Question: g) Write down an equation for the marginal social cost as a function of output (Q). Redraw the marginal benefit consumer and marginal cost producer

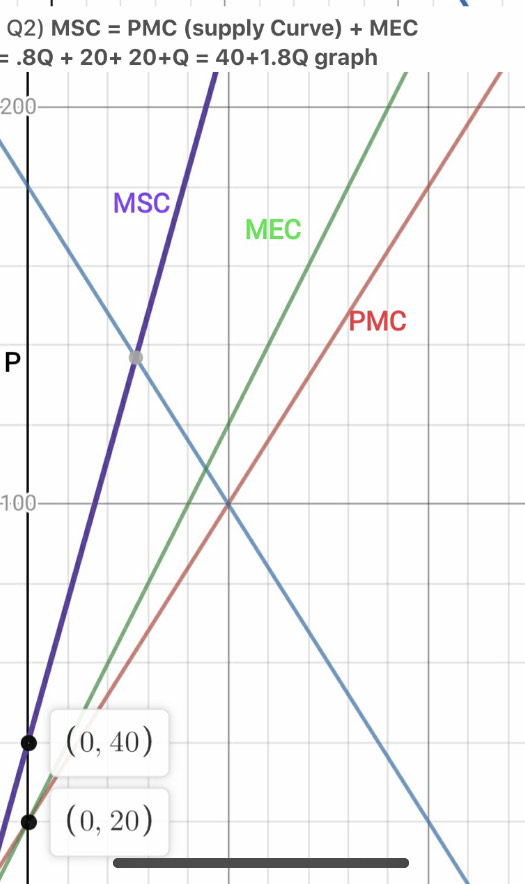

g) Write down an equation for the marginal social cost as a function of output (Q). Redraw the marginal benefit consumer and marginal cost producer curves and then plot the marginal external cost and the marginal social cost curves on the graph. h) Calculate the socially efficient equilibrium price and quantity (show your work). Label on your graph. i) For the socially efficient allocation, label the following. i) total external costs ii) total social costs iii) total social benefits iv) total social surplus v) total consumer benefits j) Calculate the gain in total social surplus due to reducing lumber from the perfectly competitive market level to the socially efficient level. Label the deadweight loss of the market. k) Label the socially efficient quota. 1) Find the constant marginal Pigou tax on lumber that would reduce lumber output to the socially efficient level from the market level. Illustrate the supply curve shift on your graph and label the marginal and total tax collected. Calculate the total tax collected. m) Two ways to compensate consumers for price rises due to the tax are and . Recall, this would only be an actual Pareto improvement if at least one person is better off due to the tax and no one is worse off. It is called a Potential Pareto Improvement because the total social surplus change due to the tax is positive, so it should be possible in principle for winners to compensate the losers from the policy. In practice, this would be difficult to achieve.\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts