Question: g) Calculate shareholders utility at time 0 under projects A and B. Assuming that shareholders maximize utility at time 0, which project would shareholders prefer?

g) Calculate shareholders utility at time 0 under projects A and B. Assuming that shareholders maximize utility at time 0, which project would shareholders prefer? (4 points)

h) Draw some conclusions about how CEO and shareholder preferences can lead to different strategy choices. What causes the differences? (2 points)

i) If you were a Board Director responsible for corporate governance at the company, what policies would you introduce to address the issue(s) that you found in part h)? (3 points)

i) If you were a Board Director responsible for corporate governance at the company, what policies would you introduce to address the issue(s) that you found in part h)? (3 points)

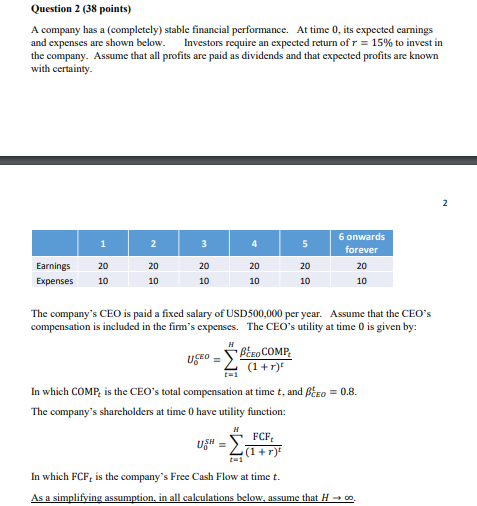

Question 2 (38 points) A company has a completely) stable financial performance. At time 0, its expected earnings and expenses are shown below. Investors require an expected return of r = 15% to invest in the company. Assume that all profits are paid as dividends and that expected profits are known with certainty. 2 1 2 3 4 5 6 onwards forever 20 10 20 20 Earnings Expenses 20 10 20 10 20 10 10 10 The company's CEO is paid a fixed salary of USD 500,000 per year. Assume that the CEO's compensation is included in the fim's expenses. The CEO's utility at time is given by: H Ug = PEROCOMP (1+r) In which COMP, is the CEO's total compensation at time t, and BEEO = 0.8. The company's shareholders at time have utility function: H FCF USH (1 + r) In which FCF, is the company's Free Cash Flow at time t. As a simplifying assumption, in all calculations below, assume that H. g) Calculate shareholders" utility at time 0 under projects A and B. Assuming that shareholders maximize utility at time 0, which project would shareholders prefer? (4 points) h) Draw some conclusions about how CEO and shareholder preferences can lead to different strategy choices. What causes the differences? (2 points) 1) If you were a Board Director responsible for corporate governance at the company, what policies would you introduce to address the issue(s) that you found in part h)? (3 points) Question 2 (38 points) A company has a completely) stable financial performance. At time 0, its expected earnings and expenses are shown below. Investors require an expected return of r = 15% to invest in the company. Assume that all profits are paid as dividends and that expected profits are known with certainty. 2 1 2 3 4 5 6 onwards forever 20 10 20 20 Earnings Expenses 20 10 20 10 20 10 10 10 The company's CEO is paid a fixed salary of USD 500,000 per year. Assume that the CEO's compensation is included in the fim's expenses. The CEO's utility at time is given by: H Ug = PEROCOMP (1+r) In which COMP, is the CEO's total compensation at time t, and BEEO = 0.8. The company's shareholders at time have utility function: H FCF USH (1 + r) In which FCF, is the company's Free Cash Flow at time t. As a simplifying assumption, in all calculations below, assume that H. g) Calculate shareholders" utility at time 0 under projects A and B. Assuming that shareholders maximize utility at time 0, which project would shareholders prefer? (4 points) h) Draw some conclusions about how CEO and shareholder preferences can lead to different strategy choices. What causes the differences? (2 points) 1) If you were a Board Director responsible for corporate governance at the company, what policies would you introduce to address the issue(s) that you found in part h)? (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts