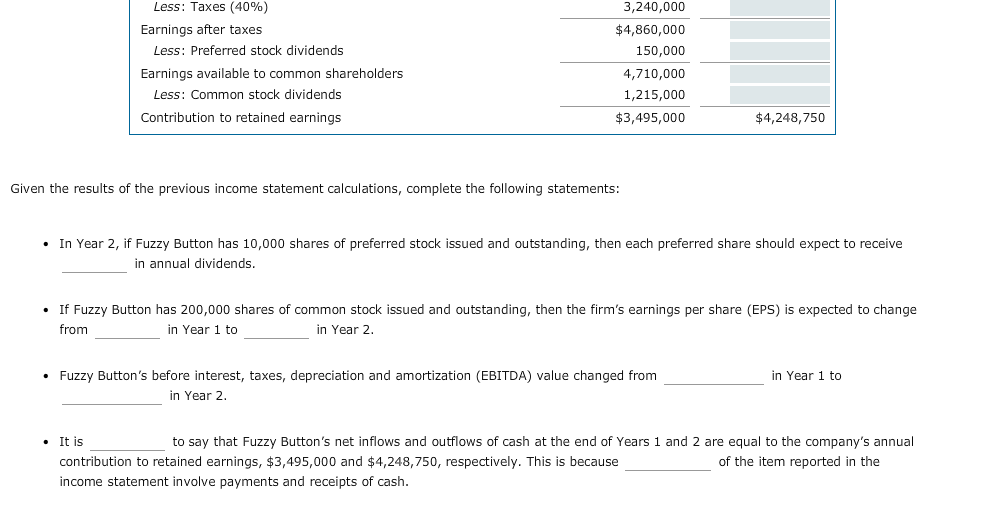

Fuzzy Button Clothing Company's income statement reports data for its first year of operation. The firm's CEO would like sales to increase by 25% next year 1, Fuzzy Button is able to achieve this level of increased sales, but its interest costs increase from 10% to 15% of earnings before interest and taxes (EBIT) 2. The company's operating costs (excluding depreciation and amortization) remain at 60% of net sales, and its depreciation and amortization expenses remain constant from year to year 3. The company's tax rate remains constant at 40% of its pre-tax income or earnings before taxes (EBT) 4. In Year 2, Fuzzy Button expects to pay $150,000 and $1,466,250 of preferred and common stock dividends, respectively Complete the Year 2 income statement data for Fuzzy Button, then answer the questions that follow. Be sure to round each dollar value to the nearest whole dollar Fuzzy Button Clothing Company Income Statement for Year Ending December 31 Year 2 Year 1 (Forecasted) $25,000,000 15,000,000 1,000,000 $9,000,000 900,000 8,100,000 Net sales Less: Operating costs, except depreciation and amortization Less: Depreciation and amortization expenses 1,000,000 Operating income (or EBIT) Less: Interest expense Pre-tax income (or EBT)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts