Question: Please refer to sample questions and sample answers TOPIC 1: THE FISHER MODEL With an initial endowment of 400 in t = 0, an investor

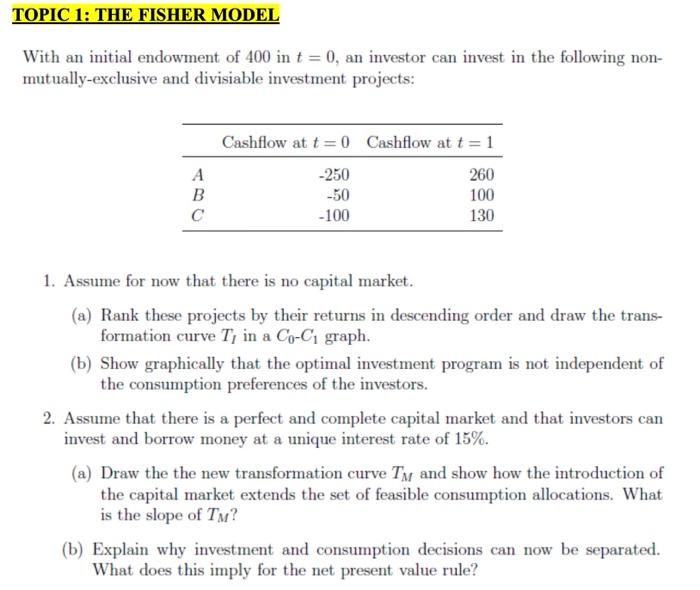

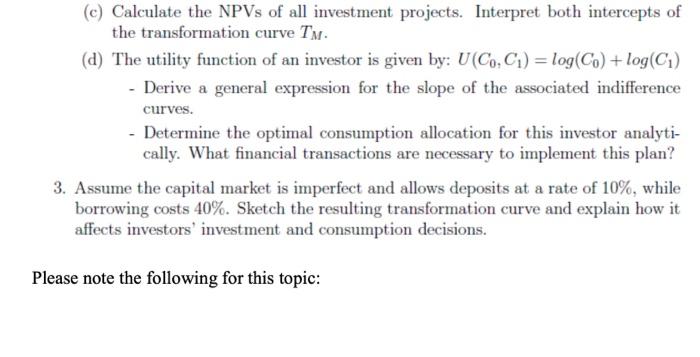

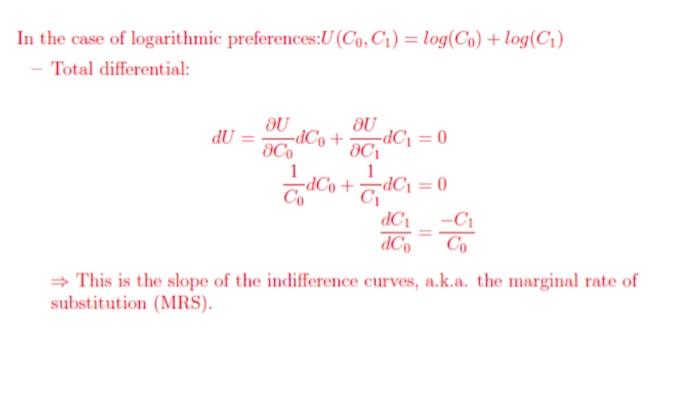

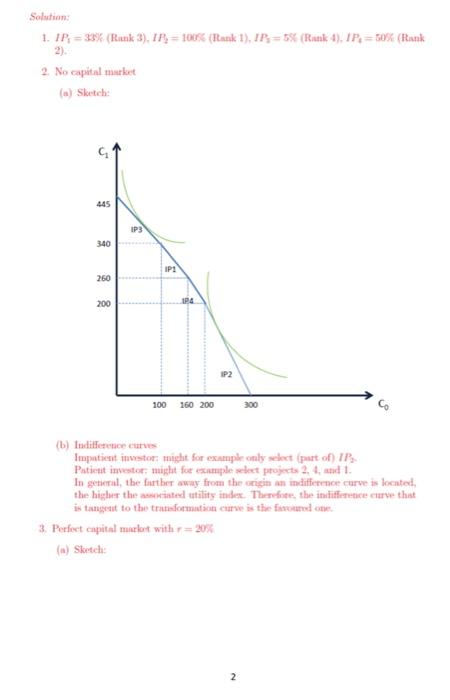

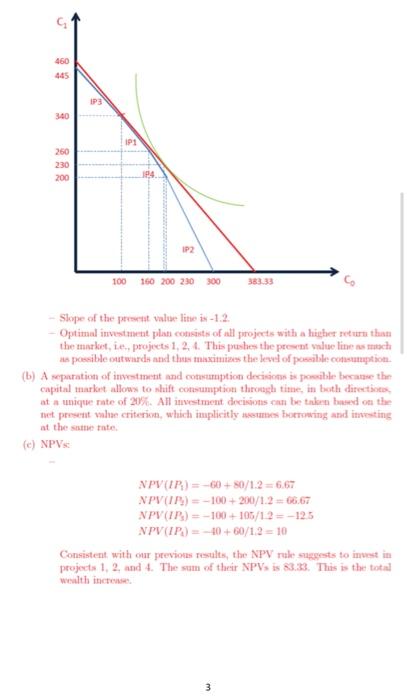

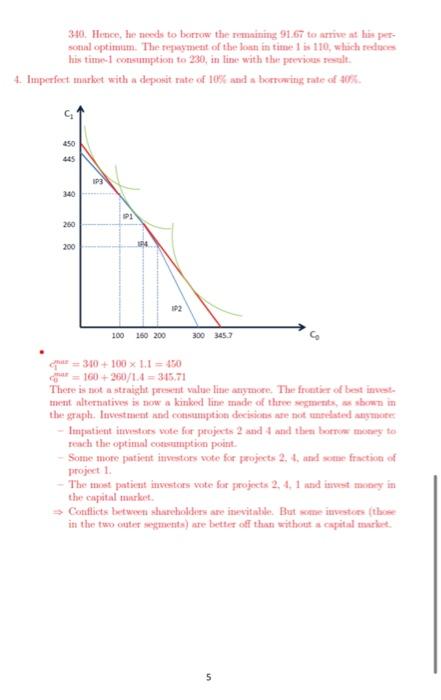

TOPIC 1: THE FISHER MODEL With an initial endowment of 400 in t = 0, an investor can invest in the following non- mutually-exclusive and divisiable investment projects: B Cashflow at t = 0 Cashflow at t=1 -250 260 -50 100 -100 130 1. Assume for now that there is no capital market. (a) Rank these projects by their returns in descending order and draw the trans- formation curve T, in a Co-C1 graph. (b) Show graphically that the optimal investment program is not independent of the consumption preferences of the investors. 2. Assume that there is a perfect and complete capital market and that investors can invest and borrow money at a unique interest rate of 15%. (a) Draw the the new transformation curve TM and show how the introduction of the capital market extends the set of feasible consumption allocations. What is the slope of TM? (b) Explain why investment and consumption decisions can now be separated. What does this imply for the net present value rule? (c) Calculate the NPVs of all investment projects. Interpret both intercepts of the transformation curve In. (d) The utility function of an investor is given by: U (Co,C) = log(Co) + log(C) - Derive a general expression for the slope of the associated indifference curves. - Determine the optimal consumption allocation for this investor analyti- cally. What financial transactions are necessary to implement this plan? 3. Assume the capital market is imperfect and allows deposits at a rate of 10%, while borrowing costs 40%. Sketch the resulting transformation curve and explain how it affects investors' investment and consumption decisions. Please note the following for this topic: In the case of logarithmic preferences:U (Co,C) = log(Co) + log(C) - Total differential: dU OU aU -dCo + aco C1 -dC1 = 0 dC1 dCi = 0 C -C dCo Co This is the slope of the indifference curves, a.k.a. the marginal rate of substitution (MRS). Analysis of Financial Markets Homework 1 - with Answers 1. The Fisher Model An investor has an endowment of 300 in t = 0 and can invest in the following divisible, non-mutually-exclusive investment projects: Cash Outflow Cash Inflow IR 60 100 100 40 80 200 105 60 IP: 1. Calculato the returns of all investment projects and sort them in descending order of returns 2. Assume for now that there is no capital market. (a) Draw the transformation curve T, based on the set of existing investment opportunities in a Co-C graph. (b) Show graphically that the optimal investment program is not independent of the consumption preferences of the investors 3. Assume that there is a perfect and complete capital market and that investors can invest and borrow money at a unique interest rate of 20%. (a) Show how the introduction of the capital market extends the set of feasible consumption allocations. What is the slope of the new transformation curve (b) Explain why investment and consumption decisions can now be separated. What does this imply for the net present value rule? (e) Calculate the NPVs of all investment projects. Interpret both intercepts of the transformation curve T's (d) The utility function of an investor is given by: U = Cox C Derive a general expression for the slope of the associated indifference Curves - Determine the optimal consumption allocation for this investor analyti- cally. What financial transactions are necessary to implement this plan? 4. Assume the capital market is imperfect and allows deposits at a rate of 10%, while borrowing costs 40%. Sketch the resulting transformation curve and explain how affects investors investment and consumption decisions, Solution: 1. IP: = 33% (Rank 3). IR; = 100 (Bank 1), IP = 556 (Rink 4), 1P=60% (Rank 2. No capital market (a) Sitch: 445 IP3 340 IP: 260 200 1P4 100 160 200 300 (b) Indifference curs Inpatient investor: might for example only select part of IP Patirtit investor, might for example et projects 2.4 and 1. In getal, the father away from the engin in indifference curve is located, the higher the seated utility index. Therefore, the indiference curve that is tangent to the transformation course is the found me 3. Perfect capital market with r = 20% (a) Sketch 2 460 IP 340 IP: 250 230 200 24 1P2 100 160 200 230 300 38333 Slope of the present valuelito ix -1.2. Optimal investment plans consists of all projects with a higher return thun the market, in., projects 1, 2. 4. This pushes the present value liness och as possible outwards and thus maximizes the level of possible costupation. (b) A separation of investment and consumption decision is provide became the capital market allows to lift consumption through time in both directions at a unique rate of 21%. All investment decisions can be taken based on the niet present volan criterion, which implicitly sees Bretowing and investing at the sisterte (C) NPV NPV (IP) = -60+80/1.2 = 6.67 NPVUN) = -100 + 200/1.2 = 66.67 NPV (IP) = -100+ 106/12 -12.5 NPV (IP) = -10 + 60/12 - 10 Consistent with our previous result, the NPV rule suggests to invest in projects 1, 2, and 4. The sum of their NPV is 83.33. This is the total 3 Co-intercept = Initial endowment + NPVR) + NPV (IPS) + NPV (P) = 383.33 It represents the total wealth and the macimum possible consumption in time 0. -intercepta = x 12 = 460 It represents the maximum possible consumption in time 1. (d) U = Cox Total differential OC GdC+CdC=0 20 aca This is the slope of the indifference curves the marginal rate of substitution (MRS) - To solve the consumption problem, opaste the MRS with the slope of the present valueline MRS=Slope of present value line (1) G = 1.200 We do not have a unique solution yet because there are infinitely many indifference curves. This line represents the set of points on the indifference curves that have the same stope is the present value line Next, we asciate the "right" indifference curse by taking the intercept of the present salue line into account: The present value lite tesulting from the optimal investment programs the function: G =C -1.2C) = 460 - 1.20) Combine (3) anul (4) 1.26 = 480 - 1.26 G = 19167 Plug this into (4) to obtain the courtesponding value: G = 230 - To reach this point, the investor first selects the optimal investment pro yram (projects 1. 2. und 4), which offers an allocation of Co= 100.6 = 340. Hence, he needs to borrow the remaining 91.67 to arrive at hispes- sonal optimum. The met of the lost in time is 110, which reduces his time consumption to 230, in fine with the previous sealt 4. Imperfect lot with a deposit rate of 10% and a bottoming rate of 60% 450 1P3 340 260 100 100 200 3003452 = 300 + 100 X 1.1 = 450 = 160 +260/14=315.71 There is not a straight present value line anymore. The front of best must mentalternatives is now a kinind line made of three segments, shown in the graph Investment and consumption decisions are not related me - Impatientias vote for projects 2 and 4 and the bottom to reach the optimal consumption point Some more patient investors vote for projects 2., and some fraction of project 1 The most patient investors vote for projects 2, 4, 1 ind invest money in the capital market Conflicts between shareholders are inevitable. But into the in the two outer segments) are better off thun without a capital met 5 TOPIC 1: THE FISHER MODEL With an initial endowment of 400 in t = 0, an investor can invest in the following non- mutually-exclusive and divisiable investment projects: B Cashflow at t = 0 Cashflow at t=1 -250 260 -50 100 -100 130 1. Assume for now that there is no capital market. (a) Rank these projects by their returns in descending order and draw the trans- formation curve T, in a Co-C1 graph. (b) Show graphically that the optimal investment program is not independent of the consumption preferences of the investors. 2. Assume that there is a perfect and complete capital market and that investors can invest and borrow money at a unique interest rate of 15%. (a) Draw the the new transformation curve TM and show how the introduction of the capital market extends the set of feasible consumption allocations. What is the slope of TM? (b) Explain why investment and consumption decisions can now be separated. What does this imply for the net present value rule? (c) Calculate the NPVs of all investment projects. Interpret both intercepts of the transformation curve In. (d) The utility function of an investor is given by: U (Co,C) = log(Co) + log(C) - Derive a general expression for the slope of the associated indifference curves. - Determine the optimal consumption allocation for this investor analyti- cally. What financial transactions are necessary to implement this plan? 3. Assume the capital market is imperfect and allows deposits at a rate of 10%, while borrowing costs 40%. Sketch the resulting transformation curve and explain how it affects investors' investment and consumption decisions. Please note the following for this topic: In the case of logarithmic preferences:U (Co,C) = log(Co) + log(C) - Total differential: dU OU aU -dCo + aco C1 -dC1 = 0 dC1 dCi = 0 C -C dCo Co This is the slope of the indifference curves, a.k.a. the marginal rate of substitution (MRS). Analysis of Financial Markets Homework 1 - with Answers 1. The Fisher Model An investor has an endowment of 300 in t = 0 and can invest in the following divisible, non-mutually-exclusive investment projects: Cash Outflow Cash Inflow IR 60 100 100 40 80 200 105 60 IP: 1. Calculato the returns of all investment projects and sort them in descending order of returns 2. Assume for now that there is no capital market. (a) Draw the transformation curve T, based on the set of existing investment opportunities in a Co-C graph. (b) Show graphically that the optimal investment program is not independent of the consumption preferences of the investors 3. Assume that there is a perfect and complete capital market and that investors can invest and borrow money at a unique interest rate of 20%. (a) Show how the introduction of the capital market extends the set of feasible consumption allocations. What is the slope of the new transformation curve (b) Explain why investment and consumption decisions can now be separated. What does this imply for the net present value rule? (e) Calculate the NPVs of all investment projects. Interpret both intercepts of the transformation curve T's (d) The utility function of an investor is given by: U = Cox C Derive a general expression for the slope of the associated indifference Curves - Determine the optimal consumption allocation for this investor analyti- cally. What financial transactions are necessary to implement this plan? 4. Assume the capital market is imperfect and allows deposits at a rate of 10%, while borrowing costs 40%. Sketch the resulting transformation curve and explain how affects investors investment and consumption decisions, Solution: 1. IP: = 33% (Rank 3). IR; = 100 (Bank 1), IP = 556 (Rink 4), 1P=60% (Rank 2. No capital market (a) Sitch: 445 IP3 340 IP: 260 200 1P4 100 160 200 300 (b) Indifference curs Inpatient investor: might for example only select part of IP Patirtit investor, might for example et projects 2.4 and 1. In getal, the father away from the engin in indifference curve is located, the higher the seated utility index. Therefore, the indiference curve that is tangent to the transformation course is the found me 3. Perfect capital market with r = 20% (a) Sketch 2 460 IP 340 IP: 250 230 200 24 1P2 100 160 200 230 300 38333 Slope of the present valuelito ix -1.2. Optimal investment plans consists of all projects with a higher return thun the market, in., projects 1, 2. 4. This pushes the present value liness och as possible outwards and thus maximizes the level of possible costupation. (b) A separation of investment and consumption decision is provide became the capital market allows to lift consumption through time in both directions at a unique rate of 21%. All investment decisions can be taken based on the niet present volan criterion, which implicitly sees Bretowing and investing at the sisterte (C) NPV NPV (IP) = -60+80/1.2 = 6.67 NPVUN) = -100 + 200/1.2 = 66.67 NPV (IP) = -100+ 106/12 -12.5 NPV (IP) = -10 + 60/12 - 10 Consistent with our previous result, the NPV rule suggests to invest in projects 1, 2, and 4. The sum of their NPV is 83.33. This is the total 3 Co-intercept = Initial endowment + NPVR) + NPV (IPS) + NPV (P) = 383.33 It represents the total wealth and the macimum possible consumption in time 0. -intercepta = x 12 = 460 It represents the maximum possible consumption in time 1. (d) U = Cox Total differential OC GdC+CdC=0 20 aca This is the slope of the indifference curves the marginal rate of substitution (MRS) - To solve the consumption problem, opaste the MRS with the slope of the present valueline MRS=Slope of present value line (1) G = 1.200 We do not have a unique solution yet because there are infinitely many indifference curves. This line represents the set of points on the indifference curves that have the same stope is the present value line Next, we asciate the "right" indifference curse by taking the intercept of the present salue line into account: The present value lite tesulting from the optimal investment programs the function: G =C -1.2C) = 460 - 1.20) Combine (3) anul (4) 1.26 = 480 - 1.26 G = 19167 Plug this into (4) to obtain the courtesponding value: G = 230 - To reach this point, the investor first selects the optimal investment pro yram (projects 1. 2. und 4), which offers an allocation of Co= 100.6 = 340. Hence, he needs to borrow the remaining 91.67 to arrive at hispes- sonal optimum. The met of the lost in time is 110, which reduces his time consumption to 230, in fine with the previous sealt 4. Imperfect lot with a deposit rate of 10% and a bottoming rate of 60% 450 1P3 340 260 100 100 200 3003452 = 300 + 100 X 1.1 = 450 = 160 +260/14=315.71 There is not a straight present value line anymore. The front of best must mentalternatives is now a kinind line made of three segments, shown in the graph Investment and consumption decisions are not related me - Impatientias vote for projects 2 and 4 and the bottom to reach the optimal consumption point Some more patient investors vote for projects 2., and some fraction of project 1 The most patient investors vote for projects 2, 4, 1 ind invest money in the capital market Conflicts between shareholders are inevitable. But into the in the two outer segments) are better off thun without a capital met 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts