Question: G3 No.1 I will like your answer thanks (don't worry about anything other than the Journal entries thank you) have someone else answer it if

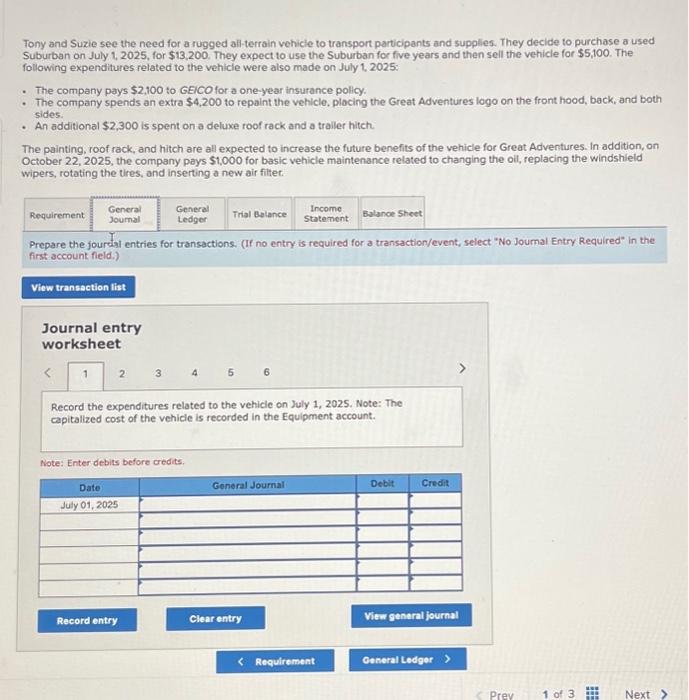

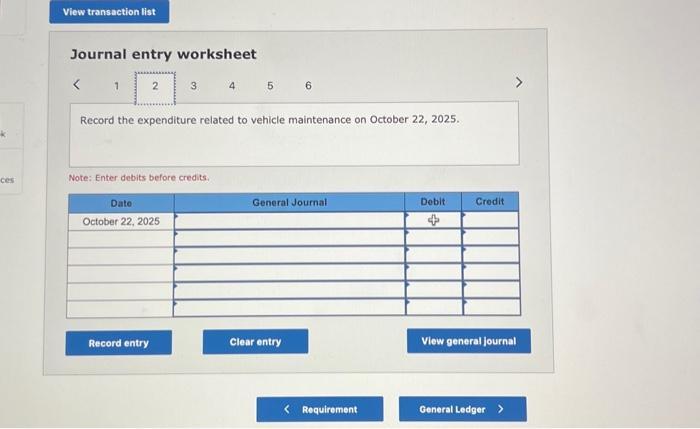

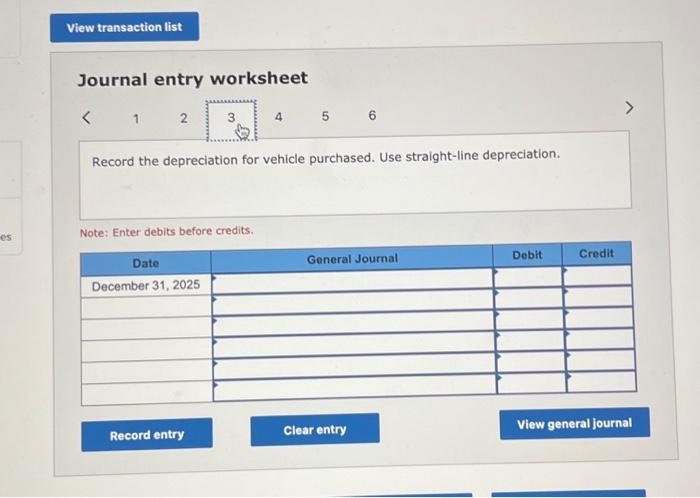

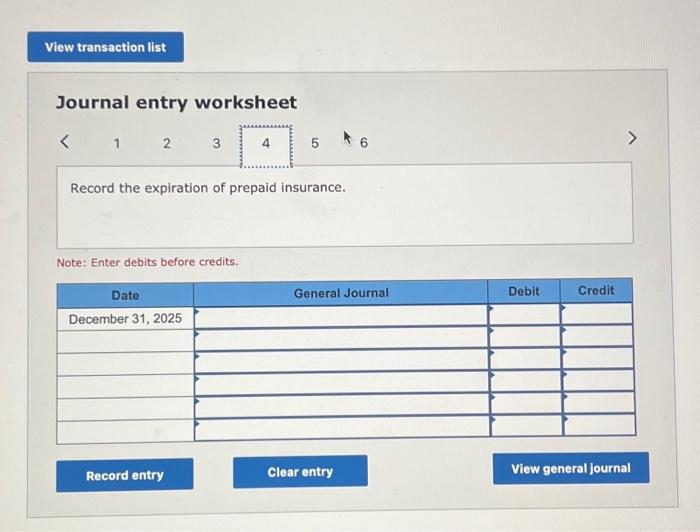

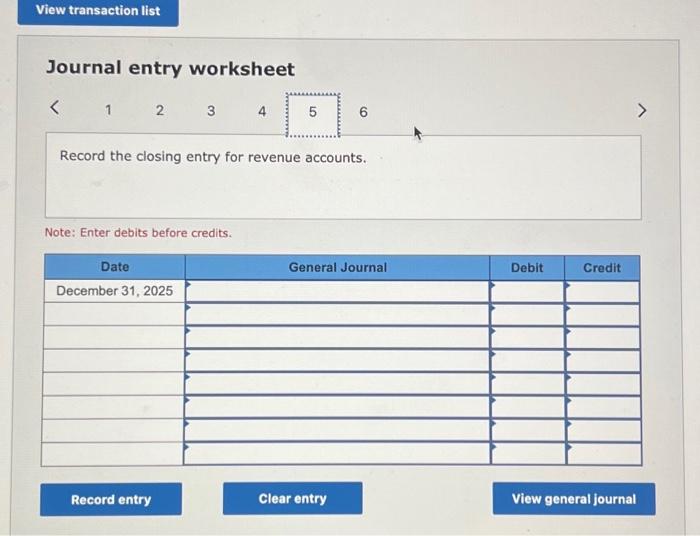

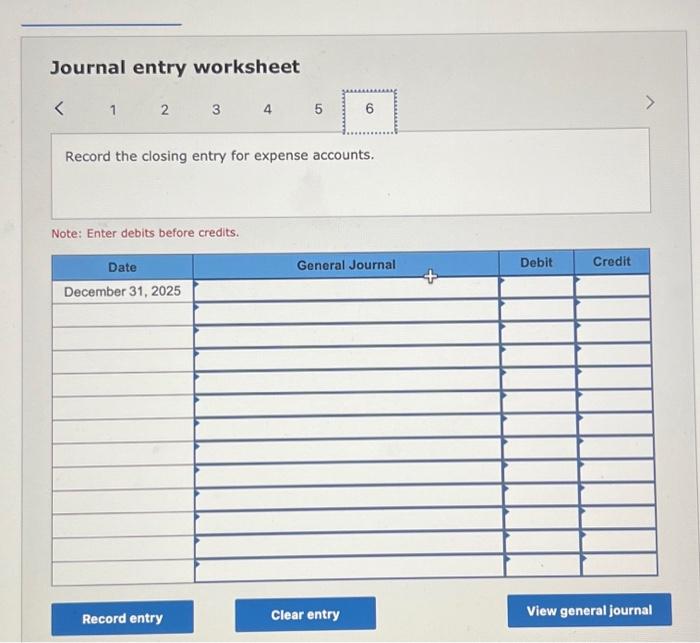

Journal entry worksheet Record the closing entry for revenue accounts. Note: Enter debits before credits. Journal entry worksheet 1 5 Record the expiration of prepaid insurance. Note: Enter debits before credits. Journal entry worksheet Record the depreciation for vehicle purchased. Use straight-line depreciation. Note: Enter debits before credits. Tony and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide to purchase a used Suburban on July 1,2025 , for $13,200. They expect to use the Suburban for five years and then sell the vehicle for $5,100. The following expenditures related to the vehicle were also made on July 1,2025: - The company pays $2,100 to GEICO for a one-year insurance pollcy. - The company spends an extra $4,200 to repaint the vehicle. plocing the Great Adventures logo on the front hood, back, and both sides: - An additional $2,300 is spent on a deluxe roof rack and a traller hitch. The painting, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Great Adventures. In addition, on October 22,2025 , the company pays $1,000 for basic vehicle maintenance related to changing the oil, replacing the windshield wipers, rotating the tires, and inserting a new air filtet. Prepare the jourctal entries for transactions. (If no entry is required for a transaction/event, select "No Joumal Entry Required" in the first account field.) Journal entry worksheet 3456 Record the expenditures related to the vehicie on July 1, 2025. Note: The capitalized cost of the vehicle is recorded in the Equipment account. Note: Enter debits before credits. Journal entry worksheet Record the closing entry for expense accounts. Note: Enter debits before credits. Journal entry worksheet 6 Record the expenditure related to vehicle maintenance on October 22, 2025. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts