Question: Fv of cash flow An investor plans to invest annual payments of $25,000, $42,000, $45,000, and $35,000, respectively, over the next four years. The first

Fv of cash flow

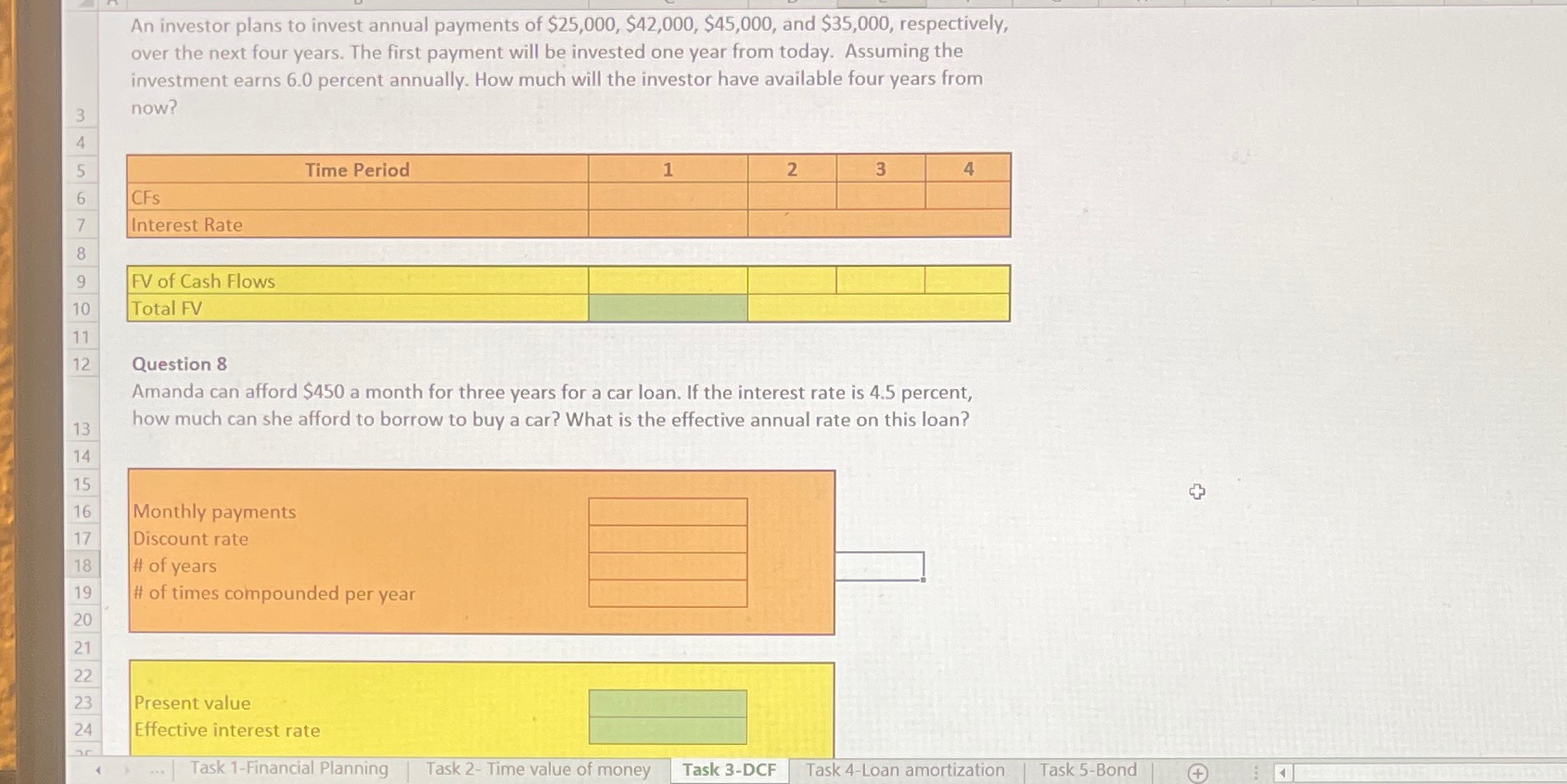

An investor plans to invest annual payments of $25,000, $42,000, $45,000, and $35,000, respectively, over the next four years. The first payment will be invested one year from today. Assuming the investment earns 6.0 percent annually. How much will the investor have available four years from 3 now? 4 5 Time Period 1 2 3 4 6 CFS 7 Interest Rate 8 9 FV of Cash Flows 10 Total FV 11 12 Question 8 Amanda can afford $450 a month for three years for a car loan. If the interest rate is 4.5 percent, 13 how much can she afford to borrow to buy a car? What is the effective annual rate on this loan? 14 15 + 16 Monthly payments 17 Discount rate 18 # of years 19 # of times compounded per year 20 21 22 23 Present value 24 Effective interest rate ac Task 1-Financial Planning Task 2- Time value of money Task 3-DCF Task 4-Loan amortization Task 5-Bond + 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts