Question: G 2 0 2 2 - 2 0 2 3 CCHS Liv... I KDE Licensure MyAccount | Americ... FastForwardAcademy Expungement Certif... You Will Love Histor...

G CCHS Liv... I KDE Licensure

MyAccount Americ...

FastForwardAcademy

Expungement Certif...

You Will Love Histor...

History Grant

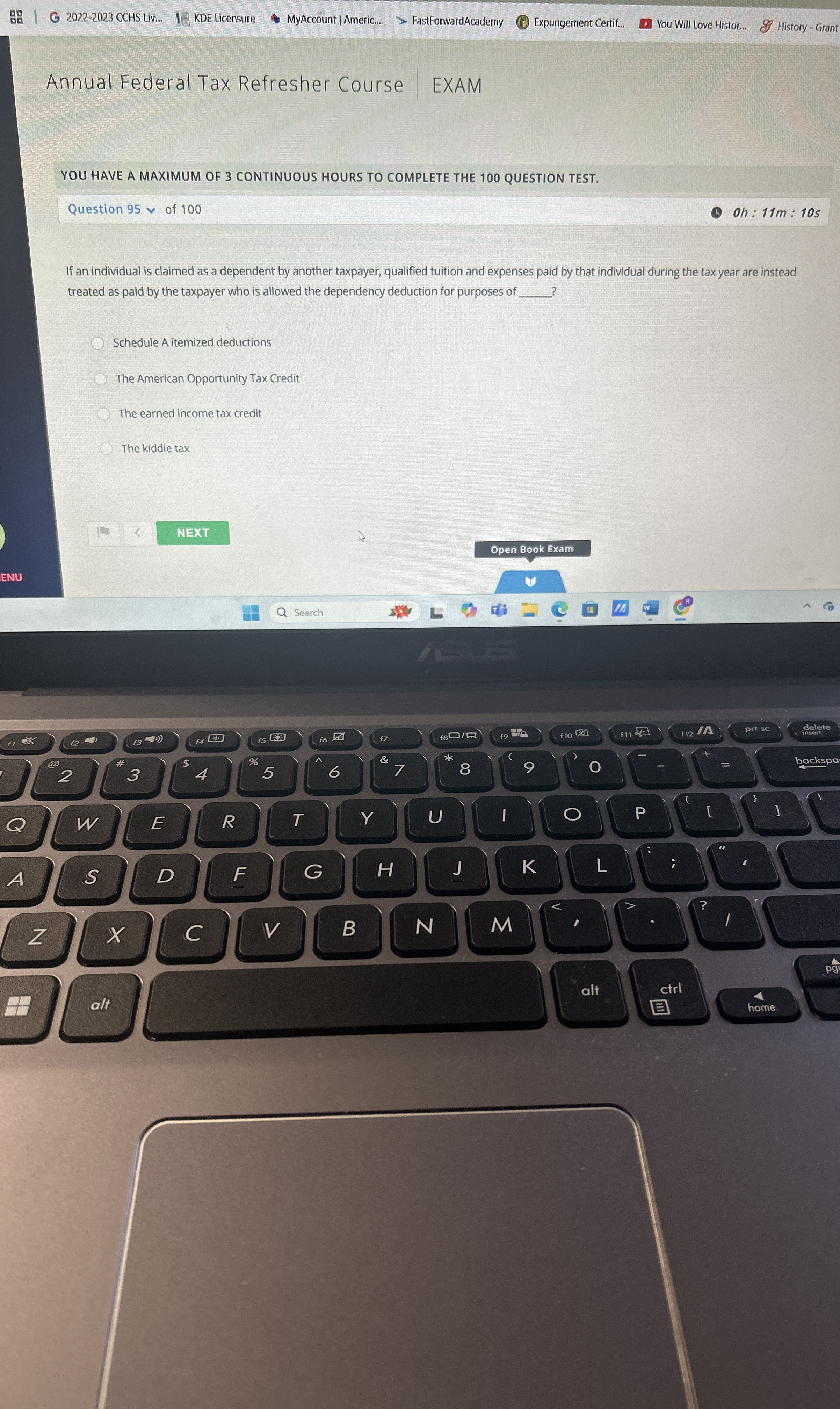

Annual Federal Tax Refresher Course

EXAM

YOU HAVE A MAXIMUM OF CONTINUOUS HOURS TO COMPLETE THE QUESTION TEST.

Question v of

oh: m : s

If an individual is claimed as a dependent by another taxpayer, qualified tuition and expenses paid by that individual during the tax year are instead treated as paid by the taxpayer who is allowed the dependency deduction for purposes of

chedule A itemized deductions

The American Opportunity Tax Credit

The earned income tax credit

The kiddie tax

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock