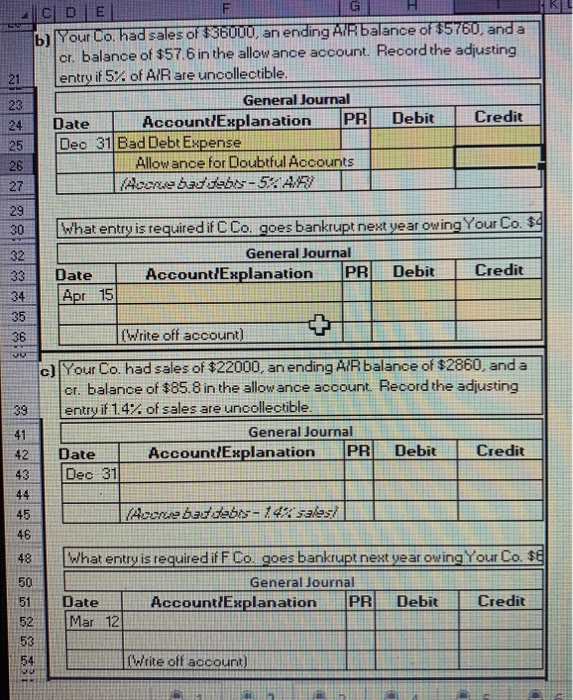

Question: G 21 23 24 25 26 27 C D E b) 'Your Co, had sales of $36000, an ending A/R balance of $5760, and a

G 21 23 24 25 26 27 C D E b) 'Your Co, had sales of $36000, an ending A/R balance of $5760, and a cr. balance of $57.6 in the allowance account. Record the adjusting entry it 5% of AIR are uncollectible. General Journal Date Account/Explanation PR Debit Credit Deo 31 Bad Debt Expense Allowance for Doubtful Accounts (Accrue bac'deb-5/24/13 29 30 32 33 34 35 36 What entry is required if C Co. goes bankrupt next year owing Your Co. $4 General Journal Date Account Explanation PR Debit Credit Apr 15 (Write off account) JU 39 c) Your Co. had sales of $22000, an ending A/R balance of $2860, and a cr. balance of $85.8 in the allowance account. Record the adjusting entry if 1.4% of sales are uncollectible. General Journal Date Account/Explanation PR Debit Credit Dec 31 41 42 43 44 74cowe baddebis-14% sales 45 46 48 50 What entry is required if F Co, goes bankrupt next year owing Your Co. $ General Journal Date Account/Explanation PR Debit Credit Mar 12 51 52 53 54 (Write off account)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts