Question: G. Financial Forecasting Company = Nvidia 1. Construct a Pro Forma Income Statement for your company for the next year, assuming that Sales grow 30%

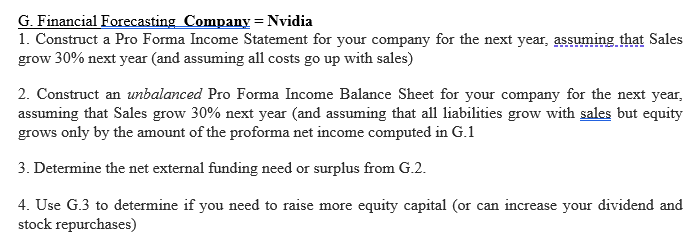

G. Financial Forecasting Company = Nvidia 1. Construct a Pro Forma Income Statement for your company for the next year, assuming that Sales grow 30% next year (and assuming all costs go up with sales) 2. Construct an unbalanced Pro Forma Income Balance Sheet for your company for the next year, assuming that Sales grow 30% next year (and assuming that all liabilities grow with sales but equity grows only by the amount of the proforma net income computed in G.1 3. Determine the net external funding need or surplus from G.2. 4. Use G.3 to determine if you need to raise more equity capital (or can increase your dividend and stock repurchases) G. Financial Forecasting Company = Nvidia 1. Construct a Pro Forma Income Statement for your company for the next year, assuming that Sales grow 30% next year (and assuming all costs go up with sales) 2. Construct an unbalanced Pro Forma Income Balance Sheet for your company for the next year, assuming that Sales grow 30% next year (and assuming that all liabilities grow with sales but equity grows only by the amount of the proforma net income computed in G.1 3. Determine the net external funding need or surplus from G.2. 4. Use G.3 to determine if you need to raise more equity capital (or can increase your dividend and stock repurchases)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts