Question: G lerman Inc., operates at capacity and makes plastic combs and hairbrushes. Although the combs and brushes are a matching set, they are sold individually

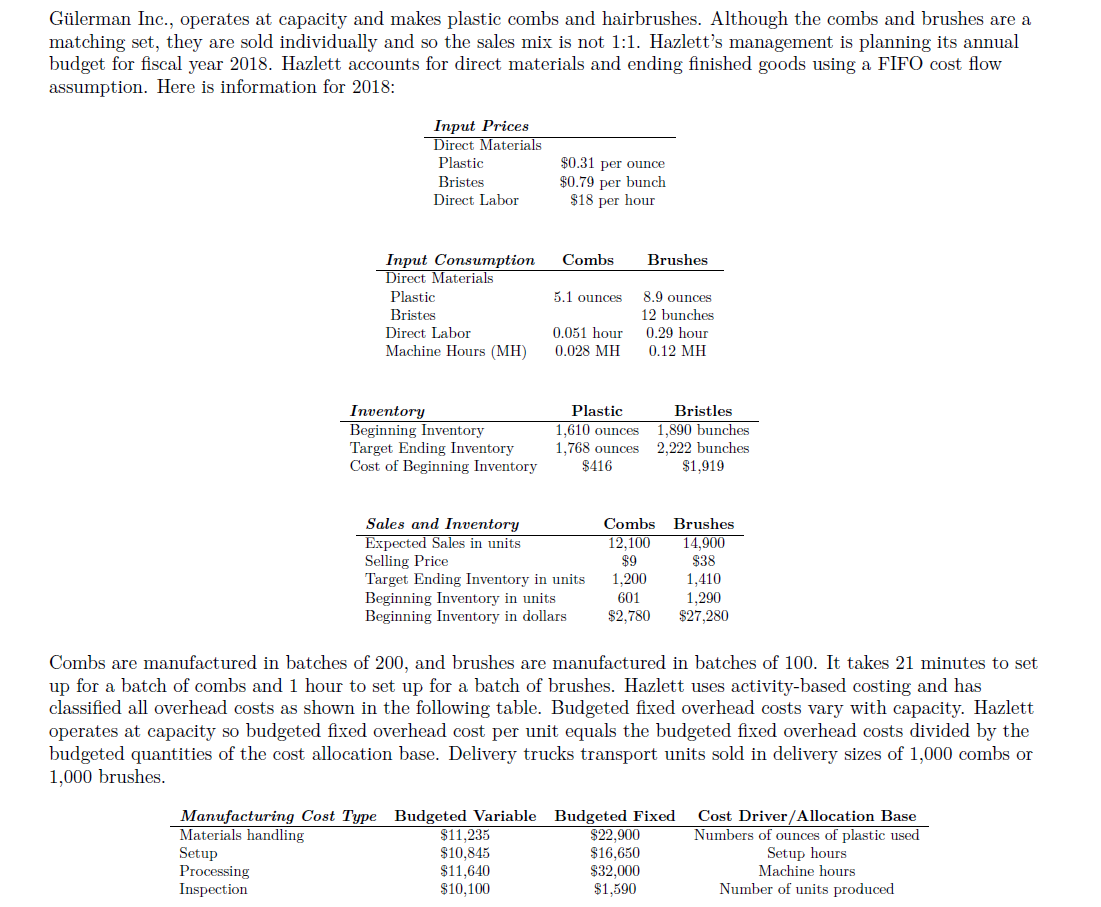

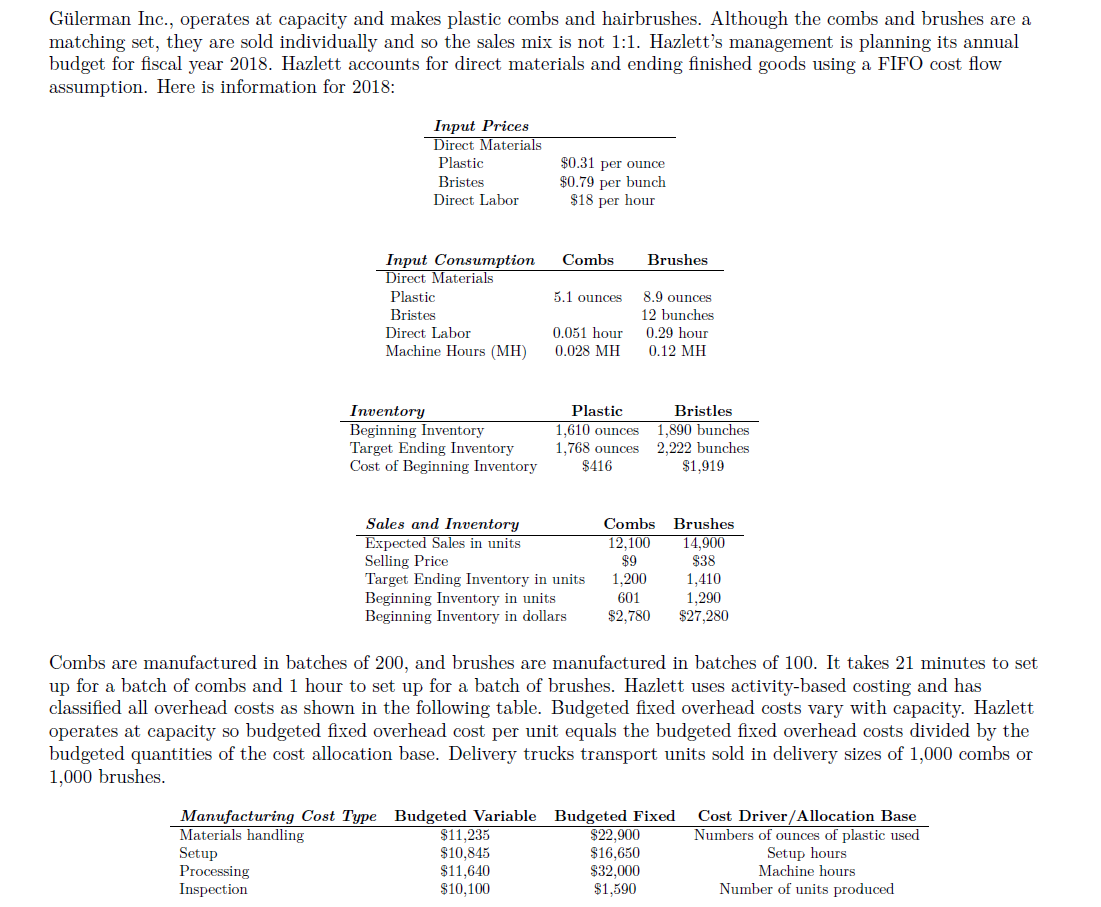

Glerman Inc., operates at capacity and makes plastic combs and hairbrushes. Although the combs and brushes are a

matching set, they are sold individually and so the sales mix is not : Hazlett's management is planning its annual

budget for fiscal year Hazlett accounts for direct materials and ending finished goods using a FIFO cost flow

assumption. Here is information for :

Combs are manufactured in batches of and brushes are manufactured in batches of It takes minutes to set

up for a batch of combs and hour to set up for a batch of brushes. Hazlett uses activitybased costing and has

classified all overhead costs as shown in the following table. Budgeted fixed overhead costs vary with capacity. Hazlett

operates at capacity so budgeted fixed overhead cost per unit equals the budgeted fixed overhead costs divided by the

budgeted quantities of the cost allocation base. Delivery trucks transport units sold in delivery sizes of combs or Combs are manufactured in batches of and brushes are manufactured in batches of It takes minutes to set

up for a batch of combs and hour to set up for a batch of brushes. Hazlett uses activitybased costing and has

classified all overhead costs as shown in the following table. Budgeted fixed overhead costs vary with capacity. Hazlett

operates at capacity so budgeted fixed overhead cost per unit equals the budgeted fixed overhead costs divided by the

budgeted quantities of the cost allocation base. Delivery trucks transport units sold in delivery sizes of combs or

brushes.

Q Calculate budgeted number of combs to be produced.

Q Calculate budgeted unit production cost of comb.

Q Calculate budgeted unit production cost of brush.

Q Calculate budgeted dollar cost of ending finished good inventory.

Q Calculate budgeted cost of goods manufactured.

Q Calculate budgeted sales revenue.

Q Calculate budgeted cost of goods sold.

Q Calculate budgeted marketing costs.

Q Calculate budgeted distribution costs.

Q Calculate budgeted operating income.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock