Question: fx 4 B D E F G H ! Razul and Amy decided to start a partnership called SA Consulting on January 1, 2020. Each

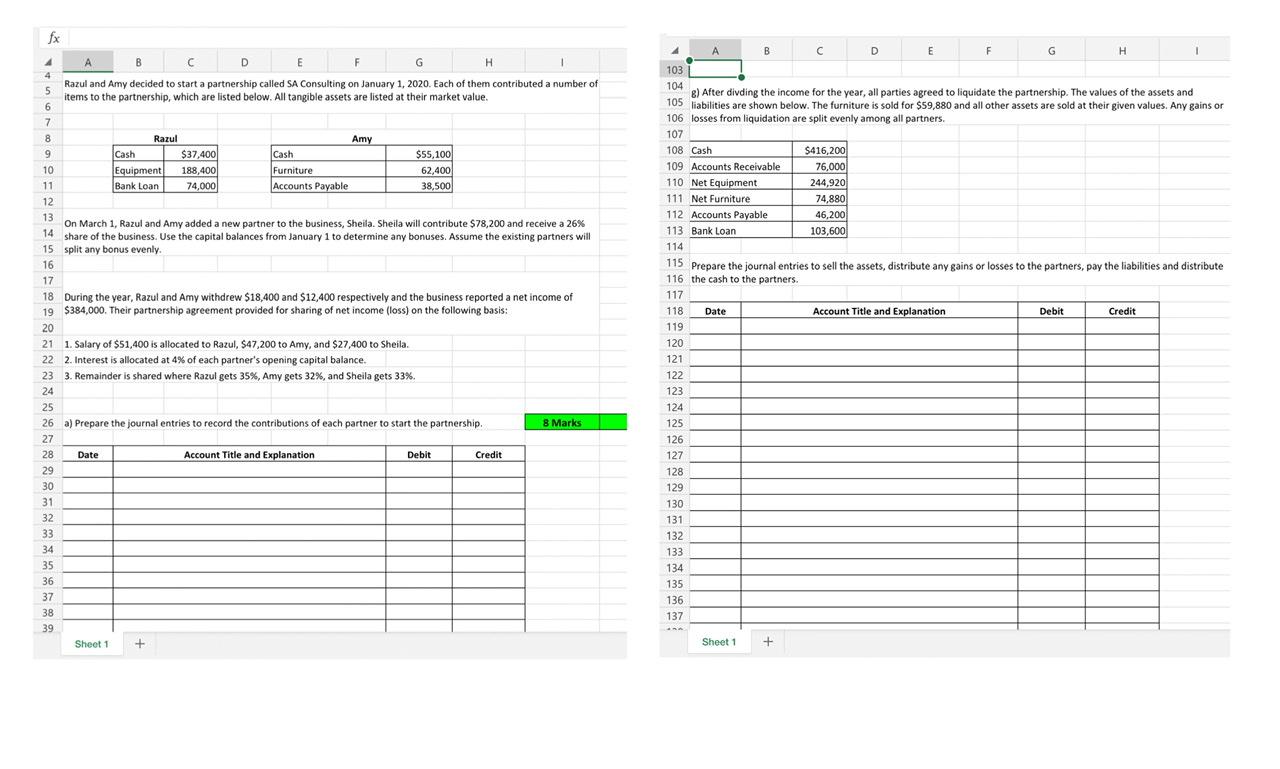

fx 4 B D E F G H ! Razul and Amy decided to start a partnership called SA Consulting on January 1, 2020. Each of them contributed a number of items to the partnership, which are listed below. All tangible assets are listed at their market value. 5 6 7 A B D E F G H 1 1031 104 - e) After divding the income for the year, all parties agreed to liquidate the partnership. The values of the assets and 105 liabilities are shown below. The furniture is sold for $59,880 and all other assets are sold at their given values. Any gains or 106 losses from liquidation are split evenly among all partners. 107 108 Cash $416,200 109 Accounts Receivable 76,000l ACCO 110 Net Equipment 244,920 111 Net Furniture 74,880 112 Accounts Payable 46,200 113 Bank Loan 103,600 114 115 Prepare the journal entries to sell the assets, distribute any gains or losses to the partners, pay the liabilities and distribute 116 the cash to the partners. 117 118 Date Account Title and Explanation Debit Credit 119 8 Razul Amy 9 Cash $37,400 Cash $55,100 10 Equipment 188,400 Furniture 62,400 11 Bank Loan 74,000 Accounts Payable 38,500 12 13 On March 1, Razul and Amy added a new partner to the business, Sheila. Sheila will contribute $78,200 and receive a 26% 14 share of the business. Use the capital balances from January 1 to determine any bonuses. Assume the existing partners will 15 split any bonus evenly. 16 17 70 10 During the year, Razul and Amy withdrew $18.400 and $12,400 respectively and the business reported a net income of 19 $384,000. Their partnership agreement provided for sharing of net income (loss) on the following basis: 20 21 21 1. Salary of $51,400 is allocated to Razul, S47,200 to Amy, and $27,400 to Sheila. 22 2. Interest is allocated at 4% of each partner's opening capital balance. 23 3. Remainder is shared where Razul gets 35%, Amy gets 32%, and Sheila gets 33%. 24 25 26 a) Prepare the journal entries to record the contributions of each partner to start the partnership. 8 Marks 27 28 Date Account Title and Explanation Debit Credit 29 30 31 32 33 34 35 36 37 38 39 Sheet1 120 121 122 123 124 125 126 149 127 12 128 129 130 131 we 132 133 134 135 136 137 + Sheet1 +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts